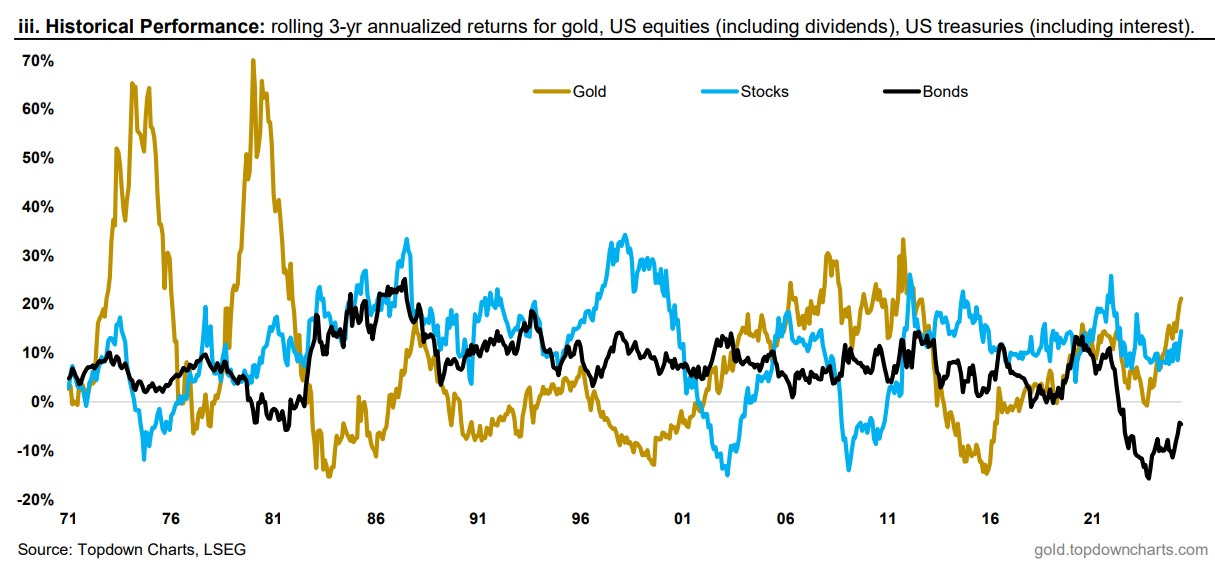

Gold Is Outperforming Stocks And Bonds

Congratulations, gold bugs, your long, painful wait is ending. The following chart shows the three-year rolling average annualized returns for stocks, bonds, and gold, with the latter now winning.

(Click on image to enlarge)

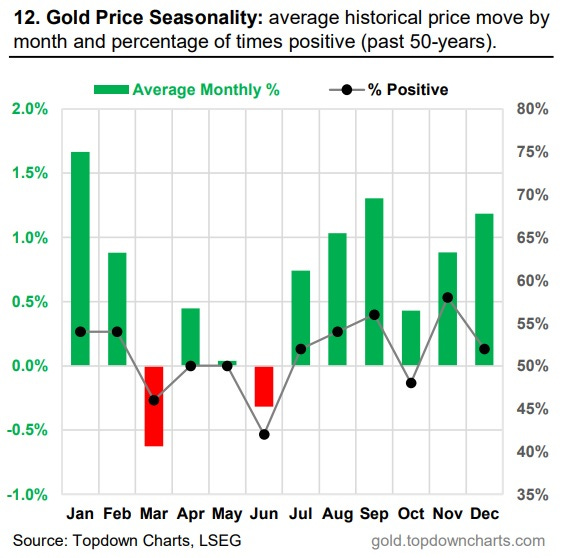

Gold is holding its gains even as it moves into its seasonally weakest stretch. No “sell and May and go away” so far.

