Gold Dips From Record High, Remains Bullish On Dovish Fed

Image Source: Unsplash

- Gold prices fall to $2,457 after hitting an all-time high of $2,483 due to profit-taking.

- Fed officials signal potential rate cuts; Governor Waller suggests downward trend for Fed funds rate.

- US Dollar Index drops to 103.72, its lowest since March 2024, while US Treasury yields decline.

Gold prices retreated as investors took profits after the yellow metal rallied to an all-time high of $2,483 earlier during the North American session on expectations that the Federal Reserve would lower borrowing costs. At the time of writing, the XAU/USD trades at $2457, down more than 0.40%.

Federal Reserve officials, led by Governor Christopher Waller, crossed the wires on Wednesday. He said the time to cut the policy rate is approaching, suggesting that the most likely direction for the Fed funds rate is downwards.

Earlier, Richmond Fed President Thomas Barkin mentioned that inflation has decreased over the last quarter, acknowledging that the current policy is restrictive. However, he is open to the possibility that the policy "is not as restrictive as thought."

Meanwhile, US housing data fared better than expected in June, hinting the economy remains solid. Building Permits and Housing Starts improved compared to May, while Industrial Production decelerated but exceeded estimates.

The non-yielding metal's last leg-up was also driven by former President Donald Trump's comments, in which he favors tax reductions, lower interest rates, and increased tariffs. These would likely be inflationary for the economy and weaken the Greenback.

The US Dollar Index, which tracks the performance of the currency against other six, sinks some 0.49% at 103.72, its lowest level since March 21, 2024. US Treasury bond yields are also falling across the yield curve, with the 10-year Treasury note yielding 4.14%, down almost one and a half basis point (bps).

Daily digest market movers: Gold retreats as buyers take a breather close to $2,500

- Weaker-than-expected US Consumer Price Index (CPI) data sponsored Gold’s leg-up above $2,400, as the odds for Fed rate cuts increased, as reflected by falling US Treasury bond yields.

- The US economic calendar featured Building Permits for June, which increased by 3.4% from 1.3999 million to 1.446 million. Further housing data showed that Housing Starts for the same period expanded by 3% from 1.314 million to 1.353 million.

- US Industrial Production in June decelerated from 0.9% in May to 0.6% month-over-month (MoM) yet exceeded estimates for a 0.3% increase.

- December 2024 fed funds rate futures contract implies that the Fed will ease policy by 52 basis points (bps) toward the end of the year, up from 50 last Friday.

- Bullion prices retreated slightly due to the People's Bank of China (PBoC) decision to halt gold purchases in June, as it did in May. By the end of June, China held 72.80 million troy ounces of the precious metal.

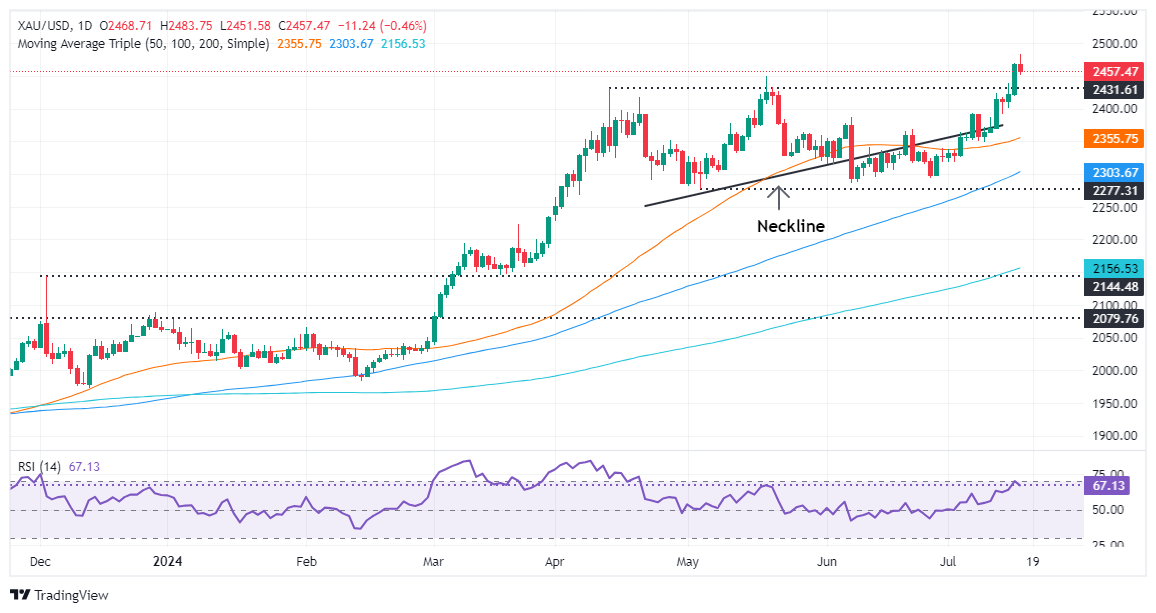

Gold technical analysis: XAU/USD retreats below $2,460 as buyers take a breather

Gold’s uptrend is set to continue, though buyers are taking a respite after hitting all-time highs shy of $2,490. Momentum is still in their favor, as shown by the Relative Strength Index (RSI), which dipped slightly but is still bullish.

If XAUUSD resumes its uptrend, the first resistance will be the all-time high at $2,483. A breach of the latter will expose the $2,490 figure, followed by the $2,500 psychological level.

On the flip side, If XAU/USD drops below $2,450, the first support would be the $2,400 figure, followed by the July 5 high at $2,392. If cleared, Gold would extend its losses to $2,350.

More By This Author:

Gold Hits New All-time High As US Yields Tumble, Buyers Eye $2,500Gold Price Secures Third Week Of Gains, Holds Above $2,400

Silver Price Analysis: XAG/USD Skyrockets Over 2% Amid ‘Double Bottom’ Confirmation

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more