Gold Hits $3,791 Record Before Easing As Powell Speech Lifts Volatility

Image Source: Pexels

Gold price climbs during the North American session on Tuesday, up by 0.73% after reaching a record high at $3,791 following the release of US economic data and Federal Reserve (Fed) Chair Jerome Powell's speech. At the time of writing, the XAU/USD trades at $3,772 after bouncing off daily lows of $3,736.

XAU/USD extends gains despite Powell’s cautious tone

Fed Chair Powell's speech mentioned that “downside risks to employment shifted balance of risks, prompting to last week’s rate cut,” and that the rate cut moved policy to a more neutral stance. Despite acknowledging employment risks, he said that “two-sided risks mean there is no risk-free path.”

Powell added that inflation has risen, remaining somewhat elevated, and that “reasonable base case is that tariff-driven inflation effects will be relatively short-lived.” He added that policy is modestly restrictive and that they remain data dependent.

Other policymakers crossed the wires. Atlanta Fed President Raphael Bostic said that he is open to the use of an inflation target range and expects further inflationary pressure ahead. Fed Governor Michelle Bowman said that she is looking for three cuts total in 2025 to support the labor market, while the Chicago Fed' Austan Goolsbee noted that the Fed needs to get inflation to 2%.

Earlier, S&P Global revealed that business activity in the US slowed in September after revealing both the Services and Manufacturing Purchasing Managers Index (PMIs).

Ahead this week, the US economic docket will feature Durable Goods Orders, the final print of the Gross Domestic Product (GDP) for Q2 and the Fed’s preferred inflation gauge, the core Personal Consumption Expenditures (PCE) Price Index.

Daily market movers: Gold price advances amid neutral Powell stance

- The US Dollar (USD) falls following Powell, undermined also by falling US Treasury yields hinting that market participants are pricing in rate cuts. The US Dollar Index (DXY), which tracks the American currency value against a basket of six peers, tumbles 0.07% to 97.22.

- US Treasury yields are falling with the 10-year Treasury note down three bps at 4.114%. US real yields — which correlate inversely to Gold prices —dove nearly three-and-a-half bps to 1.744%.

- Chair Powell revealed that the policy path is difficult, noting that they must look at both inflation and employment goals “equally.” He added that he still sees downside risks in the labor market. Regarding inflation, he says it's coming into better balance and that the Fed Beige Book showed the economy is growing modestly.

- Earlier, US economic data revealed that manufacturing and services activity slowed down in September. The S&P Global Manufacturing PMI dipped to 52.0 from 53.0 reported in the previous print. Meanwhile, the Services PMI fell to 53.9 from 54.5 in August.

- S&P Global revealed that prices paid rose to 62.6 in September, up from 60.8 last month as business mentioned tariffs “as the principal cause of further cost increases.”

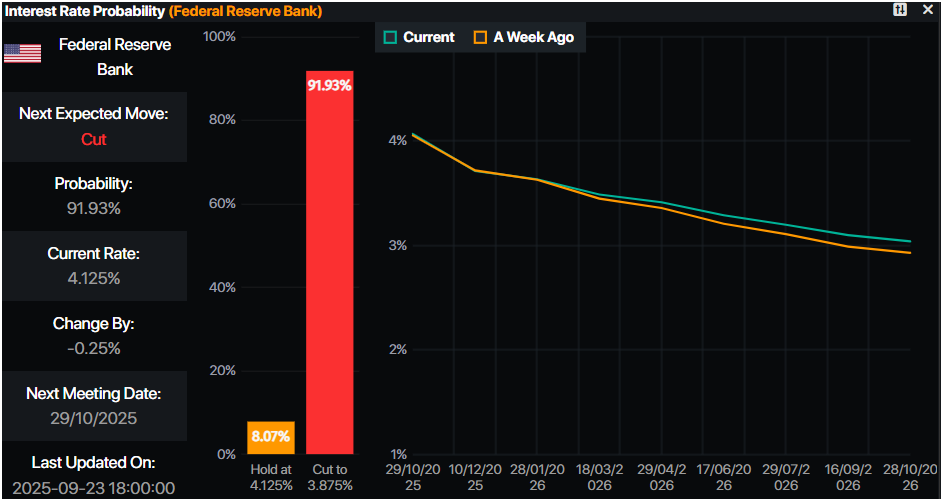

- The Fed is expected to cut rates 25 bps at the October 19 meeting, as revealed by data from Prime Market Terminal. Odds are at 91%.

(Click on image to enlarge)

Source: Prime Market Terminal

Technical outlook: Gold price reaches all-time high, target on $3,800

Gold price uptrend remains intact, but in the short term it seems that buyers are reluctant to drive XAU/USD spot prices toward $3,800. A daily close below $3,760 would pave the way for challenging $3,750, ahead of falling to $3,700.

The Relative Strength Index (RSI) suggests that bulls remain in charge, but that they’re losing some momentum.

Conversely, if buyers drive Bullion prices past $3,775 it clears the path to test the record high of $3,791. If breached, $3,800 is up next.

(Click on image to enlarge)

More By This Author:

EUR/USD Rallies To 1.1800 As Dollar Slumps Ahead Of PowellGBP/USD Steady At 1.3518 As PMIs Signal Slowdown, Powell Speech Eyed

GBP/USD Rebounds As Dollar Softens, But UK Risks Limit Upside