Gold Hovers Near Record Highs After Mixed U.S. CPI Report

Image Source: Unsplash

Gold (XAU/USD) edges modestly higher on Tuesday as traders react to the latest US inflation data. At the time of writing, XAU/USD trades around $4,615, up nearly 0.6%, just shy of Monday’s record high near $4,630.

Data released by the US Bureau of Labor Statistics (BLS) showed that headline Consumer Price Index (CPI) inflation came in broadly in line with expectations, while core inflation undershot expectations, keeping theFederal Reserve (Fed) inclined toward further monetary policy easing.

The precious metal remains underpinned by steady safe-haven demand as geopolitical and economic uncertainty keep investors cautious. Markets remain unsettled by the criminal investigation into Fed Chair Jerome Powell, which has revived concerns over the central bank's independence.

At the same time, risk sentiment has been hit by fresh geopolitical developments after US President Donald Trump threatened a 25% tariff on countries doing business with Iran amid nationwide anti-government protests.

This follows earlier US actions in Venezuela, where Washington carried out a military operation against President Nicolás Maduro, as well as Trump’s renewed rhetoric over strategic interests in Greenland.

Market movers: Markets jittery as DOJ probes Powell, Fed independence in focus

- The US Department of Justice issued grand jury subpoenas as part of a criminal investigation into Federal Reserve Chair Jerome Powell, linked to his Senate testimony on the Fed’s $2.5 billion headquarters renovation project. Powell said the move is politically motivated and stressed that the Fed will continue to set policy based on economic conditions rather than political pressure.

- Adding to concerns over Fed independence, US President Donald Trump is expected to announce a potential replacement for Jerome Powell later this month, with Powell’s term as Fed Chair ending in May 2026. Markets widely expect Trump to nominate a candidate more closely aligned with his policy views, reinforcing uncertainty around the future direction of US monetary policy.

- On the monetary policy front, markets are currently pricing in around two Fed rate cuts this year. However, last week’s US employment report showed the labour market is holding up better than many feared, tempering expectations for aggressive easing and reinforcing the view that the Fed can afford to keep interest rates unchanged at its January meeting.

- Attention also remains on the US Supreme Court, which is due to hold an opinion day on Wednesday on the legality of Trump-era tariffs. At the same time, the court is set to hear arguments on January 21 in the case over Trump’s attempt to remove Fed Governor Lisa Cook.

- Major investment banks remain broadly bullish on Gold’s outlook. Bank of America, JPMorgan, Goldman Sachs, Morgan Stanley and UBS expect prices to hold in the $4,500-$5,000/oz range through 2026, citing anticipated Fed rate cuts, rising debt concerns, steady central bank and ETF buying, and persistent geopolitical uncertainty, according to Reuters.

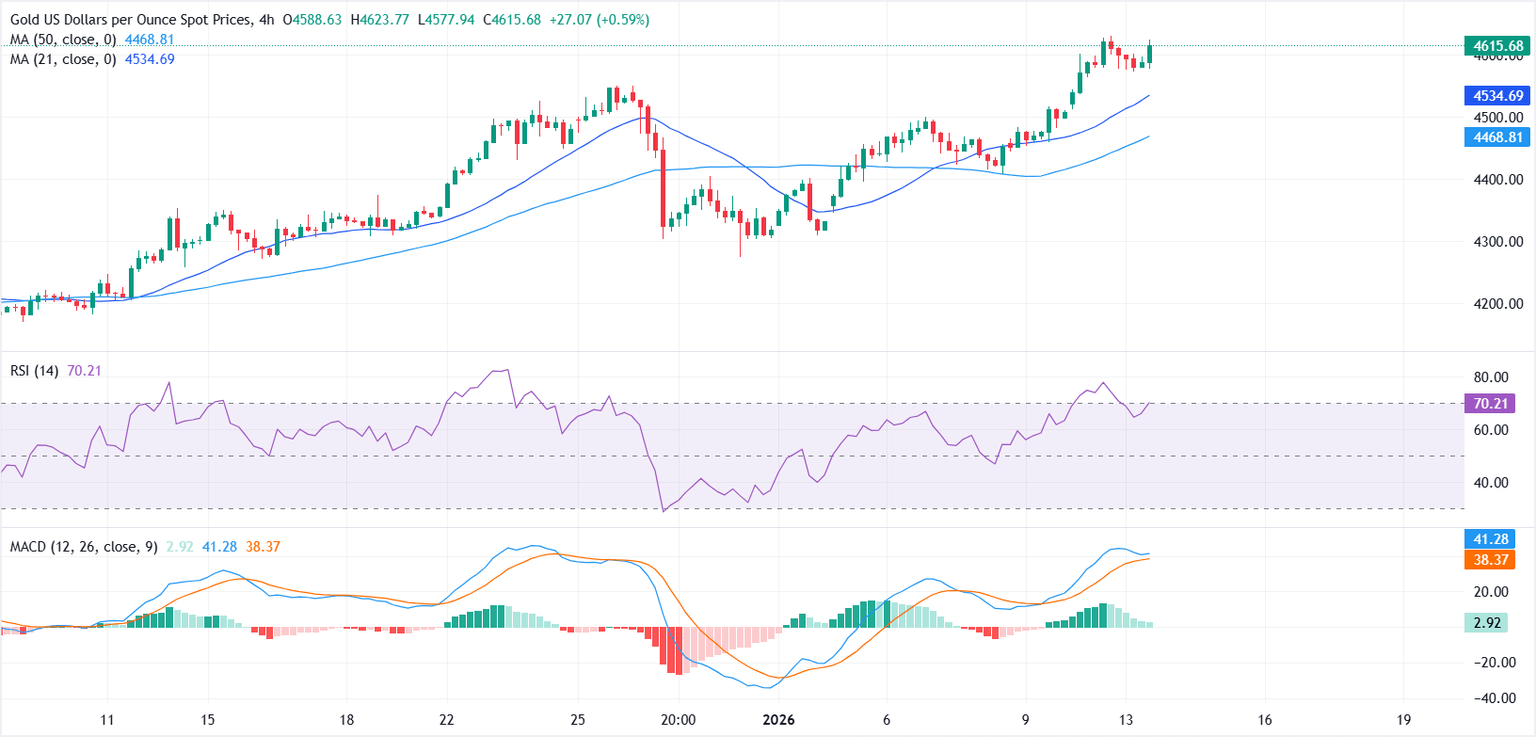

Technical analysis: Strong trend persists despite overbought conditions

(Click on image to enlarge)

On the 4-hour chart, the 21-period Simple Moving Average (SMA) has crossed above the 50-period SMA, with both indicators sloping higher, reinforcing the prevailing uptrend.

Price action remains comfortably above its key moving averages, with the 21-SMA near $4,534.94 acting as the first layer of dynamic support, followed by the 50-SMA around $4,468.91.

Momentum indicators remain constructive. The MACD is holding above its signal line in positive territory, while the modestly expanding histogram points to firm bullish momentum.

Meanwhile, the RSI stands at 70.88, flashing overbought conditions, which suggests the rally may pause or consolidate in the near term. Any pullback, however, could be viewed as corrective rather than trend-changing, keeping the broader technical bias tilted to the upside.

More By This Author:

GBP/USD Holds Steady Around 1.3475 As Traders Seem Hesitant Ahead Of US CPI ReportEUR/USD Remains Depressed Despite Strong Eurozone Consumption Figures

Gold Flat Lines Around $4,475; Looks To US NFP Report For Fresh Impetus

The technical analysis of this story was written with the help of an AI tool.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and ...

more