Gold Forecast: Continues To See Massive Choppiness

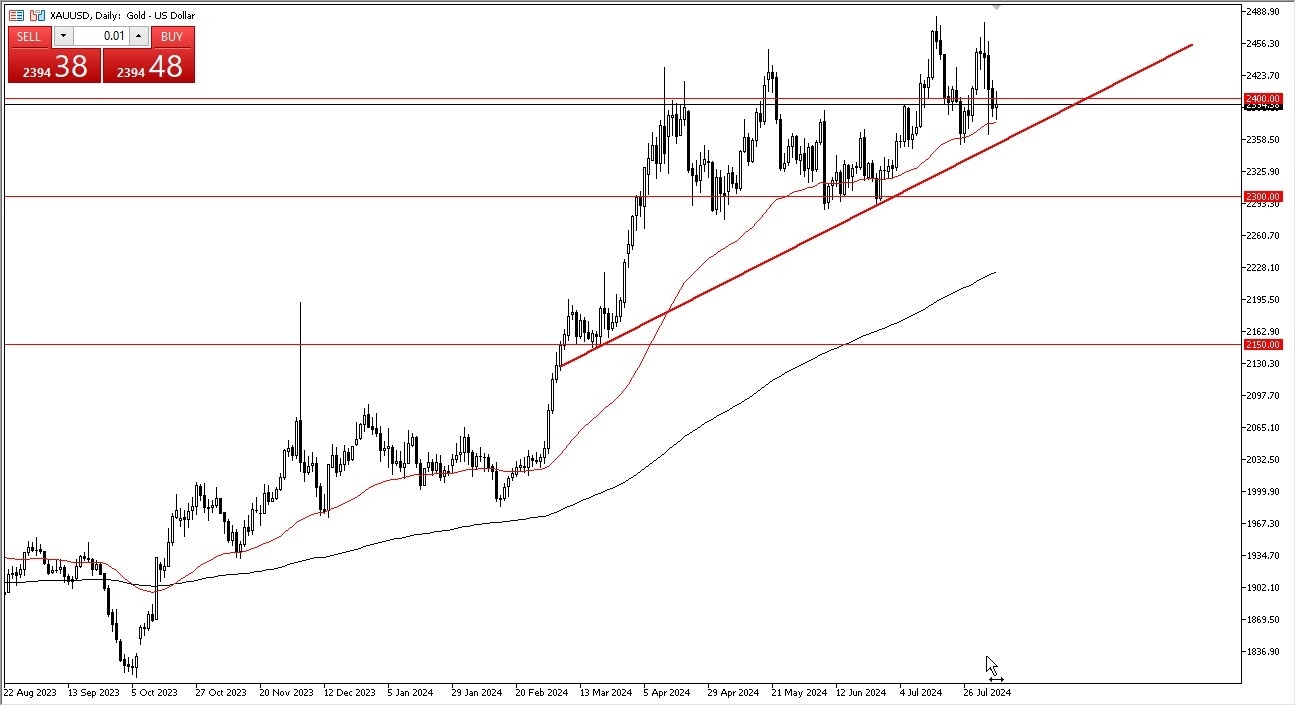

If that's going to be the case, then we could see gold suffer a little bit but ultimately, I do think in the longer term the trend in the gold market is still very much intact. We pierced the $2,400 level during the trading session but did pull back a bit. But the most important thing I think at this point is we are stabilizing.

The 50-Day EMA Indicator

The 50-day EMA underneath continues to offer support as does the uptrend line. If we were to break through the uptrend line, then it's possible that we could drop down to the $2,300 level, but I don't think at this point in time that's the most likely of outcomes.

If we can break above the highs of both the Tuesday and Wednesday candlestick, then we could go looking towards the $2,480 level again. Keep in mind though, we have the initial jobless claims coming out on Thursday, and then we most certainly we'll see a lot of volatility on Friday, mainly due to the questions as to whether or not the trading public will be willing to take risk on through the weekend.

(Click on image to enlarge)

Start Trading Today With The Best Trading Platform!

I do think gold is a natural place for the markets to hide mainly due to the fact that central banks are still buying. Interest rates look to be dropping. And then of course we also have plenty of geopolitical risks. So, I remain bullish. I just recognize that we've got some choppy action ahead.

The big thing you need to pay attention to is that the gold market does tend to be somewhat volatile, so the only thing you can control is your position sizing. I do think that eventually we go higher, but with this being the case, I also think you need to be cautious with overleveraging, so therefore I am using this as an opportunity to buy gold, but in little bits and pieces.

More By This Author:

USD/CAD Forecast: Volatility Ahead With Key DataGBP/JPY Forecast: British Pound Rallies Against Japanese Yen On Wednesday

WTI Crude Oil Forecast: Continues To Attempt Its Recovery

Disclaimer: Mr. Christophe Barraud could not be held responsible for the investment decisions or possible capital losses of users. Mr. Christophe Barraud endeavors to provide the most accurate ...

more