Gold Is Enjoying A Banner Year Despite Softer Inflation

Image Source: Pixabay

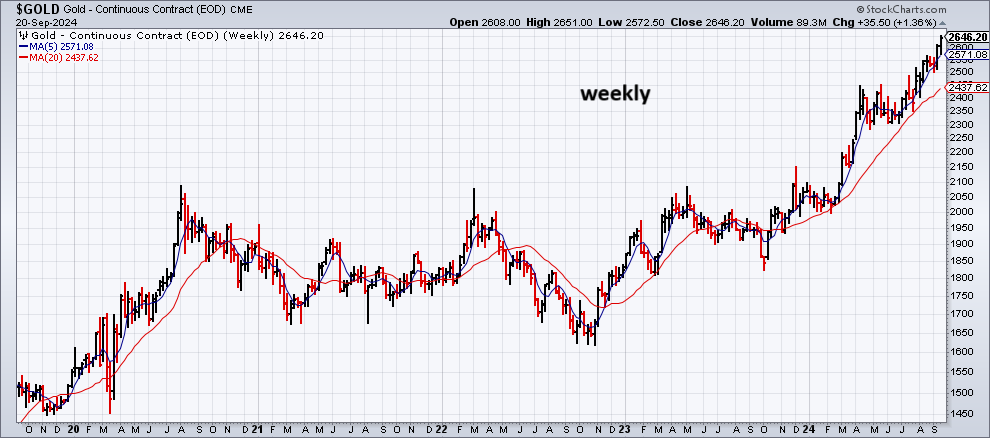

Everyone’s favorite precious metal is red hot this year, rising nearly 27% through Friday’s close (Sep. 23). Gold’s rally beats the strong runup in US stocks as well as rallies in the major asset classes, based on a set of ETFs.

An ounce of gold closed at yet another record high on Friday, topping $2,646 an ounce.

(Click on image to enlarge)

You could say that a perfect storm of events is driving gold higher, with one key exception: inflation isn’t a factor, at least based on published price data from a US perspective.

The Federal Reserve started lowering interest rates last week, and more cuts are expected. The reasoning: the war on inflation, if not yet won, is approaching that milestone. Or so Fed Governor Waller advises.

“Inflation is softening much faster than I thought it was going to, and that is what put me over the edge to say, look, I think 50 [basis points cut] is the right thing to do,” he told CNBC on Friday.

The view that gold is an inflation hedge through time isn’t wrong, but in the shorter run there a mix of factors that can dominate the metal’s price. In the current climate, despite ongoing evidence of disinflation, gold’s rally this year finds support from other drivers.

Rising risk in the Middle East is on the short list of possible/likely factors behind gold’s strength. The latest escalation in the conflict between Israel and Lebanon’s Hezbollah raises the threat of an all-out war over the Lebanese-Israeli border.

Meanwhile, the Ukraine-Russia war persists while China is testing red lines in the South China Sea with provocations targeting Filipino ships — provocations that are ultimately a test of US credibility vis-a-vis a mutual defense treaty between Washington and Manilla. US-China tensions are also on the rise due to a recently deployed US missile system in the Philippines — a system that can strike China, which in turn has triggered a sharp response from Beijing that the deployment “seriously threatens the security of regional countries and intensifies geopolitical confrontation.”

Add in the potential for political turmoil in the US in what may be a contested US presidential election in November and it’s easy to see a number of events that may persuade investors that gold’s safe-haven reputation is looking increasingly attractive.

There’s also the financial perspective. As the Federal Reserve cuts interest rates, the yield advantage in favor of bonds vs. gold eases. There’s also a view in some circles that rate cutting is premature and that it could unleash a new round of pricing pressure.

“By cutting rates more than expected, the Fed is indirectly opening the door to an increased money supply, risking a second wave of inflation and a further weakening of the dollar,” says Alex Ebkarian, COO and co-founder of precious metals dealer Allegiance Gold.

Reports of central bank purchases in recent history is another factor. In a bid to diversify foreign currency reserves, China, Russia and other countries have been ramping up holdings of gold, which is considered a non-state currency alternative to the US dollar.

“Geopolitical risks, such as ongoing conflicts in Gaza, Ukraine, and elsewhere, will ensure to sustain gold’s safe-haven demand”, Forex.com analyst Fawad Razaqzada writes in a note to clients.

The latest headline on this front: “Saudi Arabia is secretly buying gold,” reports The Jerusalem Post. “Analyst Jan Nieuwenhuijs from MoneyMetals exposes a startling truth: Saudi Arabia might be secretly accumulating gold. He estimates a staggering 160 tons purchased since 2022 in Switzerland, a move contributing to the current gold rush.

Gold’s rise this year is all the more striking because it’s outperforming commodities overall and several core subcategories, including energy, agricultural products and base metals, based on a set of ETFs managed by Invesco.

How long will the gold rally last? No one knows, but this much is clear: Is a world of elevated risks, the case for carving out an allocation to the precious metal looks compelling these days. Meanwhile, recent price trend behavior suggests that the peak for this cycle still lies ahead.

More By This Author:

GDP Nowcasts Still Indicate Low Recession Risk For U.S. In Q3Mixed Risk-Appetite Signals Sharpen Debate For Markets Outlook

Defying Recent Recession Warnings, Growth Likely To Prevail In Q3

Disclosure: None.