Gold Forecast: Continues To Look Strong As We Wait For The Fed

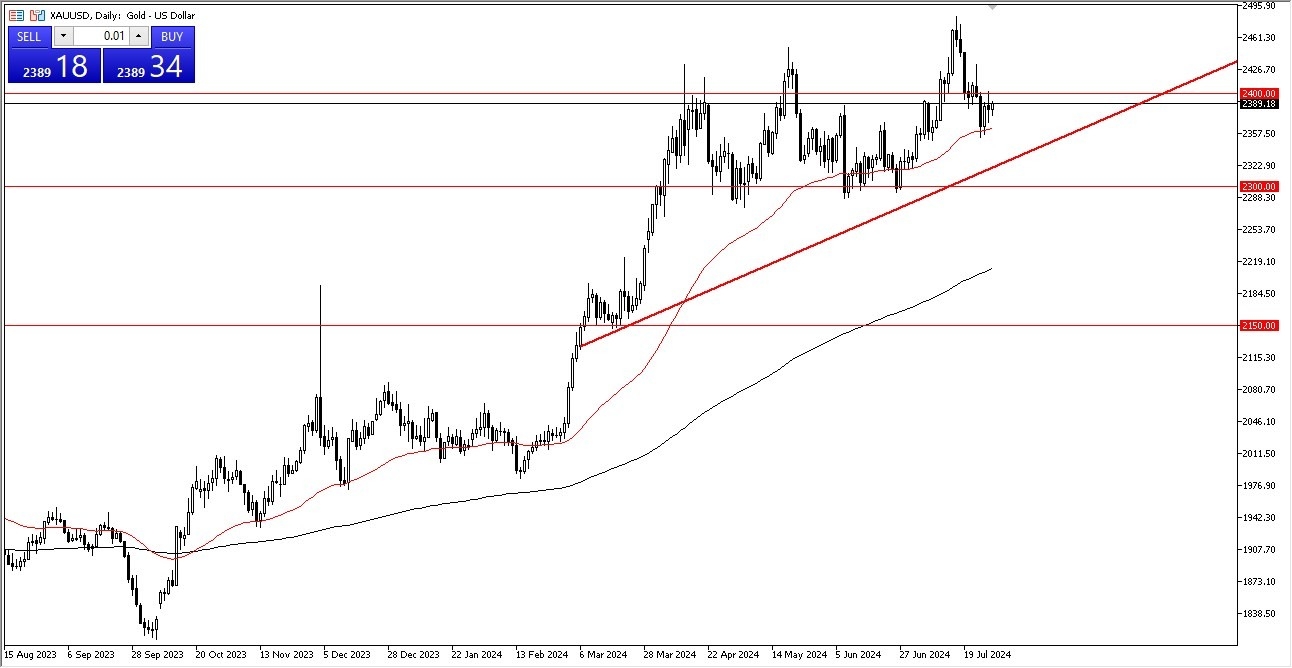

- I continue to focus on the $2,400 level as it was a major area of noise in the past.

- The market breaking above the $2,400 level could send this market much higher, perhaps reaching the $2,425 level.

- If we can break above there, then I think the market could really start to take off to the upside, perhaps even trying to get to the $2,500 level.

- This is an area that will obviously have options barriers, and a lot of headlines attached to it.

Short-term pullbacks continue to see a significant amount of support near the 50-day EMA, which is currently in the $2,360 region. Keep in mind that Wednesday is a crucial day, as the Federal Reserve has an interest rate decision, and while the decision itself may not be in play, the press conference and the statement will of course have a lot of people paying close attention to what's going on next coming out of the Fed.

The Uptrend Continues to Be Intact

Ultimately, this is a market that's been in an uptrend, and I just don't see why that would change, at least not unless the Federal Reserve completely changes its stance and becomes aggressively hawkish. But even then, I think you would probably have people freaking out and buying gold for geopolitical cover, if nothing else. We have been on a nice channel for several months now, and I think we had recently revisited the bottom part of that channel, and now we are just simply trying to recover. I do expect a lot of volatility over the next 24 hours or so, but ultimately, I think if we can get a daily close above the $2,400 level, that is in fact more likely than not mean the gold will continue to climb and eventually make new highs. I have no interest in selling in the gold market, at least not until we break down below the $2,300 level.

More By This Author:

Silver Forecast: Continues To Look For The FloorBTC/USD Forecast: Strong But Stretched

USD/JPY Forecast: US Dollar Continues To Look For Momentum Against The Yen

Disclaimer: Mr. Christophe Barraud could not be held responsible for the investment decisions or possible capital losses of users. Mr. Christophe Barraud endeavors to provide the most accurate ...

more