Gold Is Surging. This ETF Targets Gold Gains And Big Income

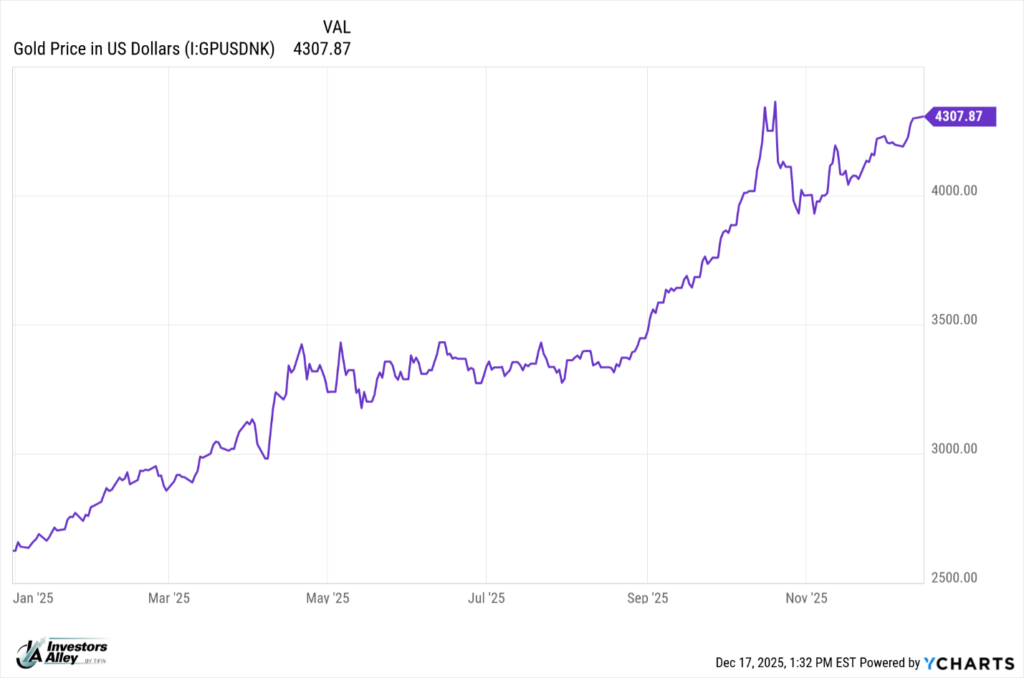

It has been an excellent year for gold as an investment.

Year to date, as I write this, the precious metal is up 65%, and the momentum to higher prices doesn’t seem ready to abate.

I believe gold will continue to move higher, possibly much higher. I could be wrong; I often talk to subscribers about the futility of predicting the future. Yet looking at where gold has been, it’s a valid assumption that it can continue to appreciate. I think it’s important to have investment exposure—one bit of diversification in your investment portfolio.

The Simplify Gold Strategy PLUS Income ETF (YGLD) offers a compelling way to gain exposure to gold. YGLD is an actively managed fund that uses futures contracts to achieve 150% exposure to gold. The leverage shows in the 101% total year-to-date return.

YGLD also includes the Simplify “PLUS Income” strategy, which the company employs across a number of its ETFs. The fund managers employ an options strategy of selling call options on uncorrelated assets, such as the three major stock indices. Selling puts for income means the option selling will not cap the potential upside if gold increases.

As an added bonus, YGLD will begin paying monthly dividends in 2026. (It has been paying quarterly.) The Simplify website lists a current distribution yield of 55.30%.

More By This Author:

Get Double Digit Dividends As Silver Breaks OutSilver’s Up 71% – Time To Buy The New 23% Yield ETF

Better Dividends Plus Buybacks Create Rare Wealth Compounding