Gold Losses Shine As Fed-Cut Bulls Weigh Dovish Implications Of Soft CPI

Image Source: Pixabay

Gold (XAU/USD) erases earlier gains on Thursday after the non-yielding metal hit $4,374 and approached the all-time high of $4,381 following the release of a weaker-than-expected inflation report in the US. At the time of writing, XAU/USD trades at $4,335.

Bullion retreats as markets question inflation data reliability, keep January Fed cut odds unchanged

The core US Consumer Price Index (CPI) print in November fell to its lowest level since early 2021, according to the US Bureau of Labor Statistics (BLS). Both headlined and core CPIs dipped, but economists warned that the 43-day government shutdown could distort some of the data that BLS workers compile for the release.

As inflation eased, expectations that the Fed could cut rates should rise, but traders took the data with a pinch of salt because the jobs data was solid, as the Department of Labor revealed in the latest Initial Jobless Claims report.

Expectations that the Fed will cut rates at the next meeting on January 28 remain unchanged at 24%, according to Capital Edge Rate probability data. Nonetheless, for the full year ahead, investors have priced 60 basis points of easing, with the first cut expected in June.

This should keep the US Dollar pressured and a tailwind for Bullion prices.

Meanwhile, easing geopolitical tensions could cap Gold’s advance as talks between the US and Russia are set to resume during the weekend in Miami, according to Politico.

Ahead, the US economic docket will feature the release of the Fed’s favorite inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index, along with the University of Michigan Consumer Sentiment Index for its final release.

Daily digest market movers: Gold fails to gain traction as US inflation dips

- The US Consumer Price Index (CPI) rose 2.7% YoY in November, easing from 3.0% in September and falling short of market expectations for a 3.1% increase, data from the US Bureau of Labor Statistics (BLS) showed. Core CPI, which excludes food and energy, cooled to 2.6% YoY, down from 3.0% previously, signaling further easing in underlying inflation pressures.

- Initial Jobless Claims for the week ending December 13 declined to 224K, down from the downwardly revised 237K prior reading and below forecasts of 225K, according to the US Department of Labor.

- A contraction in physical Gold exports from Switzerland to India dropped 15%, its lowest level since February, according to Swiss customs on data released on Thursday. The reason behind the contraction is that prices are higher.

- Gold exports from Switzerland to India plunged to 2 metric tons in November, down sharply from 26 tons in October, while shipments to China, another major bullion consumer, rose to 12 tons from 2 tons over the same period.

- US Treasury yields are falling, with the 10-year benchmark note rate down three basis points at 4.12%. US real yields, which correlate inversely with Gold prices, plunged four basis points to 1.88%.

- The US Dollar Index (DXY), which tracks the Greenbacks’ performance against a basket of six peers, is up 0.03% at 98.43.

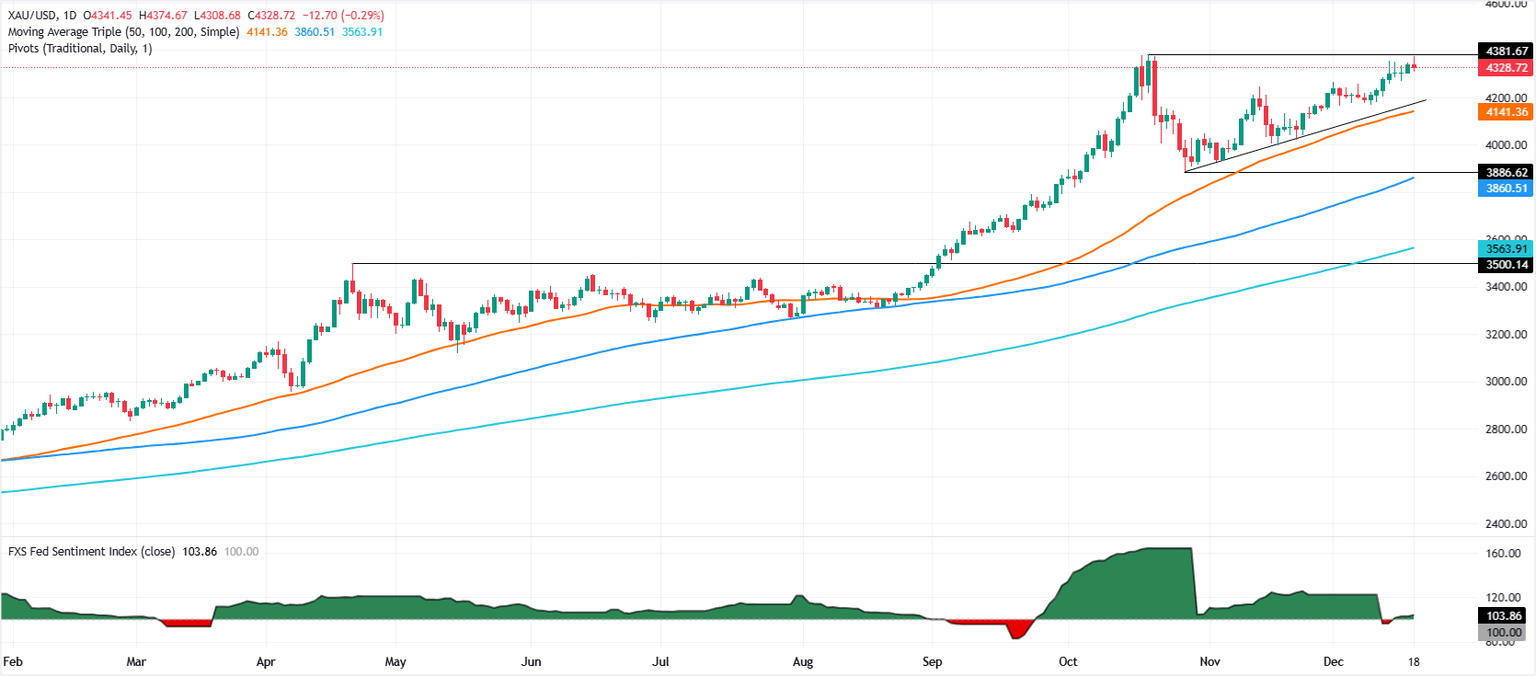

Technical Analysis: Gold’s uptrend pauses as it drops below $4,350

Gold seems to have consolidated as buyers failed to clear the previous record high of $4,381 to challenge the $4,400 mark. Bullish momentum is fading, as depicted by the Relative Strength Index (RSI), which retreated from overbought territory.

If XAU/USD closes below $4,350 on a daily basis, the first support would be $4,300. A breach of the latter will expose the December 11 high at $4,285, with further support at $4,250 ahead of a deeper pullback toward $4,200.

(Click on image to enlarge)

Gold daily chart

More By This Author:

GBP/USD Firm As Soft CPI Pressures Dollar, BoE Stance Supports Sterling

EUR/USD Treads Water With Dollar Firmer And EZ Inflation Easing

Gold Blasts Above $4,330 As U.S. Jobs Data And Venezuela Flare-Up Spark Haven Rush