Gold Extends Rally To Record High As Safe-Haven Demand Builds

Photo by Dmitry Demidko on Unsplash

Gold price (XAU/USD) climbs to a record high during the early European trading hours on Tuesday. The precious metal has risen 10% over the past month and nearly 70% in 2025 as heightened geopolitical tensions and economic uncertainty have boosted demand for safe-haven assets such as Gold.

Additionally, expectations that the US Federal Reserve (Fed) will cut interest rates further next year could also support the yellow metal. Lower interest rates could reduce the opportunity cost of holding Gold, supporting the non-yielding precious metal. The market is pricing in multiple Fed interest rate cuts in 2026 amid signs of easing inflation and sluggish jobs growth.

Traders await the preliminary reading of the US Gross Domestic Product (GDP) for the third quarter (Q3) later on Tuesday. The US economy is projected to have grown at an annual rate of 3.2% in Q3. It would be a slowdown from the 3.8% growth in Q2. In case of a stronger-than-expected GDP report outcome, this could lift the US Dollar (USD) and weigh on the USD-denominated commodity price in the near term. Also, the US Durable Goods Orders, Industrial Production and ADP employment weekly data will be published on the same day.

Daily Digest Market Movers: Gold jumps on escalating geopolitical tensions, bets on further US rate cuts

- US President Donald Trump said on Monday the United States (US) would maybe keep and maybe sell the oil it had seized off the coast of Venezuela in recent weeks, Reuters reported on Monday. Trump added that the US would also keep the seized ships.

- Russia has intensified its strikes on the southern Ukrainian region of Odesa, causing widespread power cuts and threatening the region's maritime infrastructure, per the BBC.

- Fed Governor Stephen Miran said on Monday he is likely to remain on the central bank's Board of Governors beyond the expiration of his term until whoever President Donald Trump nominates as the next Fed chair is confirmed by the Senate.

- Trump is set to nominate a new central bank chief before Fed Chair Jerome Powell's term ends in May.

- Financial markets are pricing in only a 20.0% chance the Fed will cut interest rates at its next meeting in January, after it reduced them by a quarter-point at each of its last three meetings, according to the CME FedWatch tool.

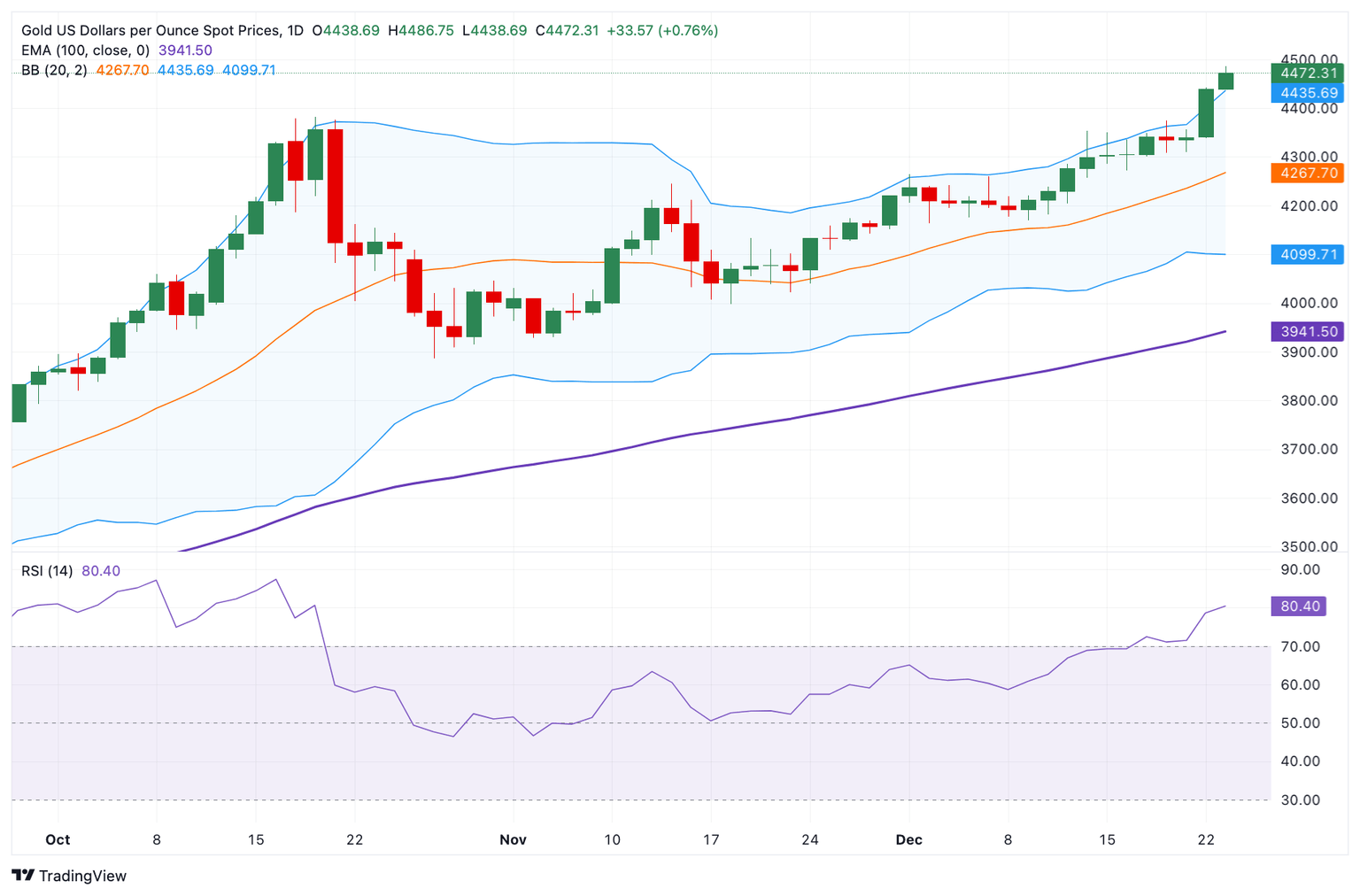

Gold maintains the overall uptrend, overbought RSI suggests some caution is warranted

Gold edges higher on the day. According to the daily chart, the constructive outlook of the yellow metal prevails, with the price holding above the key 100-day Exponential Moving Average (EMA). The Bollinger Bands widen, suggesting a stronger bullish trend.

Despite the strong trend, the 14-day Relative Strength Index (RSI) is located above 70, indicating an overbought condition. This suggests that any upside extension could be tempered by a period of digestion before the next leg higher.

The recent bull breakout could open the door for a move toward the $4,400 psychological mark. Any follow-through buying above this level could pave the way to $4,450.

On the downside, the initial support level for Gold emerges near the December 22 low of $4,338. Further north, the next contention level to watch is $4,300, the round figure, and the December 17 low.

More By This Author:

Gold Edges Lower Despite Fed Rate Cut Hopes On Cooling US InflationWTI Edges Lower Below $56.50 On US Dollar Strength, Weak China Demand

USD/JPY Climbs Above 155.50 As Traders Await US CPI Release