Gold Hits All-Time Highs And DJCI Silver Tops 10% In November

“Silver and gold, silver and gold,

Everyone wishes for silver and gold.” - Burl Ives

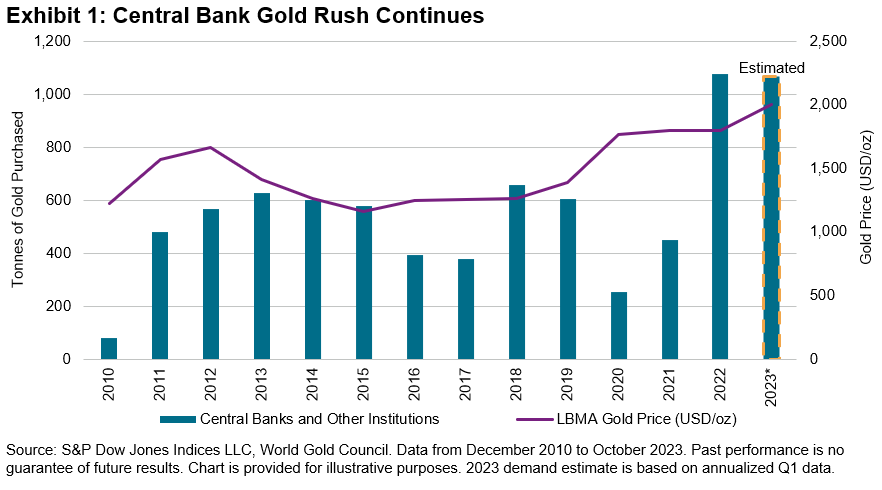

My all-time favorite stop-motion animation show was the 1964 TV special Rudolph the Red-Nosed Reindeer, narrated by Burl Ives. Playing the role of Sam the Snowman, Ives sang “Silver and Gold,” paying tribute to the work of Yukon Cornelius, a prospector mining near Santa’s workshop. Those tracking the Dow Jones Commodity Index Silver struck it rich, as the index posted a 10.6% gain in November. The Dow Jones Commodity Index Gold, not to be outdone, hit an all-time high before settling down on thin volumes. Central banks continued to add 800 tons of gold to their portfolio in the first three quarters of the year, led by the People’s Bank of China. Purchases thus far drove gold to an all-time high, as inflation wreaks havoc on fiat currencies. Following a year of record gold purchases, central banks are on pace to nearly match 2022 levels. Investors appear to be fighting the U.S. Fed, however, as net redemptions in physical gold ETFs have seen USD 12 billion in outflows YTD.

(Click on image to enlarge)

Beyond precious metals, renewed optimism of a rebounding Chinese economy led industrial metals to a strong monthly performance. Industrial metals, including the S&P GSCI Lead, S&P GSCI Zinc, and S&P GSCI Copper, gained 2%, 3% and 4%, respectively.

While “silver bells” rang up 10% returns, cocoa and coffee registered 12% and 13%, respectively, with the S&P GSCI Coffee hitting double-digit returns for the second consecutive month. Reduced production due to heavy rainfall in the Ivory Coast boosted the S&P GSCI Cocoa to 72% YTD; combined with the S&P GSCI Sugar, which was up over 50% YTD, the two will surely sweeten the holiday season. Just don’t overdo it, else Yukon Cornelius will have to bring you to the dentist to pull out that sweet tooth.

More By This Author:

Finding Fee Savings In Fixed Income

The November 2023 Rebalance Of The S&P 500 Low Volatility Index

A Tactical Look At Sectors

Disclaimer: See the full disclaimer for S&P Dow Jones Indices here.