Gold Glitters As Bitcoin Stumbles: What’s The Superior Safe-Haven Asset?

Image Source: Pexels

Geopolitical risks and market swings have driven both gold and Bitcoin (BTC) sharply higher this fall, reinforcing arguments for their adoption as portfolio diversifiers for retail investors.

Yet while gold continues to show strength, Bitcoin’s recent correction highlights the asset’s inherent volatility — even after an extraordinary rally earlier this fall.

Bitcoin’s September-October 2025 Rally

- September Performance: BTC jumped 8%, marking its best September in over a decade.

- October Breakthrough: Broke through a new all-time high, surpassing $126,000.

- Market Cap Milestone: This price growth pushed Bitcoin’s total market capitalization above $2 trillion.

- Sudden Downswing: Bitcoin dropped all the way to $110,000 in a crypto flash crash last week.

In terms of on-chain metrics, BTC’s data points to strong demand and adoption from large investors who continue to attract record inflows.

However, when U.S. President Trump announced 100% tariffs on Chinese exports last week, Bitcoin retreated.BTC fell as much as 8% before recovering part of the losses — a reminder of how sensitive this asset is to policy shocks and macro sentiment.

Similarly, gold has also enjoyed incredible performance this fall.

Driving the Gold Rally

- September Performance: Gold rose approximately 10%.

- October Milestone: Briefly surpassed $4,000 per ounce.

- Year-to-Date Gain: Was up roughly 50% by early October.

- Ultimate Safe Haven Asset: Gold continues to bypass considerable volatility in the stock market and crypto market.

The precious metal has retained its long list of heavy buyers–– mostly from central banks who continue to expand reserves and diversify away from the U.S. dollar exposure. Gold-backed exchange-traded funds have also recorded inflows.

According to data from the World Gold Council (WGC), bullion funds added 146 tonnes of the metal, up from 53 tonnes in August. In dollar value, this totaled $17.3 billion, driving assets under management (AUMs) to $472.5 billion.

There are a number of different factors driving gold’s value up including a weakening U.S. dollar and expectations of interest rate cuts. The U.S. political gridlock and rising trade tensions also seem to be powering gold’s incredible run.

Contrasting Profiles, Shared Purpose

Over the past five years, Bitcoin’s price has risen about 907%, vastly outpacing gold’s roughly 111% gain, though Bitcoin’s 12-month growth of 81.73% is closely similar to gold’s 1-year growth of 51.63%.

Yet this difference in returns highlights their contrasting characteristics.

