Gold Flashes Warning Signals

Image Source: Unsplash

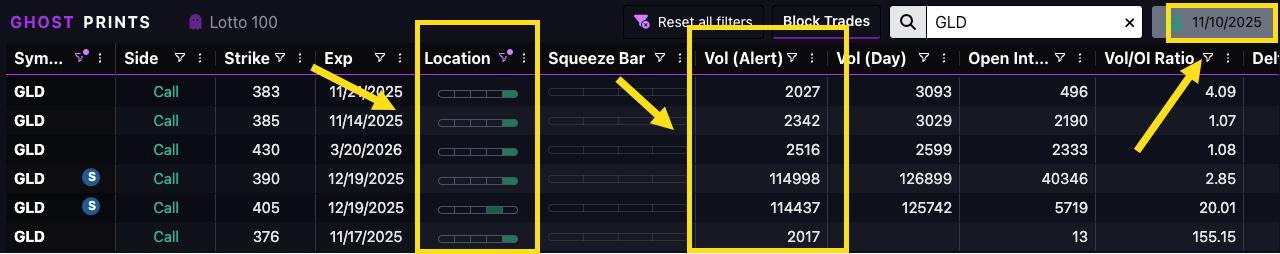

Brandon just caught institutional money making a massive gold bet. And the timing tells you everything.

Someone bought 114,000 call spreads in GLD targeting $405. That's the prior high. This trade happened right as Congress pushed through a continuing resolution to reopen the government.

(Click on image to enlarge)

More government spending equals more dollar weakness. Gold surged 2.69% today while the broader market struggled to keep pace. Even the Mag Seven couldn't outperform precious metals.

Brandon breaks down why this matters. The market rallied 1.64% today, but strip away Nvidia (up 6%) and a handful of mega-cap names, and you're looking at broad weakness everywhere else. Only tech and gold showed real strength.

Here's what the institutional flow reveals:

- 114,000 GLD call spreads bought at $390-$405 strikes

- 22,000 SLV calls purchased Friday at the $63 strike ahead of silver's move

- Both trades positioned for retests of recent highs in precious metals

The dollar is weakening in real terms. We're passing more spending bills. The economy shows stagflation signals with weak jobs data and rising delinquencies. Gold reflects that reality better than equity indexes propped up by five companies.

Brandon also spotted something else. One Ghost Prints member caught a 10,000 contract call spread in PZZA on Friday. The stock jumped 8% today on acquisition rumors. That's the kind of early positioning you see when smart money knows something is coming.

The concentration risk keeps building. Nvidia cannibalizes other sectors because no new money enters the market. It becomes a zero-sum game where something must fall for the leaders to rise.

Market breadth continues deteriorating. Stocks above their 200-day moving average, 50-day, and 20-day all show weakness. Yet indexes grind higher on the backs of the biggest names.

Video Length: 00:09:54

More By This Author:

When The Tape Tells You NoCheck Out This U.S. Index (Not A Bubble)

The Real Stock Market Unwind Hasn’t Begun

Neither TheoTrade nor any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, registered ...

more