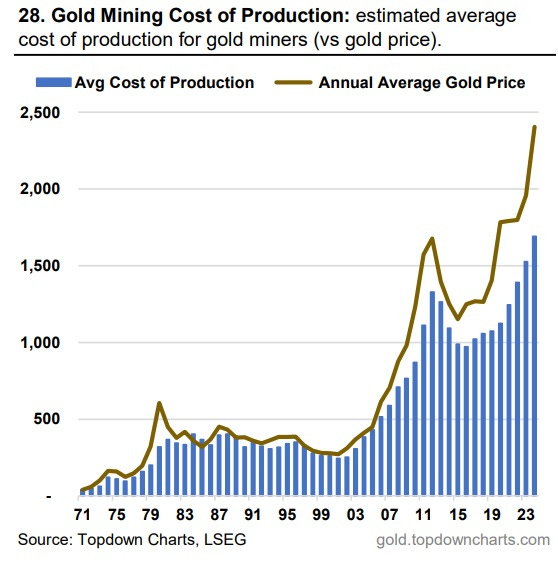

This is great news for gold miners, which are seeing their revenues outpace their costs, dramatically widening their profit margins. Note that the next chart is a bit outdated. With gold at $3,300/oz, current margins are actually a lot wider.

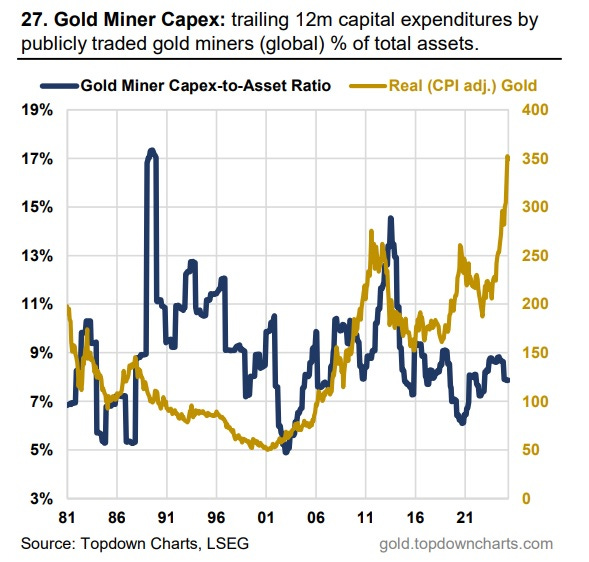

Wider margins mean more cash flow, which in turn means higher capital spending. The miners underinvested during gold’s long doldrums, and now have to catch up by finding and/or buying more ounces in the ground.

A growing share of this capex will be in the form of M&A, as big miners buy smaller ones at ever-more-favorable premiums. Check out the recent gains seen by our Portfolio stocks.

What About Silver?

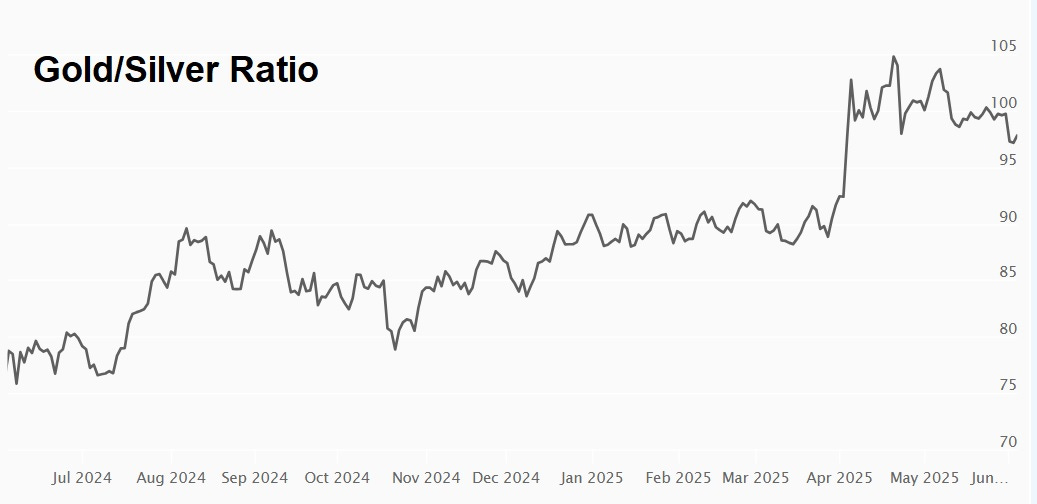

The gold/silver ratio (the number of silver ounces required to buy one ounce of gold) peaked recently at a historically crazy-high 105. Normally, a reading above 90 is a sign that silver is about to outperform gold (i.e., the gold/silver ratio declines). And that’s starting to happen, as silver tests resistance at $35/oz.