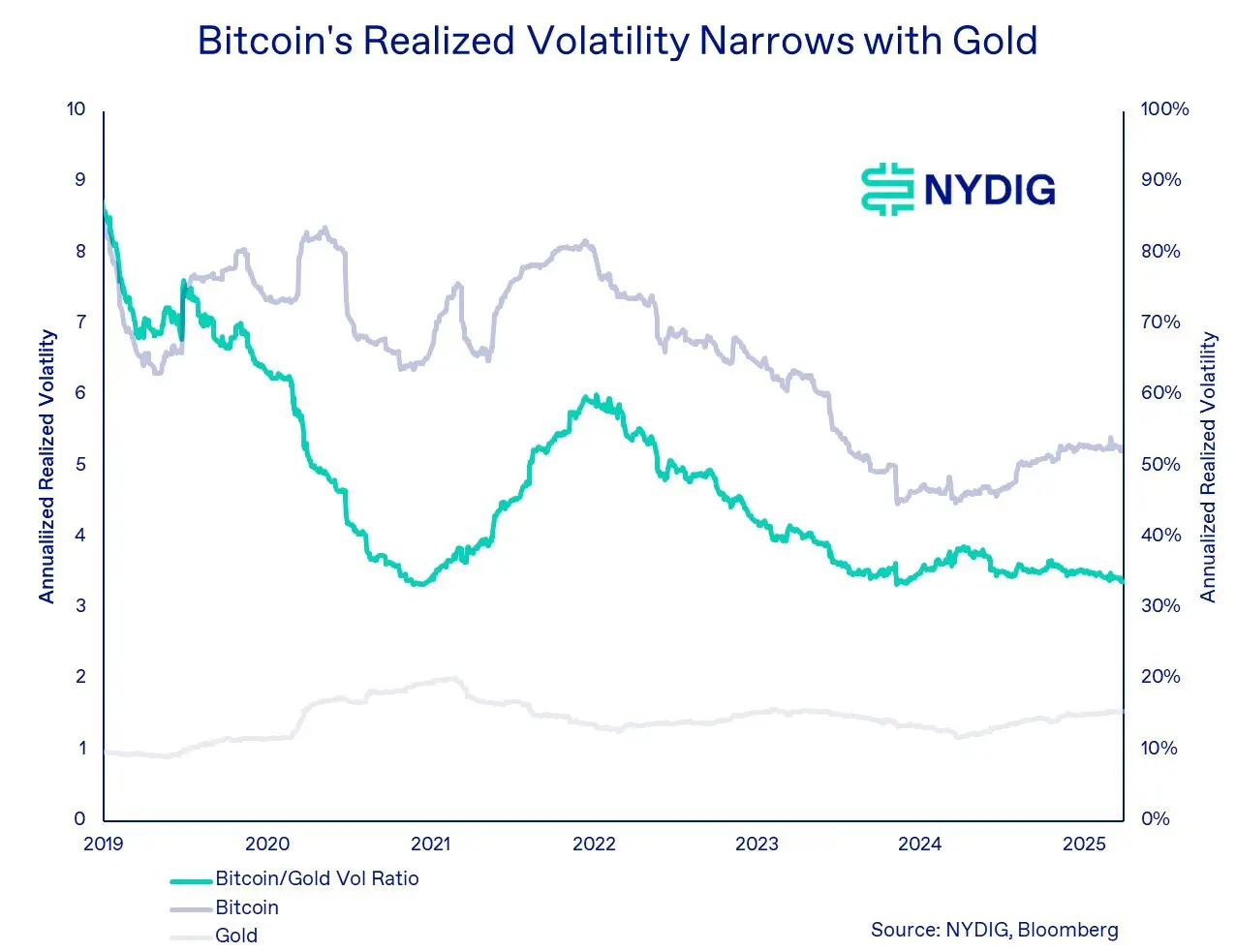

For one, Bitcoin’s exceptional price return is accompanied by significant volatility, with annualized price swings often exceeding 50%. In contrast, gold’s volatility numbers are lower, typically around 15%, a level comparable to broad equity indices. Where gold tends to rise during crises, Bitcoin can move sharply in either direction — thriving mostly when liquidity and risk appetite grow.

(Click on image to enlarge)

Bitcoin’s Realized Volatility Narrows with Gold (Source: NYDIG)

This stark difference in risk profiles clarifies their distinct roles within institutional portfolios. Gold is predominantly treated as a portfolio stabilizer, whereas Bitcoin is categorized as a higher-risk, speculative asset.

Institutional interest and macro drivers

Despite the difference in their risk profiles, both assets continue to drive increased institutional participation.

Bitcoin’s Appeal

- Its digital structure is attractive as a hedge against currency debasement.

- Bitcoin is far easier to transfer and hold compared to gold.

- Digital assets have existed for less than 20 years, so there’s potentially more room for growth.

Gold’s Role

- Gold remains an enduring asset and monetary anchor that provides stability during times of financial market uncertainty.

- Gold is significantly less volatile than Bitcoin.

The Shared Driver:

A common set of macroeconomic worries is driving funds into both assets, including:

- U.S.-China trade tensions.

- A general unease about the long-term value of fiat currencies.

The future market performance of this stabilizer and growth asset will depend on how these macroeconomic policies evolve and the persistence of the current geopolitical climate.

More By This Author:

Record Quarter For ETF Inflows Pushes BlackRock Stock HigherConsumer Sentiment Dips To Lowest Level Since May

Applied Digital Jumped 28% - Here’s Why