Gold Drops Over 1% As Dollar Surges After Trump Threatens BRICS With ‘100% Tariffs’

Image Source: Unsplash

- Gold prices fell as a stronger dollar weighed on sentiments, limiting demand for the yellow metal.

- Trump threatened the BRICS bloc with 100% tariffs if they seek alternative to the dollar.

- Gold traders wait for key economic data from the US this week as the market expects a 25% rate cut by the Fed.

Gold prices fell sharply on Monday, snapping consecutive days of gains, as the dollar rose against a basket of major currencies.

A stronger dollar makes commodities priced in the greenback more expensive for holders of other currencies, thereby limiting demand.

“Resurgent demand for the US Dollar (USD) across the board as a safe-haven asset, trumping Gold price as a traditional safety bet at the start of the US nonfarm payrolls week,” Dhwani Mehta, analyst at FXstreet, said in a report.

At the time of writing, the February gold contract on COMEX was at $2,652.09 per ounce, down 1.1% from the previous close.

Among other precious metals, the March silver contract was also 1.4% lower at $30.668 per ounce on Monday.

Trump threatens to impose steep tariffs on BRICS nations

US President-elect Donald Trump threatened to impose “100% tariffs” on the BRICS bloc, warning them against seeking alternatives to the dollar.

The comments weighed heavily on the currencies of the BRICS bloc and pushed up the dollar.

This pressured gold and silver on Monday.

Moreover, “expectations that US President-elect Donald Trump’s tariff plans could reignite inflationary pressures and limit the scope for the Federal Reserve (Fed) to cut interest rates trigger a fresh leg up in the US Treasury bond yields,” Haresh Menghani, editor at FXstreet, said in a report.

This, in turn, assists the USD to stage a solid bounce from a nearly three-week low touched on Friday and turns out to be a key factor driving flows away from the non-yielding yellow metal.

Last week, Trump had also threatened to impose a 25% tariff on imported goods from Canada and Mexico.

Fed interest rate cut bets

Despite the rising dollar, gold may have support from expectations of interest rate cuts by the US Fed later this month.

“The downside appears cushioned in Gold price amid sustained bets for a 25 basis points (bps) interest rate cut by the US Federal Reserve this month,” Mehta said.

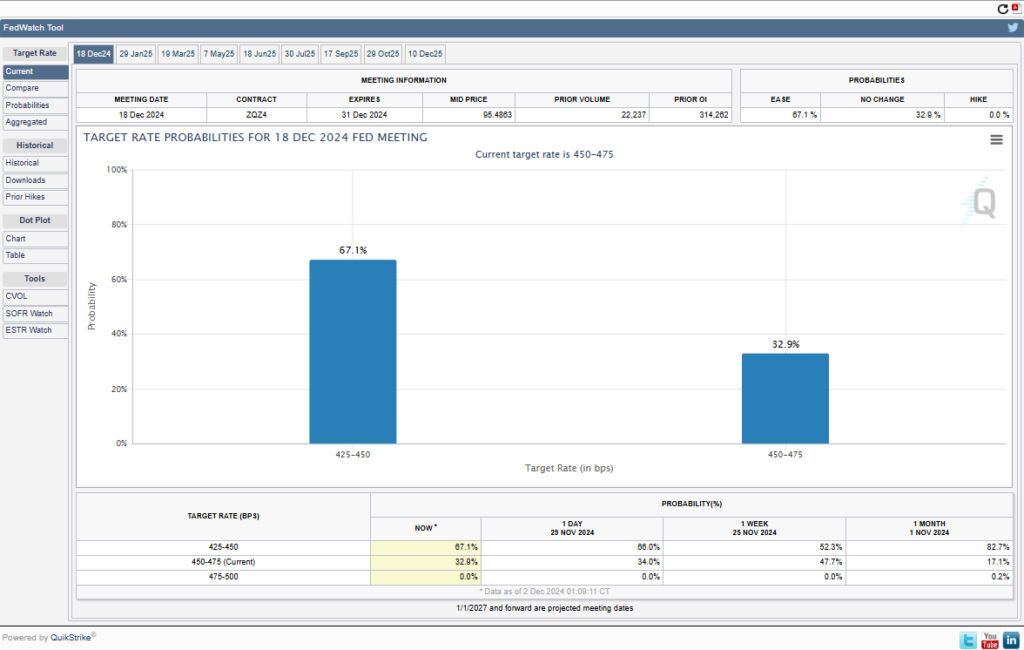

According to the CME FedWatch tool, the markets have priced in a 67.1% probability of the US central bank cutting rates by 25 bps in December.

(Click on image to enlarge)

Source: CME Group

The Fed had cut interest rates twice this year with a supersized 50 bps cut in September and a 25 bps reduction last month.

“Markets also remain wary of the ongoing geopolitical tensions between Russia and Ukraine while digesting the insurgent activity by Jihadist-led rebels in the Syrian city of Aleppo on Friday night,” Mehta said.

In response, Israeli Prime Minister Benjamin Netanyahu said Sunday that Israel is monitoring the situation in Syria.

A fresh escalation in the Middle East geopolitical conflict could revive Gold’s appeal as a traditional safe-haven asset.

Economic data and technical forecast

Gold traders will now look forward to the US Institute of Supply Management’s Manufacturing Purchasing Manager’s index (PMI) data due later on Monday.

Mehta noted:

The US data will be key to gauging expectations for future Fed rate cuts, eventually impacting the non-interest-bearing gold price.

Traders will also look for further cues from the US non-farm payrolls data, which will be released later this week. The data is particularly significant as it

Is monitored by the Fed for policy decisions.

The immediate support for gold prices is seen at last week’s low of $2,605 per ounce.

If prices fall below this level, then gold could drop to its 100-day simple moving average of $2,576 per ounce.

(Click on image to enlarge)

On the upside, gold has resistance at $2,670 per ounce, which is crucial for further upsides.

More By This Author:

Could Dollar General Stock Price Rebound After Earnings?The Gap Stock Price Could Drop 35% As A Risky Pattern Forms

Is India Missing Its Demographic Dividend? Slow Growth Raises Concerns

Disclosure: Invezz is a place where people can find reliable, unbiased information about finance, trading, and investing – but we do not offer financial advice and users should always ...

more