Gold Is Now Definitely An Impulse Buy

Image Source: Pixabay

Recently, Costo began selling gold bars on its website. The bars were a big hit, generating revenues of $100 million in the most recent quarter. Now, Walmart has opened its own precious metals shop.

So, who’s next?

If gold works for the biggest-box retailers, expect Target (TGT) and other similar chains to join in. The result might be a significant amount of gold being taken off the market and stashed in safe deposit boxes and hiding places.

Both Ends of the Buying Spectrum

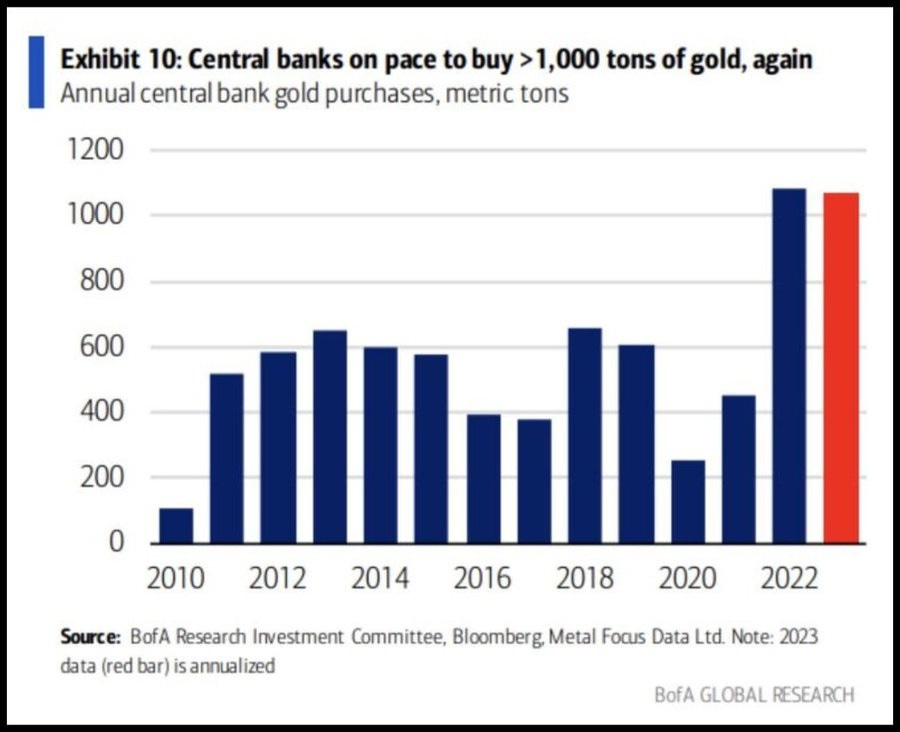

This good retail news comes as central bank buying ramps up to record levels.

(Click on image to enlarge)

Not so long ago, central banks were net gold sellers, and individuals had to seek out dedicated dealers to buy precious metals. The times are certainly changing.

Good News on the Legal Front

According to Kitco News:

"Several new bills filed in the Oklahoma and Missouri legislatures are seeking to eliminate state capital gains taxes on the sale of gold and silver, and also contain provisions to treat the precious metals as money rather than commodities, according to a recent article by Michael Maharrey for Schiff Gold. Missouri and Oklahoma are already among the 42 state that do not charge sales tax on the purchase of gold and silver bullion.

"Taxes on gold and silver sales raise the cost associated with precious metals investment, and the added transaction costs are a barrier to using the metals as money. If the bills succeed in eliminating this tax on the exchange of gold and silver, Missouri and Oklahoma would effectively treat bullion as money instead of as a commodity.

"The bills are a step toward reestablishing gold and silver as legal tender, as well as a challenge to the Federal Reserve’s monopoly on money in the United States."

2024 Might Be a Big Year

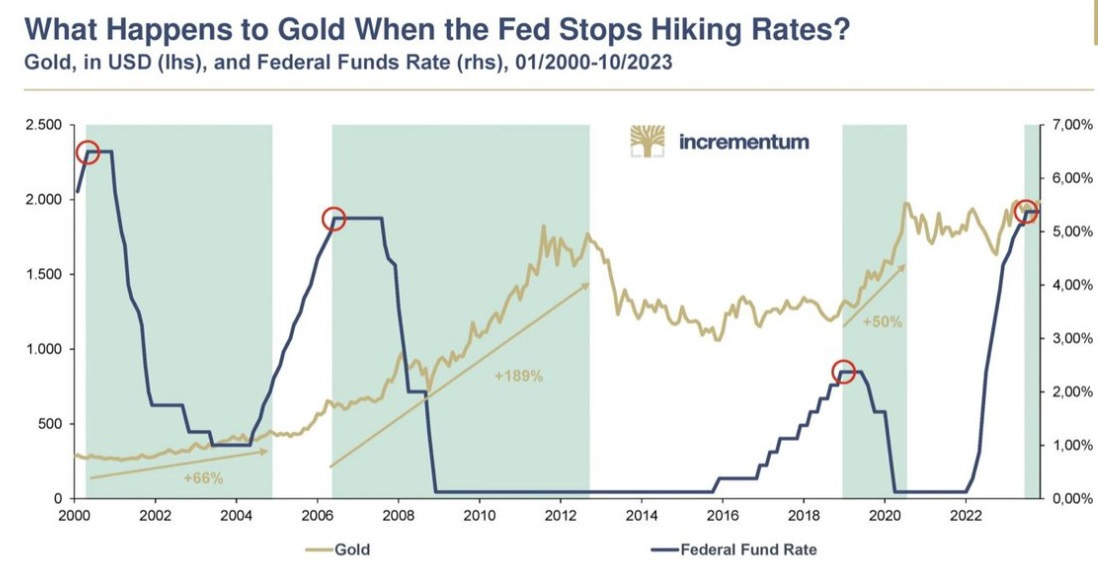

The above is happening in a monetary environment that, if past is still prologue, is already a great setup for precious metals. In the last few cycles, gold started major moves immediately after the Fed stopped raising interest rates — which seems to have just happened again.

(Click on image to enlarge)

More By This Author:

“Just Take It”: America’s New Foreign Policy Slogan Exasperates De-Dollarization

Sea Planes And Safe Landings In 2024

Could The Entire Banking System Come Tumbling Down?

A great move by #Costco, now they need to add Pt to make it complete.