(Click on image to enlarge)

What’s Driving the Precious Metals Bull Market?

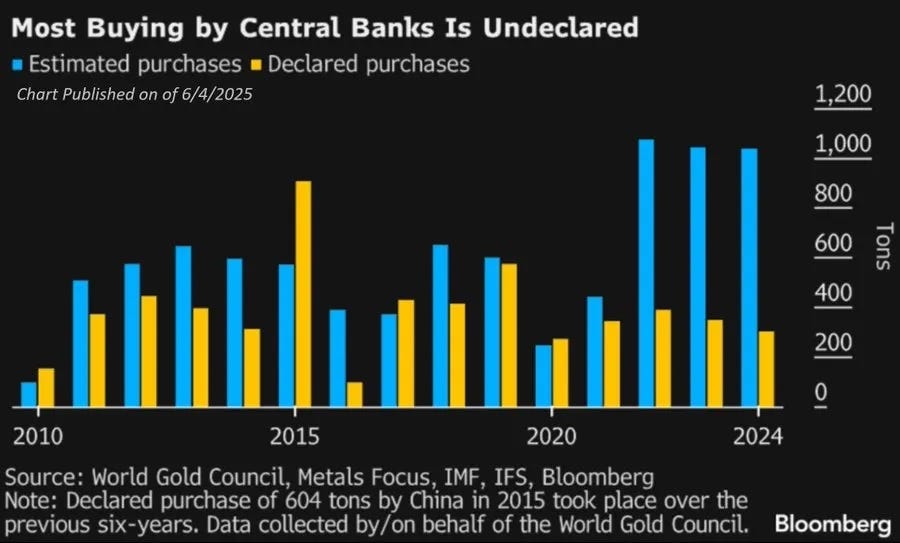

Central banks have been aggressive buyers of gold for the past few years, which accounts for the steady price increase.

(Click on image to enlarge)

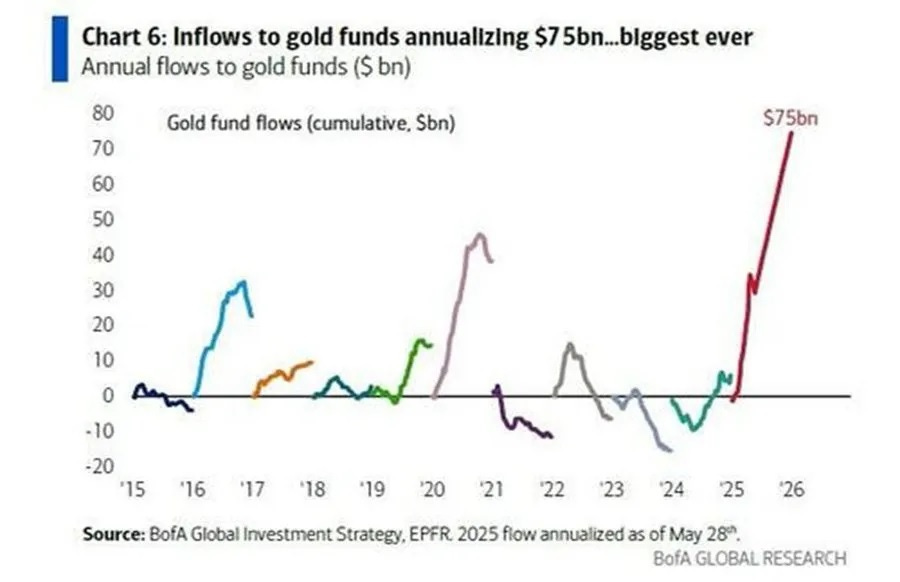

Wall Street, meanwhile, has suddenly discovered precious metals. From Katusa Research:

Wall Street Just Placed a Massive Gold Bet—And Retail Has No Idea.

