Gold Commodity Elliott Wave Technical Analysis

Gold Elliott Wave Analysis

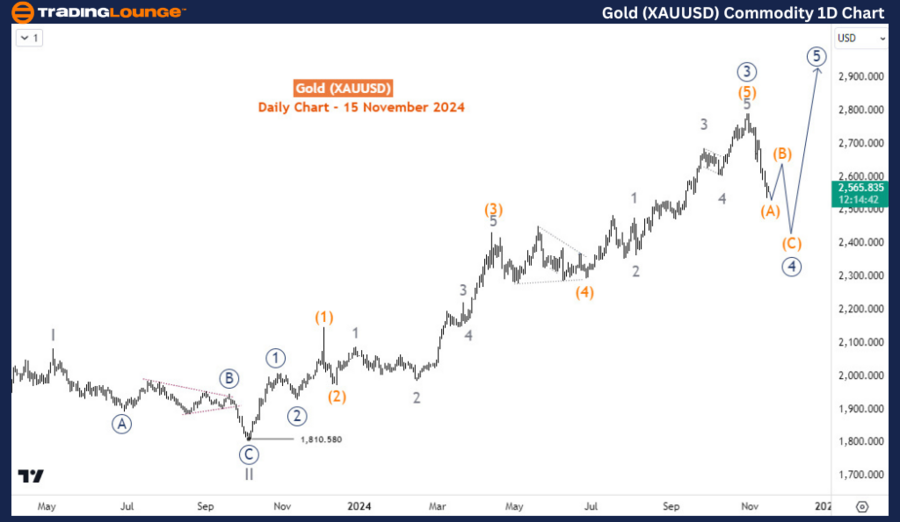

Gold is about 9% from its record high in late October. Despite the sell-off, the bias remains bullish from a medium—and long-term perspective. However, despite the expectation that the commodity will return to the upside to continue the bullish trend, the current pullback from October will likely extend lower.

Daily Chart Analysis

From the long-term Elliott wave perspective, price appears to be correcting the bullish cycle that started in October 2023 when Gold was exchanged for 1810. After completing wave (IV) of the supercycle degree in September 2022, Gold rallied to complete waves I and II of (V) in May 2023 and October 2023 respectively. Thus wave III of (V) started in October 2023 at 1810. However, it appears wave III has not finished yet. The current pullback is expected to either be in wave ((4)) of III already or wave (4) of ((3)) of III. The most important task now is to note what structure is unfolding from the late October peak.

(Click on image to enlarge)

H4 Chart Analysis

On the H4 Chart, the price is currently in the last stage of wave (A). A corrective bounce for wave (B) should follow before further decline in wave (C) which could extend toward 2400 or lower depending on the height of wave (B).

(Click on image to enlarge)

More By This Author:

Unlocking ASX Trading Success - Westpac Banking Corporation

Elliott Wave Technical Analysis - Berkshire Hathaway Inc.

Elliott Wave Technical Analysis - S&P/TSX 60 Index

Analyst Peter Mathers TradingLounge™ Australian Financial Services Licence - AFSL 317817

.thumb.png.6cd834a2f0689843ce9b1d6facad7b9e.png)