Gold Is Ripe (5 Charts)

Image Source: Pixabay

Near the end of every Summer season, we pick blackberries.

Because here on the West Coast of Canada they’re ripe for the picking…

In public parks…

At the start of trails…

On the edge of forests…

All you have to do is grab a bucket. Most people don’t though. They head to the store and pick up some fruit from the air-conditioned, misted pyramids of the fresh fruit section.

We prefer to pick our own blackberries (and fruit) when the season comes.

By the end of August, we’ve already started thinking about the fall, and blackberries are ripe for the picking.

So we pick them…

And make pie.

Then store it in our freezer for Thanksgiving and for when guests come over.

That being said, it’s also the season for gold…

When gold profits will be ripe for the picking.

That’s because every year at this time, the Chinese and Indian markets buy a ton of gold for their weddings.

For them, gold is a gift and part of the customary dowry to be given to the new couples as a blessing towards their future.

And that means, as part of a cyclical process, the price of gold goes up every year at the end of August and early September.

Not only is it the season for gold on an average year, gold is ripe for a few more reasons.

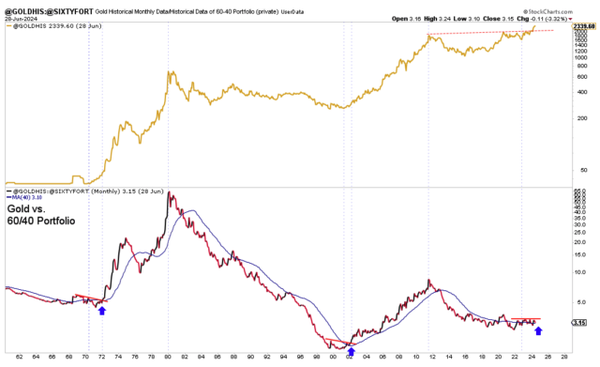

For example, take this chart from Jordan Roy-Byrne:

The chart shows bubbles of the past and gold’s reaction.

As bubbles rise, the ratio between gold and the traditional 60/40 – stock/bond portfolio flatlines.

You can see it…

During the early 70s…

During the Dot Com bubble…

During pre-covid…

And then now, for the past two years…

(Click on image to enlarge)

When you compare the ratio with the gold chart above, gold is in the beginning of a break-out.

Now we are waiting for the equities and bond bubble to deflate.

Here are the signs of those bubbles deflating soon…

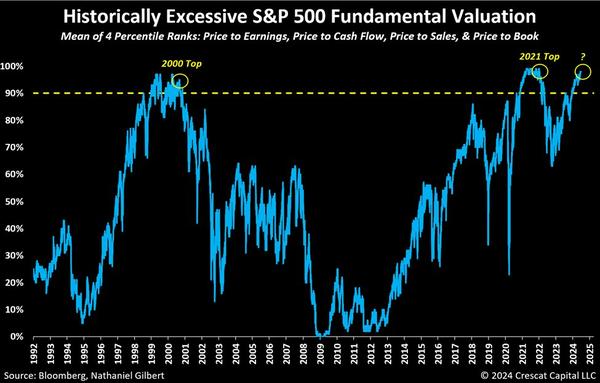

This chart from Kevin C. Smith shows the S&P’s historically excessive valuation.

The Dot Com bubble lasted about three years, which we are soon approaching.

(Click on image to enlarge)

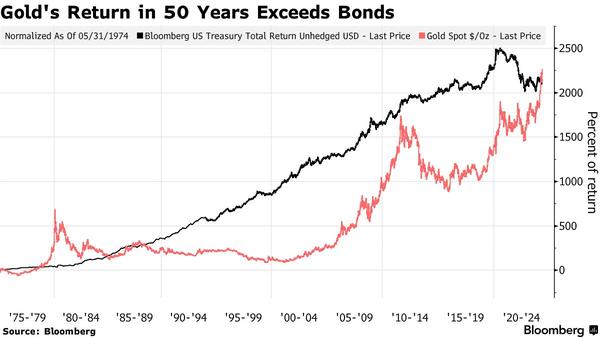

For bonds, the bubble is already beginning to deflate.

Over a period of 50 years, the return on gold is now outperforming bonds.

And that means, gold could be starting to replace bonds as a more reliable long-term store of value, but it also means US Treasury bonds are becoming less valuable overall.

(Click on image to enlarge)

Yes, gold is ripe…

Here’s how gold will become ripe enough to “fall off the tree.”

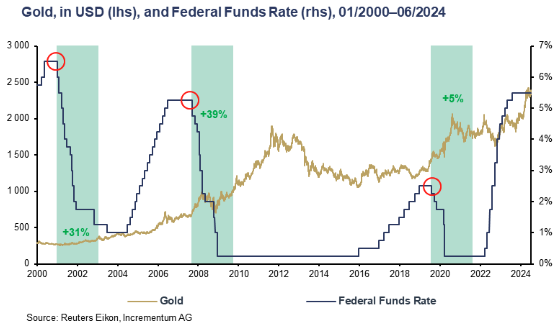

This is a chart of changes in the Federal Fund Rate and the price of gold.

(Click on image to enlarge)

As you can see, every time the Federal Reserve begins to lower interest rates gold rises through each recession…

Sometimes more than double it’s value only a few months before…

Recently, some commentators are predicting that inflation data could indicate lower rates before the end of September.

Bloomberg reports:

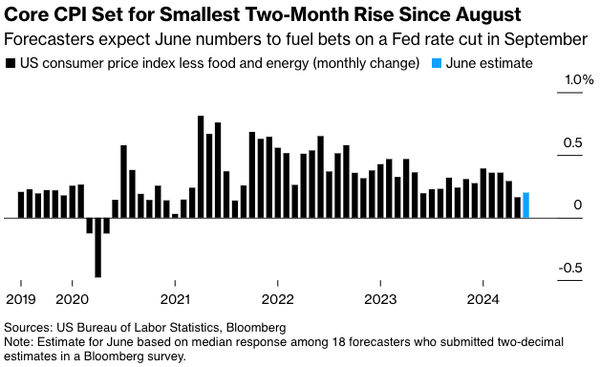

US Inflation Data to Bolster Case for Fed Interest-Rate Cut in September

“The figures, to be published Thursday by the Bureau of Labor Statistics, will probably show a key gauge of prices excluding food and energy advanced just 0.2% in June for the second month in a row, according to the median estimate in a Bloomberg survey. The broader consumer price index is seen posting a smaller 0.1% increase, thanks in part to lower gas prices.

Such an outcome would help solidify expectations in financial markets that the Fed will begin cutting rates at its September policy meeting, marking the first step in unwinding its most aggressive tightening campaign since the early 1980s.”

(Click on image to enlarge)

Yesterday, the Bureau of Labor Statistics(BLS) posted a drop of 0.1% in Core CPI, which was lower than predicted.

So gold is as ripe as can be.

Also, if you can, pick some fruit this Summer, it’ll make for a great late-summer family activity.

More By This Author:

Will Debt Sink The American Empire?

Recession Watch: Jobs And Real Estate Head South

Have We Been In Recession For Years?