Gold Ends The Week In Decline

Image Source: Pixabay

Gold remained below $3,340 per ounce this week, on track to close in negative territory for the first time in three weeks. The downward pressure followed stronger-than-expected US economic data, which reduced expectations of an imminent interest rate cut by the Federal Reserve.

June’s retail sales significantly outperformed forecasts, while initial jobless claims dropped to a three-month low – further evidence of the US economy’s resilience despite ongoing trade tensions.

In response, Adriana Kugler, a member of the Federal Reserve’s Board of Governors, suggested that maintaining the current interest rate in the near term would be prudent. Meanwhile, Mary Daly, President of the Federal Reserve Bank of San Francisco, still anticipates two rate cuts before year-end.

Gold continues to benefit from demand for defensive assets amid escalating trade and geopolitical risks. Former US President Donald Trump has announced plans to notify more than 150 trading partners of impending tariffs, heightening uncertainty in global trade.

Additionally, rising geopolitical tensions worldwide reinforce gold’s appeal as a hedge against instability, thereby ensuring its role as a key tool for wealth preservation.

Technical Analysis: XAU/USD

H4 Chart:

(Click on image to enlarge)

The XAU/USD pair is consolidating around $3,344 on the H4 chart, with the current range extending downward to $3,312. Today, prices have retested $3,344, and we anticipate further consolidation near this level.

- Bullish scenario: a breakout above $3,344 could trigger an upward wave towards $3,384

- Bearish scenario: a downward breakout may lead to a decline towards $3,235

The MACD indicator supports this outlook, with its signal line above zero and pointing firmly upward.

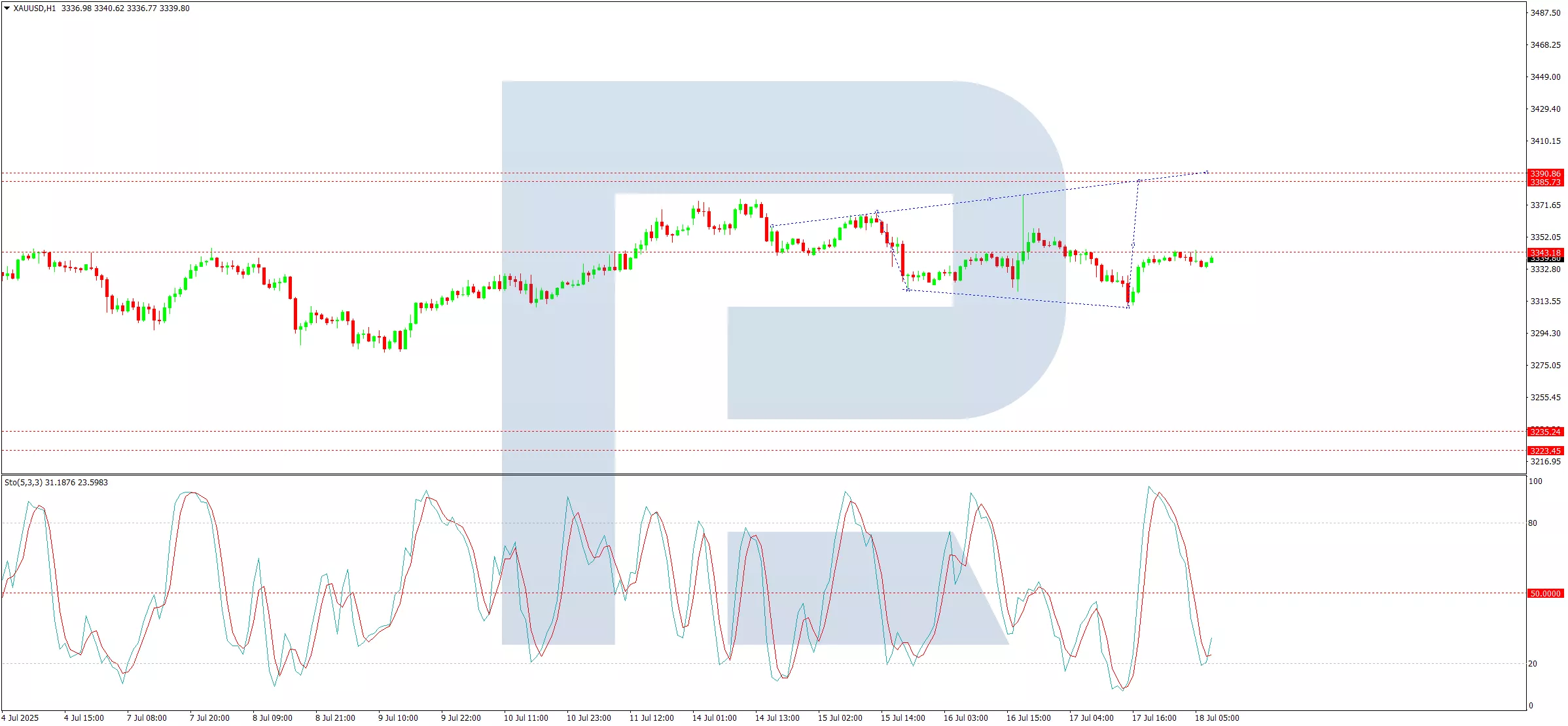

H1 Chart:

(Click on image to enlarge)

On the H1 chart, the market completed a decline wave to $3,310 before rebounding to $3,344, effectively returning to the consolidation range’s midpoint. Currently, trading lacks a clear directional bias, with equal potential for further gains or losses.

- Upside potential: a breakout above $3,344 may extend gains towards $3,384

- Downside risk: a drop below the range could see a downward wave towards $3,235

The Stochastic oscillator aligns with this view, as its signal line has risen from 20 and is now trending upward towards 80.

Conclusion

Gold faces short-term bearish pressure from robust US economic data, but long-term support persists due to trade uncertainties and geopolitical risks. Traders should monitor key technical levels for breakout opportunities in either direction.

More By This Author:

EUR/USD Under Pressure Amid Strong US Dollar Sentiment

The Pound Continues To Decline, With Little Support From The Bank Of England

Gold Holds Steady But Could Rise On Tariff Developments

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more