Gold Dips Under $4,200 As Rising Yields And Fed Jitters Hit Bullion

Image Source: Unsplash

Gold (XAU/USD) retreats on Monday as traders brace for the Federal Reserve (Fed) meeting, where the central bank is expected to deliver its third consecutive rate cut, ahead of 2026. At the time of writing, XAU/USD trades at $4,195, down 0.27%, after hitting a daily high of $4,219,.

US Treasury yields pressure Gold; Fed decision and geopolitics drive outlook

The rise of US Treasury yields is capping bullion’s advance, with sellers driving spot prices below $4,200. A Fed cut on Wednesday could pump Gold prices up, with the non-yielding metal tending to fare well in low-interest-rate environments, meaning that further upside is seen in the near term.

The outcome of the meeting could set the tone for Gold’s direction, as a 'hawkish cut' could cap Gold’s advance. On the other hand, the lack of progress of a peace deal between Russia and Ukraine could underpin the yellow metal, which so far is poised to end the year with gains of close to 60%.

On Tuesday, the US data docket will feature the ADP Employment Change 4-week average, alongside the Job Openings and Labor Turnover (JOLTS) report for September and October.

Daily digest market movers: US Treasury yields, pressure Gold prices

- US Treasury yields are rising. The 10-year benchmark note rate is up nearly three basis points at 4.168%. US real yields, which correlate inversely with Gold prices, are also rising three bps to 1.908%, a headwind for bullion.

- The US Dollar Index (DXY), which tracks the American’s currency performance against other six, is up 0.11% at 99.09

- Geopolitics continued to play its role with Gold prices as newswires revealed that Ukrainian President Volodymyr Zelenskiy met with European leaders in London, as Washington pressures Kyiv to agree to a proposed peace deal with Russia. Zelenskiy said that China is not interested in forcing Russia to end its war on Ukraine.

- Last week’s US inflation data, although it was unchanged near the 3% threshold, stabilized, setting the stage for another 25-basis-point rate cut. Money markets' odds for a Fed cut of that magnitude sit at 86%, according to Capital Edge data.

- Meanwhile, Morgan Stanley sees more upside in Gold, due to the falling US Dollar, demand for ETFs, central bank purchases and safe-haven demand.

- In the meantime, an earthquake hit Northeastern Japan, reported Nikkei Asia. They wrote, “A powerful quake with a preliminary magnitude of 7.6 struck northeastern Japan late Monday night, with the weather agency issuing a tsunami warning for coastal areas of Hokkaido as well as Aomori and Iwate prefectures.”

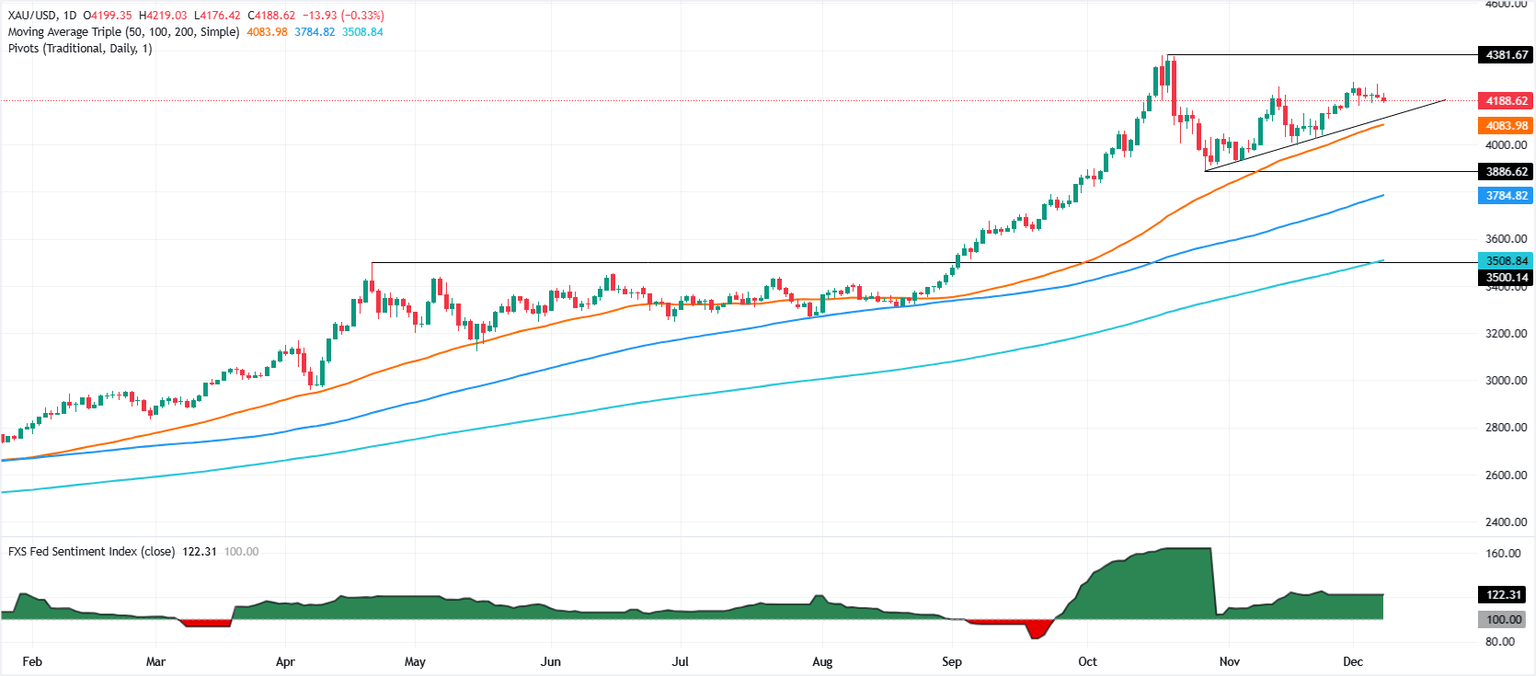

Technical Analysis: Gold price slides below $4,200

Gold’s uptrend remains intact, yet buyers were unable to keep spot prices above $4,200, which could open the door to test lower prices. Bullish momentum faded as depicted by the Relative Strength Index (RSI), which so far turned flattish, showing signs of buyer fatigue ahead of the FOMC’s decision.

If XAU/USD rises back above $4,200, expect a test of the $4,250 and $4,300. A breach of the latter exposes the all-time high of $4,381. Conversely, a drop below the 20-day Simple Moving Average (SMA) near $4,144, clears the path towards $4,100 and the 50-day SMA at $4,076.

(Click on image to enlarge)

Gold daily chart

More By This Author:

GBP/USD Steady As Markets Brace For Blockbuster Fed–BoE Two Weeks

EUR/USD Consolidates At 1.1650 As Us Inflation And ECB Risks Shape Outlook

Gold Holds Strong At $4,200 As Fed-Cut Anticipation Builds