Gold Is Poised To Move As The Euro Is Now Cheaper Than The USD

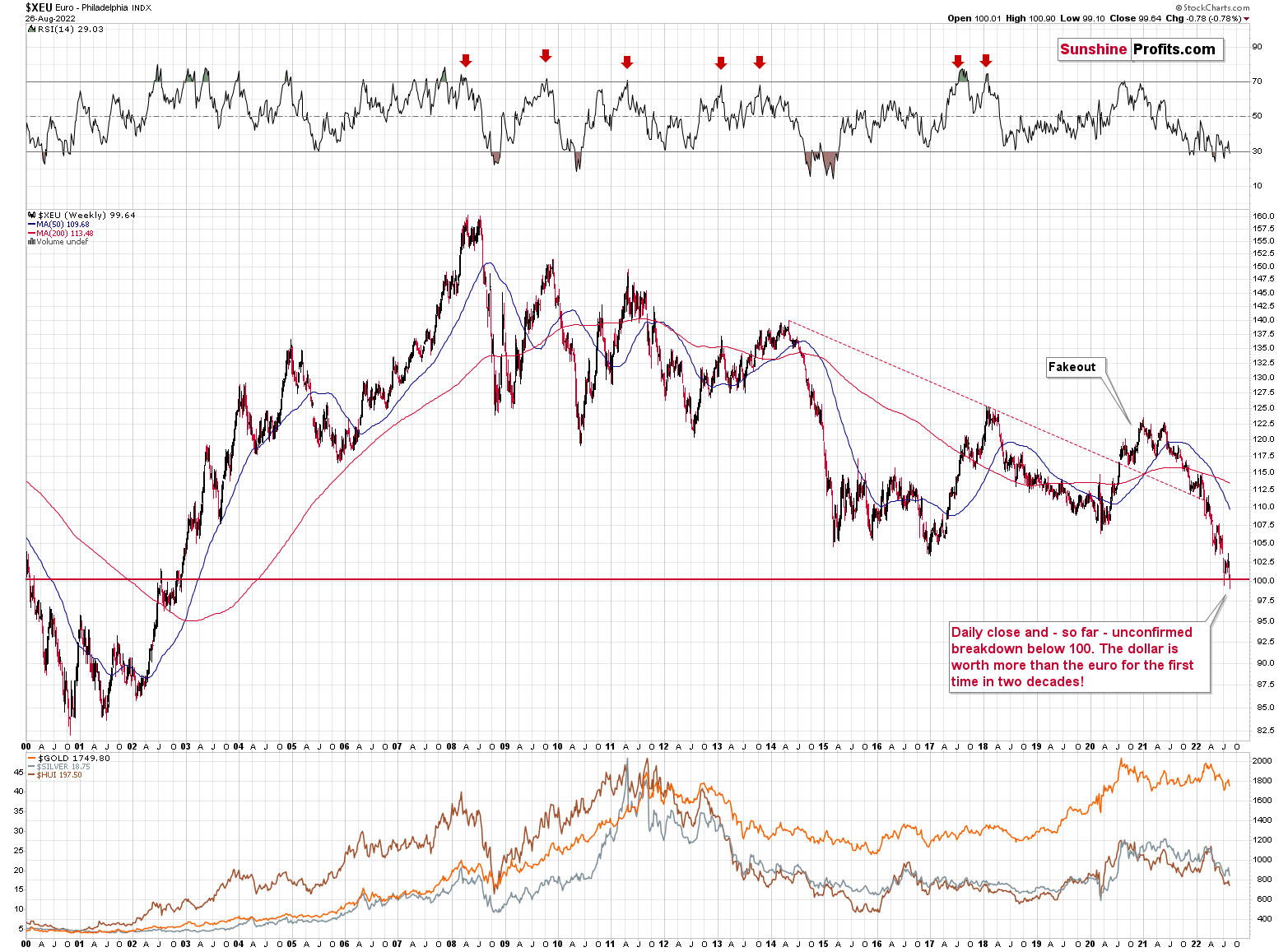

As long as gold is priced in the U.S. dollar, it’s critical to keep the latter in mind. And last week, something epic happened in the forex market.

Namely, the EUR/USD closed the week below the all-important 1 level.

For the first time in almost two decades!

(Click on image to enlarge)

When this level was first approached weeks ago, I wrote that a rebound was likely, but I also added that I expected this level to be broken after the rebound. That’s exactly what we just saw.

This. Is. Huge.

