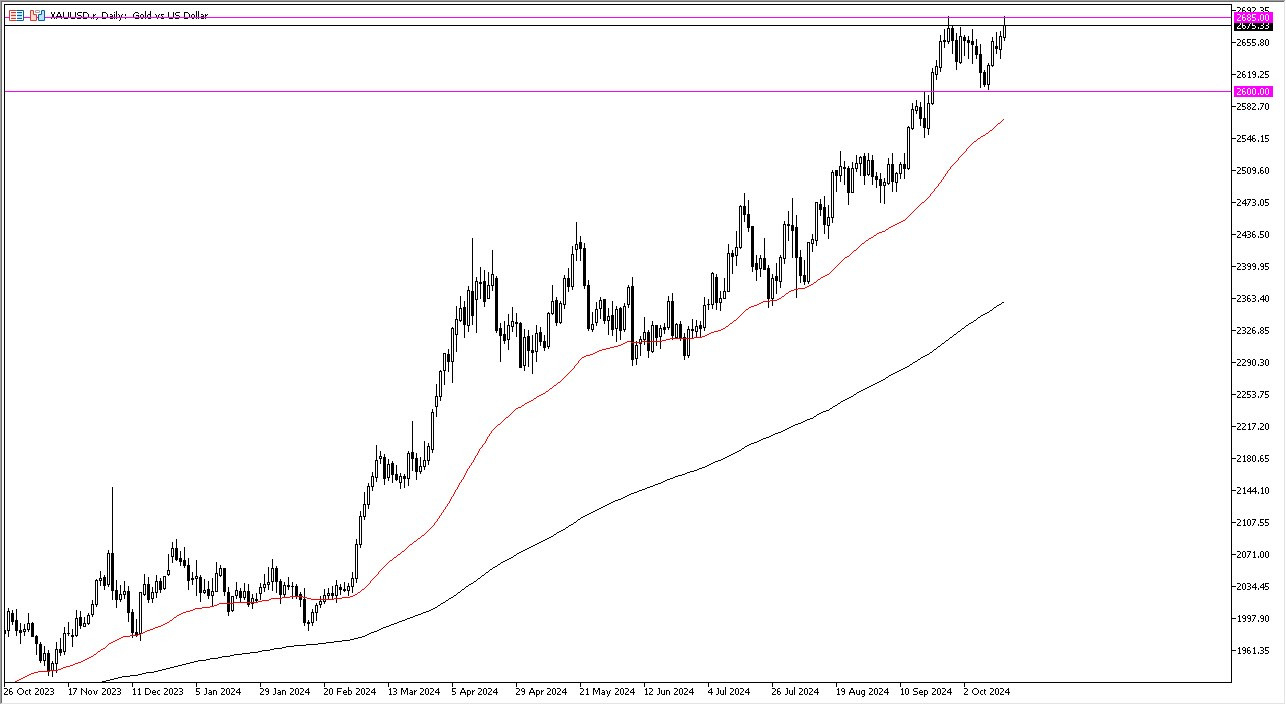

Gold Forecast: Gold Retreats From Recent All-Time High

- During my analysis of the gold market, the first thing that I notice is that we touched the $2685 level, an area that previously was the swing high and the all-time high in the market, but we did retreat from there.

- When we opened up the trading session on Wednesday, it looked like we were going to take off and smash through that high, but we have given back some of these gains, showing that perhaps some of the panic is starting to subside.

(Click on image to enlarge)

The reason I say it’s panic is that we started to see the stock markets in the United States pull apart rather rapidly at the open, and at the same time started to see gold take off to the upside. That being said, the market is still very much in an uptrend, so I don’t necessarily think that we need to see some type of panic break out. Rather, I think that we just need to see a lot of the same behavior that has been the case for a while. There are plenty of fundamental reasons for gold to continue going higher, so therefore I think this continues to be a bit of a “one-way trade” as things continue to look the same as they did a few months ago.

Fundamental Reasons for Gold to Continue Higher

There are plenty of fundamental reasons for gold to go higher, not the least of which of course would be the geopolitical issues that currently plague the markets right now, including the hot war in Ukraine, the hot war in Lebanon and the various other areas of tension around the world. Furthermore, we also have central banks around the world cutting rates, so that of course means that bonds won’t pay as much in the way of payments anymore, meaning that storing gold will be more palatable. Beyond that, we have a lot of concerns as to whether or not we need to find some type of safety in general, as markets look very shaky, that means that gold could very well be a safe haven for a lot of portfolios.

I am a buyer, and I recognize that short-term pullbacks are more likely than not going to be buying opportunities. It is not until we break down below the 50 Day EMA that I would start to worry about the overall trend, but even then, I think we have quite a bit more damage necessary to start shorting.

More By This Author:

USD/CAD Signal: US Dollar Looks Stretched Against LoonieGBP/USD Forecast: British Pound Continues To Watch A Major Level

USD/JPY Forecast: Pullback After Hitting Resistance

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more