Gold: Fed's Meeting Activates Annual Buy Triggers

Technicals

Gold is trading last at $1775.60, down about $7.50. Silver is at $25.8450, down about 18 cents. Copper is slightly higher at $4.22. Coinbase is down about 10 points to about 211.75. The Grayscale Bitcoin Investment Trust is down about 10% to about 25.13 in a fast market.

Courtesy: ema2trade.com

We use our proprietary Variable Changing Price Momentum Indicator (VC PMI) to analyze the markets and to act as a GPS for our trading. Based on the daily data, the VC PMI identifies the extreme levels above and below the mean. We favor trading at the extreme levels, since such trades have the highest probability of success. The VC PMI daily average gold price is $1778. The extreme level above that average is $1792, which is the VC PMI Sell 1 level. The Sell 2 level is $1801. The VC PMI extreme levels below the mean is $1769 and the Buy 2 level $1755. The daily average price is $1778. With the price closing below that price, it is a bearish price momentum according to the artificial intelligence in the VC PMI. If the price is around the average, then there is a 50/50 chance of the market going up or down. Therefore, we trade the extreme levels; we do not trade around the mean, since the odds are 50/50. At the extreme levels, there is a 90% (Sell 1/Buy 1 levels) or 95% (Sell 2/Buy 2 levels) chance of the market reverting back to the mean. It is not 100% certain, but the odds greatly favor trading from the extreme levels.

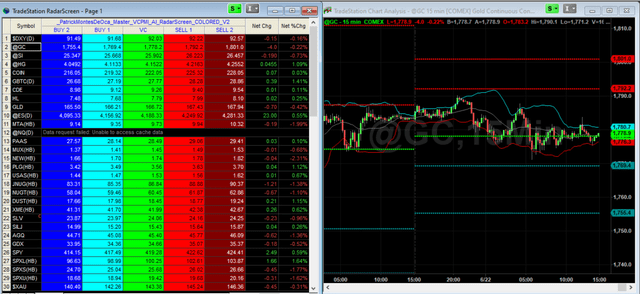

Courtesy: Trade Station Technologies, Inc.

The gold market right now is neutral to bearish. If gold closes above $1778 - the average price - then it will activate a bearish price momentum and it will be likely to revert back down to the mean. If gold comes down to $1769, the Buy 1 daily level, where it will be likely to revert back up to the mean from there. Right now there is no day trade for gold.

Silver

Courtesy: Trade Station Technologies, Inc.

Silver has mixed signals via the VC PMI and is trading at $25.8650. The VC PMI daily average price is $25.90. The Sell 1 level is $26.22 and the Sell 2 is $26.46. The VC PMI Buy 1 level is $25.67 and the Buy 2 is $25.35. We also are looking at the weekly VC PMI numbers and the 360-day cycle buy level, which has been activated at $25.85. The 360-day cycle trigger is significant. If we get above $25.90, the daily bullish price momentum will be in play and the target of $26.82 will be activated. The initial 360-day target is $26.59, which is the weekly average. On the daily and weekly, we are looking at an oversold condition. The weekly level is all the way down to $25.02. It looks like the market found buyers this morning. Now the market is reverting right back up again. On the daily signal, we are neutral to bearish, so it is a mixed signal. However, we focus on the yearly cycle, with the $25.85 trigger.

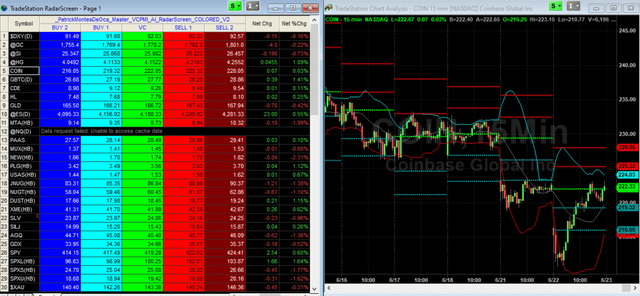

Coinbase

Courtesy: Trade Station Technologies, Inc.

Coinbase was up at 400 plus and is now trading at about 219. The volatility in virtual currencies is something no one has seen before. The US dollar, a fiat currency, does not fit into the new virtual currency. We appear to be moving into a virtual economy with great interest in virtual currencies. There is great debate about the legitimacy and logistics of virtual currencies. In any case, the market is showing the great need for an alternative to fiat currencies, like the US dollar. Gold and silver are strong candidates as an alternative, especially given their long history of being viewed as currencies or real assets. They are also far more stable in price than virtual currencies. The US dollar is facing a tremendous amount of supply, which is being added to the economy. The Fed’s balance sheet has reached unprecedented levels. Even countries, such as China, are starting to experiment with virtual currencies. Retail is also becoming virtual since you can order anything from groceries to cars online without ever going to a physical store. We are in the middle of a major reset as we seek a currency that will fit into this new paradigm.

Fundamentals

Last week, Fed Chairman Powell basically did nothing. He said they would see what happens over the next two years. Two years is a long time these days; even a year is a long time. Based on the 10-year note, it does not seem to indicate that there are fears about inflation. The note has been around the 1.50 area throughout all of this talk about inflation. Now it is at 1.49 and there has not been any major shift in the note. We watch the 10-year note as an indicator of what the market thinks about inflation. We also track lumber, since it is used in building and construction. Lumber prices have collapsed to 907.50. The only other market showing some kind of inflationary indication is crude oil, which is at 73. Brent oil is at 75. As we return to a more normal economy, crude is going to be much more in demand. The price increase seems to be more related to supply chain issues related to the pandemic than anything else. It will take time to restore the supply chains. We are also facing one of the worst droughts in hundreds of years, which will put pressure on the grains. The market last week, in general, collapsed, in commodities, to unprecedented levels, especially for one trading session. Inflation does not appear to be a worry. Supply chain issues and the drought appear to be worries. For virtual currencies, we expect the extreme volatility to continue.

Disclosure: I am/we are long GDX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business ...

more