Gold Is The World's New Reserve Asset

Image Source: Pixabay

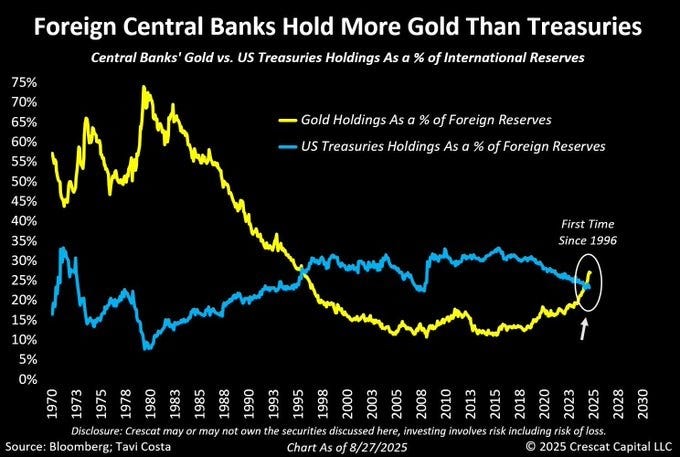

For most of this century, the world’s central banks have held US Treasury bonds as their primary reserve asset. But lately, for a variety of reasons, they’ve been converting their dollars into gold. And this year, the lines crossed, as the amount of gold they own exceeded Treasuries.

Not a Coincidence

Pretty much everyone has a problem with the dollar’s reserve currency status. Other major countries are sick of the US weaponizing its privilege, while the US is sick of financing everyone else’s trade surpluses at the expense of American industry.

In a recent video with Miles Franklin, macroeconomist Luke Gromen fleshed out this thesis. Some quotes:

The US dollar has been the reserve currency, the anchor for global trade, finance, and power. That's given America huge advantages. Cheaper imports, strong buying power overseas, and a deep global market for US debt. But it has also created a catch-22. To keep the world supplied with dollars, America has to run trade deficits year after year that keep the global system running. But over time, those same deficits weaken our own economy, hollow out our industrial base, erode national security, and slowly eat away at the dollar's value and credibility and the demand for Treasuries. Economists call this Triffin's dilemma.

And now, for the first time in a long time, we're hearing this dilemma openly acknowledged at the very top of the US government. And it's raising the question, is the Trump administration preparing for a deliberate policy shift, even a monetary reset? Is President Trump willing to take short-term economic pain for what he believes is the greater long-term good of restoring America's productive strength and sovereignty? The president has openly talked about the benefits of a weak dollar as a strategic move to restore American manufacturing strength.

This has been decided. We are reshoring. We are going to weaken the dollar and something else is going to serve as a neutral reserve asset for the global system. Whether it's Trump, whether it's Bessant, whether it's Miran, whether it's Vance, they're all saying the same thing, which is we want to get rid of the dollar as a global reserve asset and store of value, and we want to maintain the dominance of the dollar within global payment systems.

It's happening in plain sight for those with the eyes to see it. The US military for 15 years has been saying look, our our industrial base is too hollowed out. We can't fight a war against a near-peer or major power. We can't make the weapons to go to war.

You often hear analysts say, "Ultimately, the US military backs the dollar." Well, sure. And guess what backs the US military? Chinese rare earths and Chinese factories.

The dollar is going to be much lower sometime in the next 3 years. I ultimately think it means much higher asset markets, much higher gold, much higher bitcoin. That's why I say all roads lead to gold and bitcoin.

The full video:

Video Length: 01:30:27

A Trend With Long Legs

It’s easy to watch the action in precious metals and related miners, and stress over when and how to take profits. But gold’s return to the center of the global monetary system — at the expense of the dollar’s exchange rate — looks like a trend with very long legs. It will take years to play out, and during that time, precious metals will be among the best-performing assets. So, as the saying goes, Be right and sit tight.

More By This Author:

Gold/Silver Miners Are Two-Thirds Through Their Best Quarter EverUS Treasuries Have Crossed The Rubicon

Exploding Inventory Is (Finally) Cutting Home Prices