Gold: Making 2020 Seasonal Bottom

Fundamentals

Gold is not trading based on the vaccine news. It is trading on the economic effects of the pandemic. The system was fragile and full of debt even before the pandemic, which has only added debt. It did not take much for the system to break, which it did in March. We are in the midst of a transformation of the old economic system to a new system. We are looking at a new virtual system and economy. The economy split between the elite who can borrow money at almost zero rates and buy stocks, which continue to go up, and Main Street and blue collar workers who suffer and lose their livelihoods.

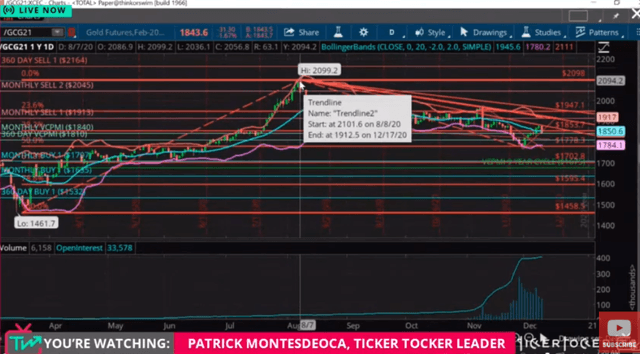

(Click on image to enlarge)

(Courtesy: Ticker Tocker)

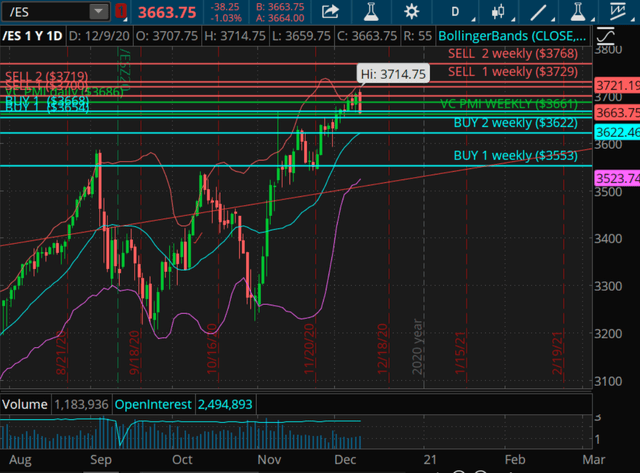

Gold collapsed to $1461 in March. It then roared back to $2099 as the news about the pandemic was factored into the market and discounted to a large degree. The Feds came in with record stimulus, which caused gold to then start to decline again. The Fed is prepared to leverage up to 10% of our GDP to keep the market stable. The markets took that very positively and rocketed up. The E-mini S&P reached new highs, trading now at 3700. The E-mini is meeting some resistance at these highs.

The key questions are whether we are going to find buyers at the new lower gold levels and whether the stock market is in a topping formation. For answers, we look at what the market is doing.

Bitcoin Investment Trust (OTC:GBTC)

Pundits are starting to talk about Bitcoin as competing with gold. There is no product in the world that is going to compete with a currency that has been around for thousands of years. Bitcoin has only been around for 10 years. Pundits are saying that Bitcoin is eliminating the gold market. Bitcoin is not a currency. It is a virtual asset. Currency is used as a tier one asset, meaning it can be used to collateralize any deal. You cannot use Bitcoin as a tier one asset. Therefore, it is not a currency, at least yet. Leaders are substituting Bitcoin for fiat currency, with no backing. We will see if any of these virtual currencies are going to be backed by anything. Governments may decide to issue a virtual currency, but they aren’t going to do it via Bitcoin or other existing virtual currencies. If they create a virtual currency, then they will ban or eliminate other virtual currencies. Bitcoin is a tradable asset, and we do trade the Grayscale Bitcoin Trust. It is regulated. It is the only fund created to trade Bitcoin. Use it as a tradable asset. But it is not competition for gold. What if something happens to technology or the Internet and you can’t get into your account? What if you are hacked? There are risks in putting it all in the cloud.

