Gold - In Neutral Mode!

Gold finished the week with a bullish close above 1,320 USD. Bulls remain in control and the expected spike towards around 1,350 USD remains very realistic over the next few days or maybe weeks.

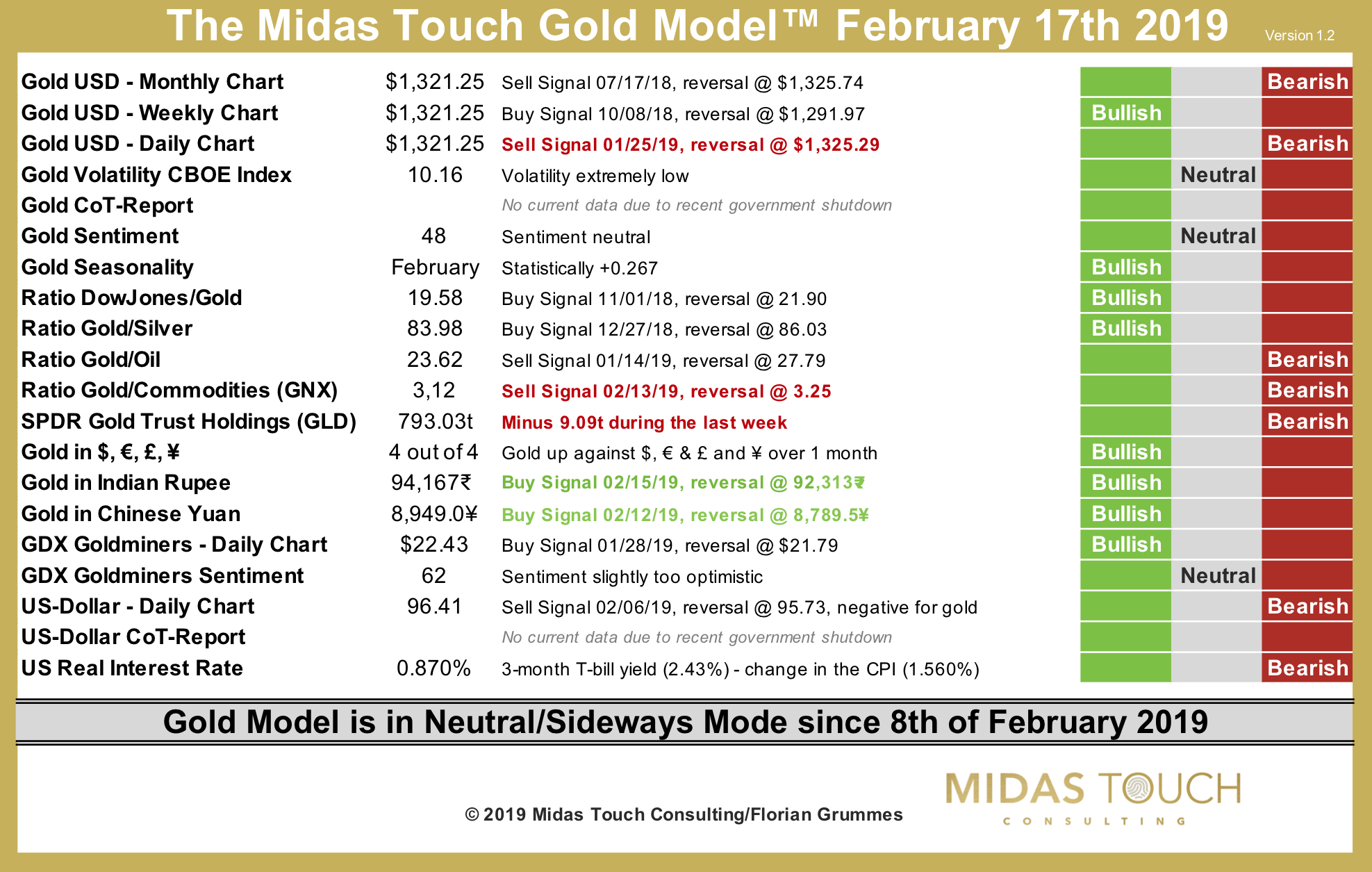

At the same time, our Midas Touch Gold Model™ is in neutral mode, indicating that the air is getting thinner and thinner for the bulls! Of course, general public perception is getting more and more bullish, pushing all the amateur traders into the slaughterhouse…

(Click on image to enlarge)

Gold simple monthly chart as of February 17th, 2019

Interestingly enough, the monthly chart for gold is just a few dollars away from a pro-cyclical buy signal. But these type of signals on the monthly chart usually come in very late and are basically just confirming the last six months of price action.

