Gold: Global Economic Risk Is On Red Alert Due To Pandemic

Fundamentals

The fundamentals for gold and silver remain strong, even as both have high volatility, which is great for day traders. With uncertainty about the US presidential election next week, doubts about any possible US stimulus package, tensions with China, and increasing COVID-19 cases with unemployment rates high and businesses closing, gold and silver are bullish in the mid to long term. Europe is locking down again, which will further harm their economies. In the short term, we will get some reversals in gold, which you can use to build a larger long-term position. With increasing government debt, fiat currencies will continue to decline in value, which also is bullish for gold and silver. Whoever wins the US election next week is going to face the economic necessity of a larger stimulus package, which will further pump up stocks, while also being bullish for gold and silver as fears of inflation will increase. As we move into a new economic system, gold will play a major role as a stabilizing currency, especially as inflation and hyperinflation fears increase with the massive printing of money and increasing debt.

Creating more supply of any asset, such as a currency, decreases its value. Therefore, governments printing money will reduce its purchasing power and increase the rate of inflation. At least up to this point, governments do not appear to be concerned with the inflationary effects of their money printing. Since they are not, it appears likely that inflation or even hyperinflation is on the horizon. They may at some point introduce a digital currency or another currency as the global reserve currency, but no one knows at this point. The system is broken and is unsustainable, so change will happen. With such massive debt, any increase in interest rates will lead to extensive defaults around the world. For all of these reasons, we are buying gold and silver for the long term. It's a great opportunity.

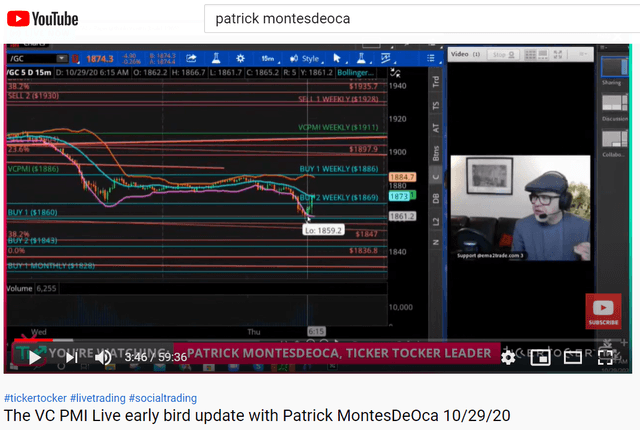

When gold came down today to $1,859, the media started to say that the boom in gold was over. If you listened to the media, you would have sold. Yet, supply came into the market and gold reversed back above $1,872. The Variable Changing Price Momentum Indicator (VC PMI) said that the market was likely to reverse, and it did.

Gold

Gold is at $1,872. Gold is down $6. We have come back from the lows today. The daily mean level we are looking at based on the VC PMI is at $1886. The daily Buy 1 level is $1,860, which has been activated. We are now getting another active signal to buy at $1,874. The target above is $1,886, which is the weekly target. Trading above $1,869 is activating the weekly Buy 2 signal with the same $1,886 target. You can use $1,869 as a stop level. Do not use straight stops, since they can be taken out. We do use straight stops to trail a position, but other than that, we do not use straight stops. If you have multiple contracts, you also can get out with profits at various levels to protect your profits. We are at the bottom of the trading range and, once we break out of that range, the target will be above $1,900, and possibly up to $1,988.

Courtesy: TickerTocker

The Buy 1 level provides a 90 percent probability of the market reverting from that level back to the mean, while the Buy 2 level has a 95 percent probability of a reversion to the mean. The same applies for daily, weekly and monthly signals, as well as for the Sell 1 and Sell 2 levels back down to the mean.

Gold is giving us a long signal daily and weekly with a target of $1,886. The corrections we have been getting have all been short-lived. Serious money is coming into the gold market from hedge funds and institutional investors. With interest rates almost at zero, there's very little room to earn any income on a bond portfolio.

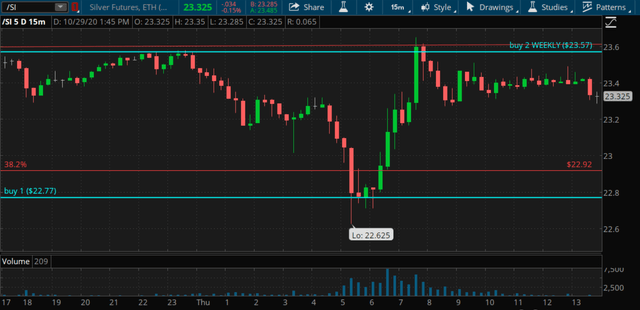

Silver

Silver has had a major reversion back down to the daily Buy 1 level at $22.8250 this morning. The daily target is $23.72. The Buy 2 weekly level is $23.57, which will activate a weekly trigger buy signal. The Buy 1 weekly target is $24.14. The reversion appears to be confirming that the metals cannot be kept down.

Disclosure: I am/we are long GDX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from SA). I have no business relationship ...

more