$75 BILLION just flooded into gold funds—that's 3X higher than any crisis before. When institutional money moves this fast, this violently, they're not speculating. They're positioning.

(Click on image to enlarge)

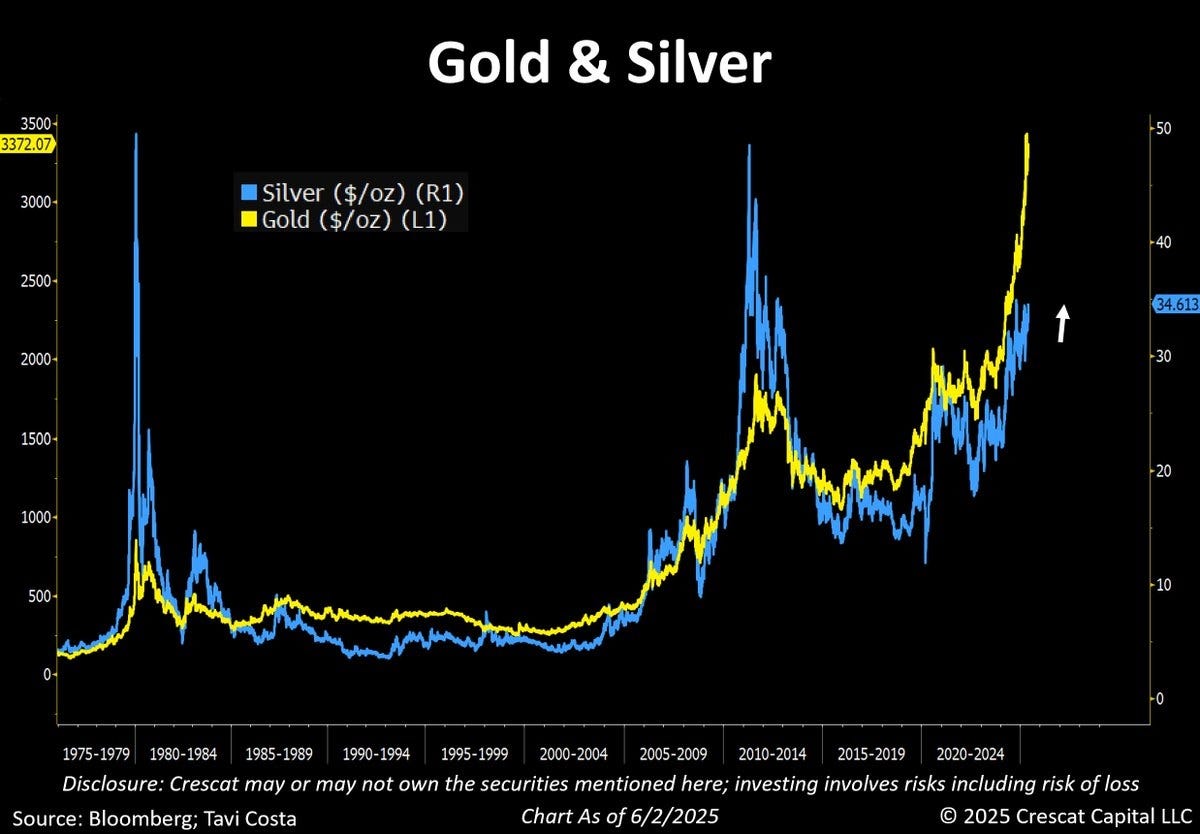

This run, in short, compares favorably with the previous two precious metals bull markets (in the 1970s and 2000s), when the well-positioned made life-changing money.

(Click on image to enlarge)

More By This Author:

The Fed’s New Old Tool: Quantitative Easing Repackaged And Running Just FineBank Of Japan Already Fears For Food Crisis, Social Unrest

Believe It Or Not, Gold Is Still Out Of Favor