Gold Futures: Further Consolidation On The Cards

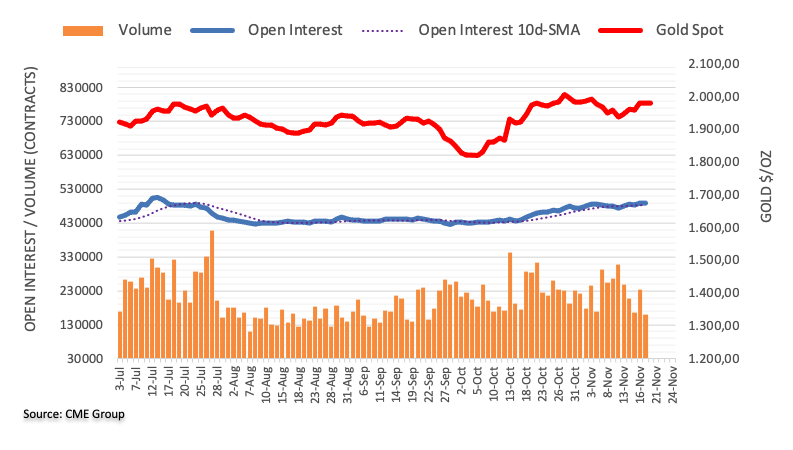

Open interest in gold futures markets increased for the second session in a row on Friday, this time by around 1.1K contracts according to preliminary readings from CME Group. Volume, instead, resumed the downtrend and shrank by around 73.8K contracts following the previous daily build.

Gold appears supported by the 200-day SMA

Gold prices could not sustain a move to the area above $1990 on Friday, closing with marginal losses near $1980. The move was amidst rising open interest and decreasing volume, exposing further range bound trade in the very near term. In the meantime, the precious metal appears well supported by the key 200-day SMA at $1937 per troy ounce for the time being.

(Click on image to enlarge)

More By This Author:

Crude Oil Futures: Further Recovery Not FavoredEUR/JPY Price Analysis: Interim Contention Emerges At 158.80

Crude Oil Futures - A Deeper Drop Seems Not Favored

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more