Gold Forecast: Gold Continues To Chop Back And Forth

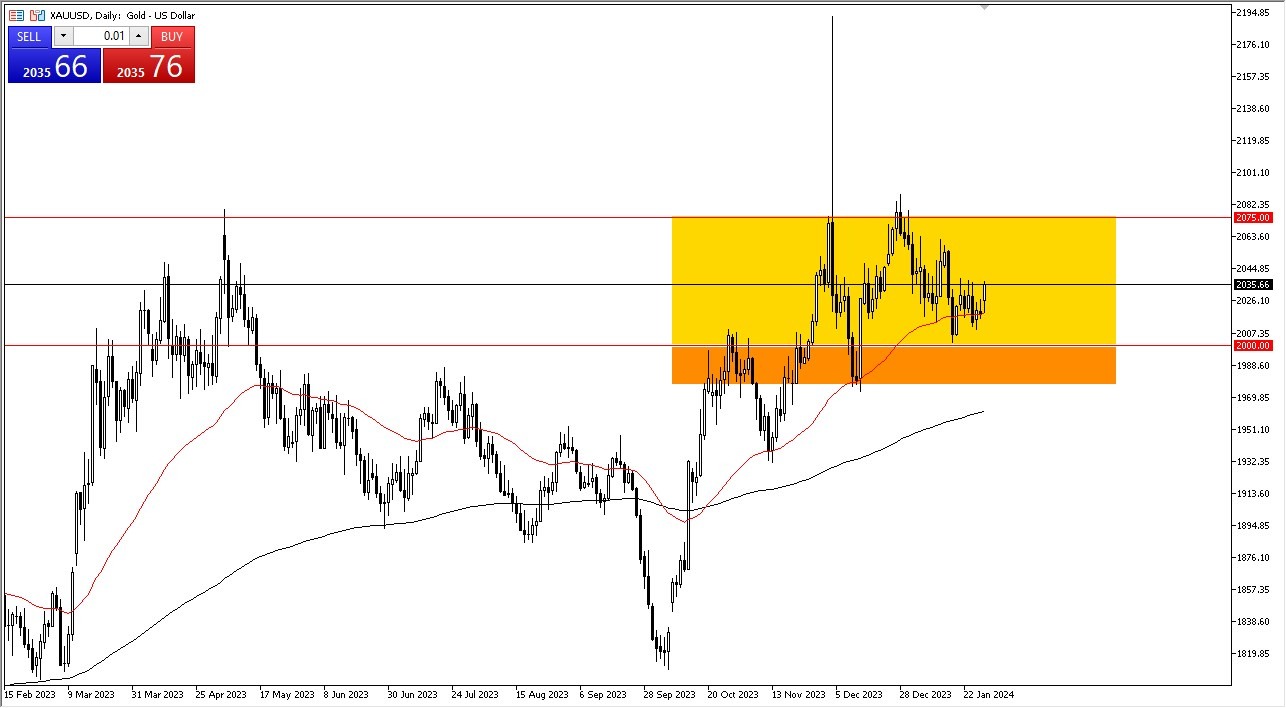

I think the $2,000 level underneath offers a bit of a hard floor in the market but that hard floor in the market also extends down to the $1,980 level.

- Gold had initially fallen a bit during the early hours on Monday, but then turned around to bounce significantly from the 50 day EMA, which of course is a very bullish sign.

- If we can take out the $2040 level on a daily close, then I think gold will go looking to the $2060 level next, and then eventually the $2075 level.

- This is the longer-term target that I have in mind, but it will be a real fight to get there from everything I see on the charts, and in fundamental analysis at the moment.

Short-term pullbacks continue to get bought into despite the fact that there are a lot of questions asked of where we go longer term all things being equal. I think the $2,000 level underneath offers a bit of a hard floor in the market but that hard floor in the market also extends down to the $1,980 level. This is a huge zone that I think a lot of people are going to be paying close attention to and the 200 day EMA is racing toward it period. If we were to break down below the $1,980 level, then it's a very negative sign and the up trending gold is probably over. If we can break above the crucial $2,075 level above, then I think you have a situation where the market is likely to continue to go much higher.

(Click on image to enlarge)

Volatility Will Continue

In general, this is a situation where I think you see a lot of volatility and a lot of buy on the dip, mainly due to the fact that there are a lot of interest rate headwinds out there, but at the same time, you have to look at a lot of geopolitical concerns and that in and of itself might make gold an attractive investment for the rest of the year. After all, it seems like conflict is breaking out everywhere and that generally does well for gold as well. Interest rates dropping would help and it is anticipated that perhaps the Federal Reserve is going to start cutting this year, maybe even being followed by the European Central Bank. So, we will have to wait and see, but all of that bodes well for gold in the longer term.

More By This Author:

EURUSD Forecast: Euro Drifts Lower Yet AgainDow Jones 30 Forecast: Dow Jones 30 Continues To See Buyers

Silver Signal: Silver Continues To See Volatility

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more