US Dollar Devalued

We do believe that the US dollar is going to devalued in the future. That is why the market is looking for alternatives, such as gold and Bitcoin. Investors are looking for ways to protect themselves against what is coming; a devaluation of the US dollar as we print more and more money. The government is creating money out of thin air, which devalues the purchasing power of the US dollar and inflates all assets priced in dollars. The US dollar as the world’s reserve currency is faltering and facing competition from the euro, the yuan and other currencies, as well as from gold.

Pandemic

The pandemic continues to damage the economy. An end is in sight with vaccines, but we are still facing months of further lockdowns and damage to the economy. The more damage there is done, the more stimulus will be required, which further harms the US dollar’s value. In 1971, when the US dollar was taken off the gold standard, it was the beginning of the long-term devaluation of the dollar. Billionaires and millionaires are now becoming common as inflation increases the apparent value of the dollar, even as the value of the dollar has plummeted since 1971. Will government officials consider using gold to back up the currency as it collapses? We do not know. Will we go to a virtual currency issued by governments? No one knows, but gold has been of value for thousands of years. It is also clear that we are continuing to move into a debt economy, but now moving into a virtual economy. Interest rates must remain around zero or the debt payments will cause the system to collapse. If there is inflation, governments can’t raise interest rates to control it because of the massive levels of debt. The only way to handle that debt is to devalue the dollar so much that the debt can then be paid off.

In 1981, Mexico had to devalue the peso from 16 to the dollar to thousands to the dollar to allow it to pay the debt in the old currency. The US is doing the same thing, except they aren’t saying it officially. They are, instead, printing money, which devalues the dollar quietly and most people do not notice.

Technicals

Gold is in a fast market down $32 to $1842. We are recommending that if you shorted the market yesterday, then cover your position. If you hedged, take 50% of the hedge. Gold is now at the monthly level we have been looking for. We are starting to see buyers come into the market down at these levels.

Gold came down to $1847. $1840 is the monthly average price, so buyers are starting to come into the market. This is a great opportunity to add to your long-term position in gold. We got the swing correction that the Variable Changing Price Momentum Indicator (VC PMI) had been forecasting the past few days. The market is oversold, and it has come down to complete the swing correction counter-trend pattern. This is down to a 38.2% Fibonacci retracement at $1847. This level could be the annual low. The market is testing that low. If it closes below $1840, then $1821 is the weekly average, which we’ve been trading this week.

Now we want to start to trade the long side from these levels, while maintaining a hedge or short-term downward bias, which will probably last until the middle of the month. This correction could test the previous yearly average of 1810.

The market is extremely oversold. Use $1840 as your protective level. Watch the market and see what it does until it triggers the next VC PMI trigger. We are coming into a level of support, so cover shorts and look to get on the long side of the market. $1847 will confirm that the low is in. The daily level is at $1857, which is the first anchor to get on the long side on a close above.

For the long term, the monthly level is $1840, which is being tested. It looks like we found some buying at that level. There is beginning to be a reversion from there. The 360-day average price of $1810 is right below $1840. We recommend that if you are looking to add to your long-term gold position, use these levels between $1840 and $1810 to get on the long side, if the market gives you that opportunity. It may not, but watch for the chance.

The daily chart looks pretty bearish by a big bar, making a daily reversal to the downside. We want to see support around $1840-1810. The market made a high into the resistance level and failed to rise, which signalled a possible sell-off today. On November 6, gold tried to get through $1967, but found ferocious sellers due to the news coming out about how effective the vaccines may be. But whatever the fundamentals, we focus on the technicals and the VC PMI to trade the market. The VC PMI serves as a GPS to guide us as we trade. Crises create volatility, which, for a trader, creates opportunity and a dream come true.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold and silver, check us out on Ticker ...

more