Gold Forecast: Trying To Break Out

This is a market that I think continues to show significant bullish pressure due to the fact that central banks around the world continue to add liquidity and quantitative easing.

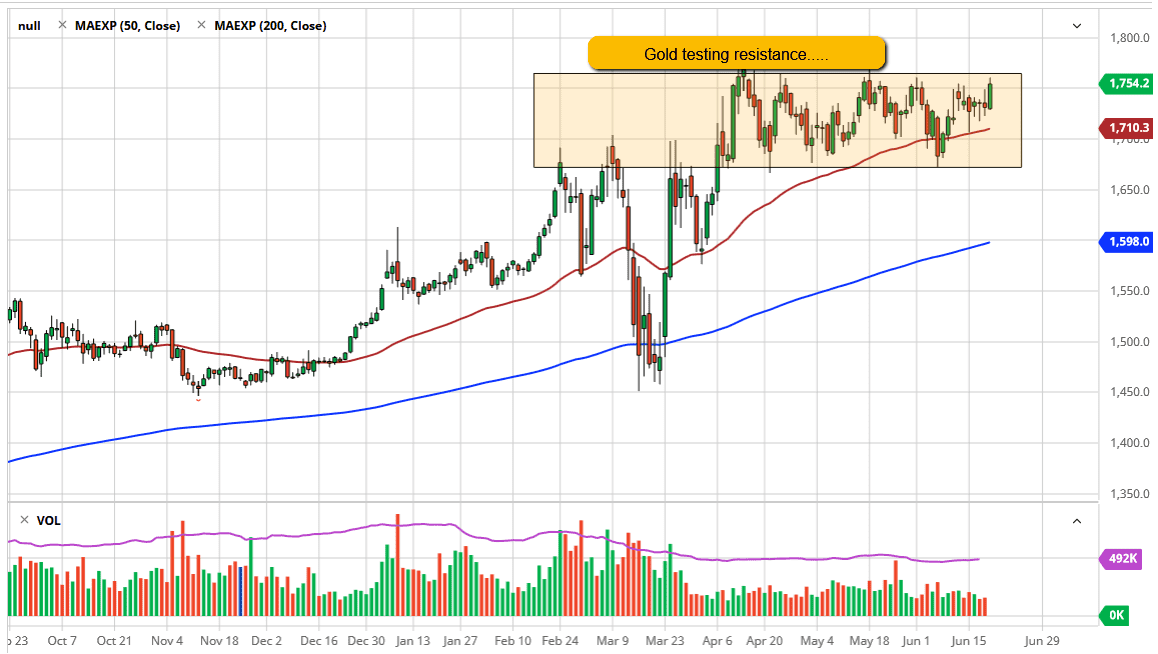

Gold markets have rallied significantly during the trading session on Friday, reaching above the $1750 level for the first time in a while. We did pull back from the $1770 level, so we did not quite manage to break out completely, but what it should show is that we are winding up a move ready to do so. It is possible that part of the problem with the move was the fact that it was during quadruple witching, meaning that several options were expiring at the same time which causes a lot of volatility into various markets around the world. With that being the case, you can only read so much into the candlestick but when you look back at the beginning of the week, you can see that the buyers certainly jumped in and pushed higher at a higher low. In fact, we even touched the 50 day EMA which of course is something important.

Looking at this chart, if we were to break down below the 50 day EMA I think there is still plenty of support underneath at the $1675 level, which is an area of extreme support. If we were to break down below there, it is likely that the market could go down to the 200 day EMA at the $1600 level. Ultimately, this is a market that I think continues to show significant bullish pressure due to the fact that central banks around the world continue to add liquidity and quantitative easing. Having said that, it does tend to throw money into the precious metals markets and I think that this is a “buy on the dips” type of scenario that will continue going forward.

Given enough time we will go looking towards the $2000 level, but we have a lot of work to get through that area and go much further. We will not get there overnight, but I believe that by the beginning of next year, we will have reached the $2000 level. As far as selling is concerned, I simply just do not have a reason to do so because there is a significant amount of reasons for the market to go higher as far as monetary policy is concerned.

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more