This is something that the media will catch on to and is likely to trigger action from the investing public. This is where the early part of the panic could start in the forex market, and it could then catch on in other markets – stocks, gold, silver, mining stocks, etc. This is the “oops, the unthinkable is happening” moment.

Those of you who have been profiting from how this situation develops practically throughout the entire year (like my subscribers), will likely be happy to know that the above indicates (I’m not making any guarantees, of course) that the biggest gains (based on mining stocks’ declines) are likely just ahead.

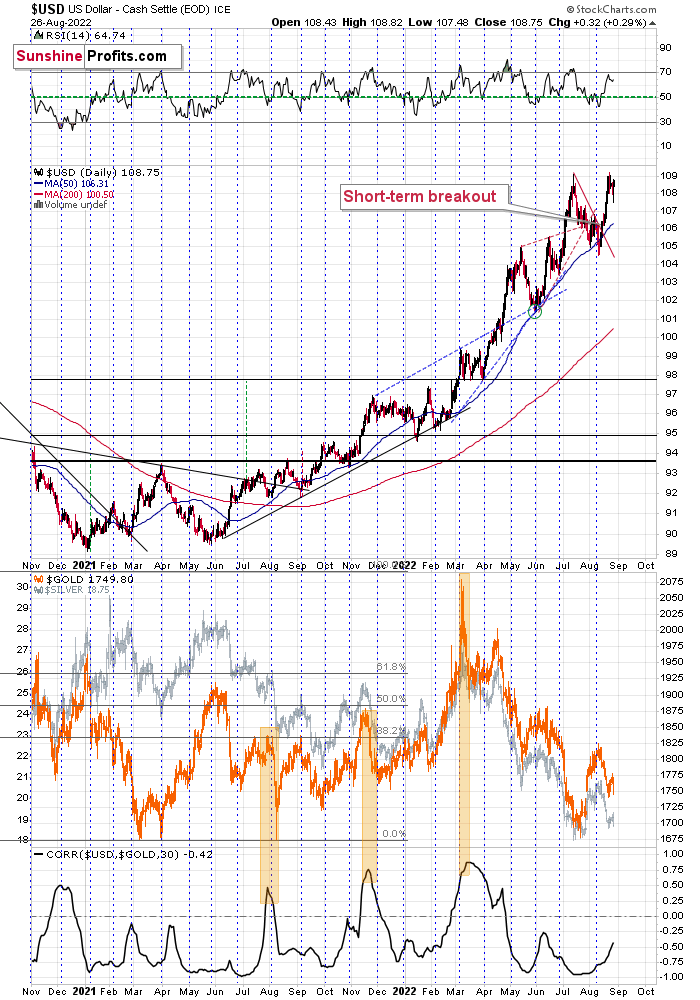

Moving back to the USD Index, it had recently moved slightly below its 50-day moving average, and then it moved back above it. After that, it started to rally, and it continued to rally until this moment.

(Click on image to enlarge)

This move is in tune with what we saw at previous local bottoms. The RSI moved slightly below 50, which used to accompany bottoms in the previous months.

So, the scenario in which the USD Index has already bottomed seems quite likely. In fact, we already saw a breakout to new highs in today’s (Aug. 29) pre-market trading.

Please note that back in June/July, gold was initially reluctant to decline. It moved sharply lower after it was already clear that the USDX was moving to new highs. Consequently, we might see a sizable short-term decline in gold very soon.

Let’s zoom out.

(Click on image to enlarge)

