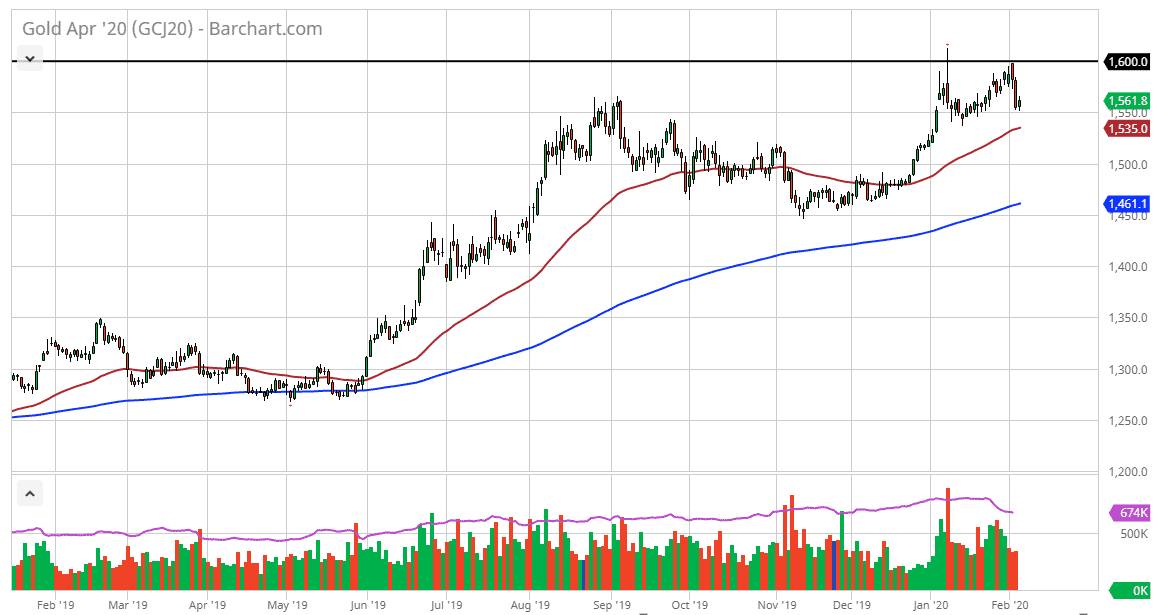

Gold Forecast: To Continue Trying To Stabilize Itself

Gold markets have gone back and forth during the trading session on Wednesday, as there are multiple forces out there moving the markets back and forth. The $1550 level has offered support during the trading session, just as it had previously. However, you should also keep in mind that the market has shown itself to be very resilient over the longer term, and therefore it’s not a huge surprise that we could get a bit of stabilization in the short term. Ultimately, the 50 day EMA is starting to reach towards the level, and therefore it could offer even more support. Ultimately, if the market was to turn around a break above the highs from the trading session on Wednesday, it’s likely that the market could go higher and towards the highs yet again. Ultimately, the market should then go to the $1600 level afterward.

If the market was to break down below the 50 day EMA, it’s likely that the market could go down to the $1500 level. That, of course, is a major support level base not only on the previous support seen previously, just as well as resistance. To the upside, if the market does break above the $1600 level, it’s likely that the market should continue to go higher, perhaps reaching as high as the $1800 level. All things being equal, pullbacks continue to be buying opportunities as there are a lot of issues out there that could continue to drive money into gold, but ultimately this is a market that will remain very noisy.

Gold has been bought not only due to the coronavirus ripping through Asia, but we also have plenty of loose economic policy coming out of central banks around the world that should continue to have gold rising longer term. This is especially true in places like the European Central Bank and the Federal Reserve, two of the most important central banks of the world. As long as they remain extraordinarily loose with their monetary policy, it makes sense that gold should continue to gain based upon the idea fiat currencies falling, and plenty of economic headwinds at the same time. Again though, it’s about building a core position in adding slowly, not jumping in with both feet immediately. A certain amount of patience will be needed, but we are most certainly in an uptrend and that has not changed.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more