(Click on image to enlarge)

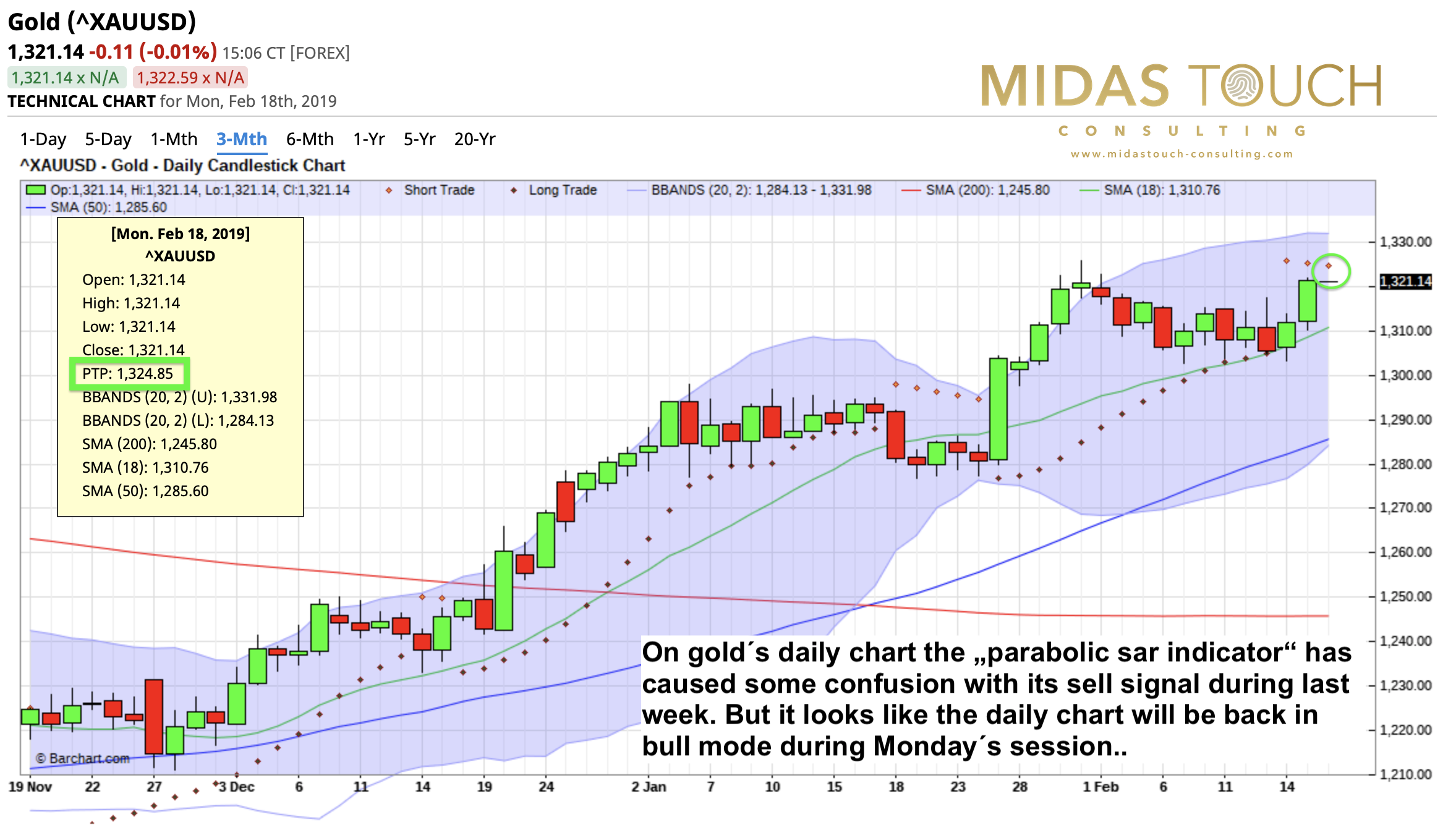

Gold simple daily chart as of February 17th, 2019

Zooming into the daily chart for gold, the model added a new sell signal during the week when gold pulled back towards 1,302 USD. This is probably just irritating “short-term noise” as the daily chart only needs to move above 1,325.05 USD to flip this signal towards bullish again.

Positive are in any case the new buy signals for gold in Indian Rupee and Chinese Yuan. The strong outflows (minus 9 tonnes) from the inventory of the largest gold ETF (GLD) on the other hand are a negative signal. They might imply that the last leg of this six-month up-wave is (as usual) only happening in the paper markets for gold! Note that exaggerations in the gold market are never backed by physical demand…

Conclusion

Gold remains in a strong uptrend and has very good chances to reach the massive horizontal resistance around 1,350 USD. But now is not the time to be brave in the precious metals sector. Instead, tighten your stops and continue to take some speculative money off the table. While we have a runner left to cash in, preparation are being made to place a swing trade short on gold once we have reached around 1,350 USD. The next larger wave will be down!

Disclosure: None.

"The strong outflows (minus 9 tonnes) from the inventory of the largest gold ETF (GLD) on the other hand are a negative signal."

Florian, how reliable are GLD's holding reports? GLD does not give retail investors the right to redeem for any of its mystery physical gold holdings. This fact alone ensures the GLD shares to be nothing more than paper at the end of the day.

GLD also has a glaring audit loophole in their prospectus that states they have no right to audit subcustodial gold holdings. To this day, I have not heard of a single good reason for the existence of this backdoor to the fund. I remember there was a highly publicized visit by CNBC's Bob Pisani to GLD's gold vault. This visit was organized by GLD's management to prove the existence of GLD's gold but the gold bar held up by Mr. Pisani had the serial number ZJ6752 which did not appear on the most recent bar list at that time. It was later discovered that this "GLD" bar was actually owned by ETF Securities.