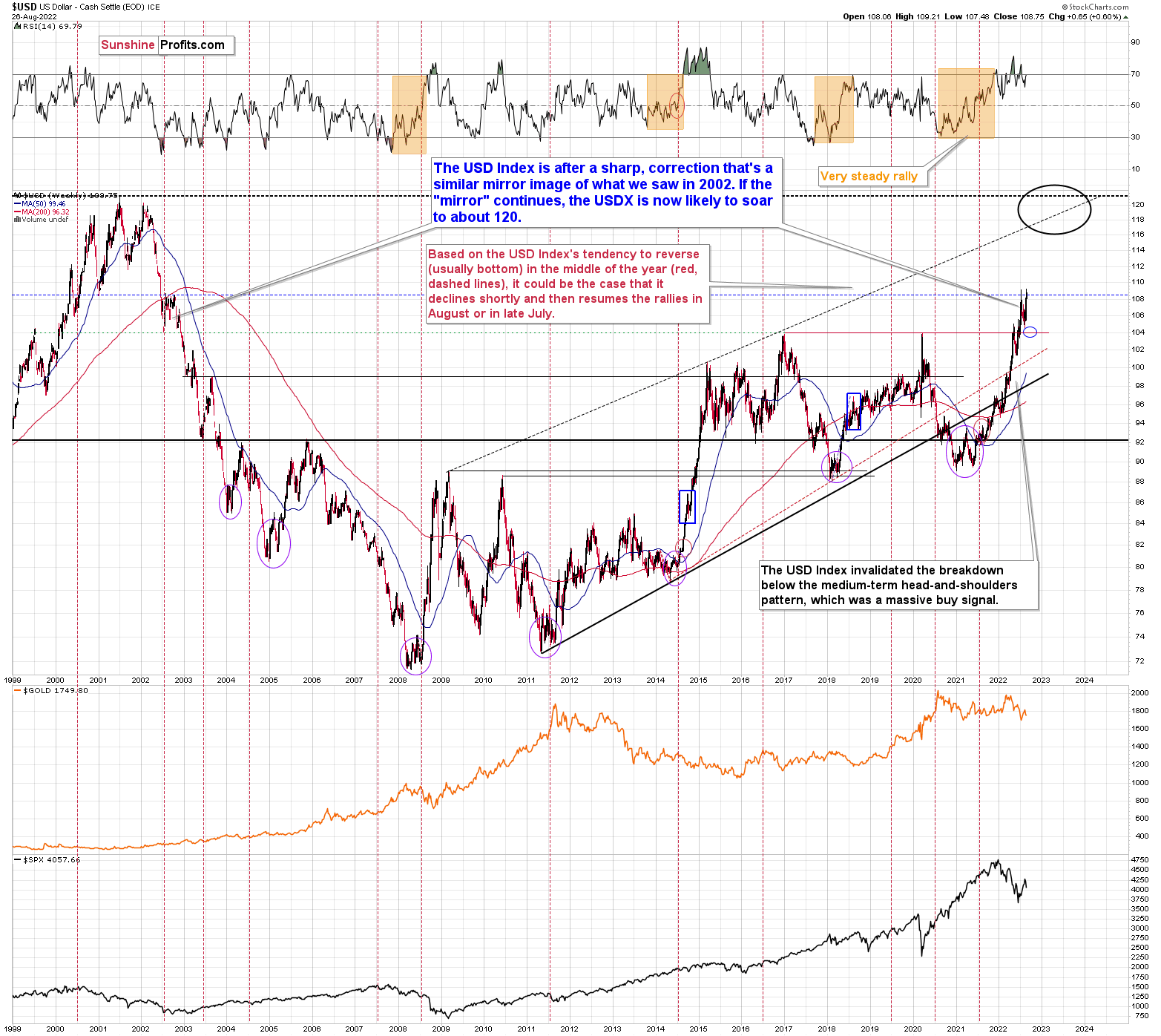

I previously wrote the following about the USD Index’s long-term chart:

There’s also the possibility that the USD Index keeps declining until it reaches the very strong support at about the 104 level – the previous long-term highs (…).

Last week, the USD Index bottomed at about 104.5, which was very close to the above-mentioned 104 level. If traders had expected the USD Index to bottom at this level, then some of them might have bought at higher levels in order to maximize their odds of catching the bottom, thus actually creating the bottom at higher levels.

As the USDX moved to the upper border of my previous downside target, it seems that the short-term bottom is already in.

This, in turn, likely means that the peak for precious metals is already in.

Please note that the USD Index is currently rallying in an approximately mirror image of how it declined in 2002. Based on this, it seems that one shouldn’t be surprised by a rather quick move from the current levels to about 120 – the USD Index’s long-term highs. Of course, the implications for the precious metals market are profoundly bearish.

If you can’t or don’t want to profit from declining mining stock prices, I also have good news. Please note that the decline is not likely to take place forever. Based on how the precious metals sector declined in 2008 and 2013 and based on multiple other indications, it seems that we’ll see a major bottom this year. While higher prices are encouraging, please note that there are two moments that determine a given trade’s or investment’s profitability – it’s not just the exit price, but also the entry price.

Thanks to declines and lower prices, one can get in at much lower levels and thus greatly increase the profits (again, I’m not guaranteeing any profits or market performance – nobody can guarantee it) from the entire huge rally that’s likely to take place in the following years.

The “mother of all buying opportunities” in the precious metals sector is likely not here yet, but it’s likely to present itself in the not-too-distant future. Stay tuned!

More By This Author:

Powell’s Words Can’t Shape Gold’s Medium-Term FundamentalsIf Investors Revive After Jackson Hole, Will The GDXJ Rise?

Don’t Be Influenced By Powell’s Upcoming Speech

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more