Gold Chasing Price Feels Very Nice

It’s rare that I suggest that gold market investors should engage in “price chasing”.

The 1970s were a time to do it. So was 2009.

What about today? Today, the answer is… yes!

(Click on image to enlarge)

When price rallies to the neckline of the largest bull continuation pattern in the history of the gold market…

Simply put, it’s a time to chase price!

(Click on image to enlarge)

short-term gold chart

Investors must adjust their thoughts and actions to reflect the current technical reality of the gold market:

It’s now very similar to the 1970s. Daily swings of $40, $50, and even $100 are the “new normal”.The good news is that all that’s needed to deal with these swings… is a yawn.

It’s a time to put the space helmets on, and…

Unfortunately, it’s also time to understand why this is happening.

The 2021-2025 time zone is potentially the biggest war cycle since 1941-1945.

For now, Ukraine dominates the war cycle action, but that will likely change, and most of the blood spilled could soon be on US soil. For Americans, the converging cycles are both global and civil.

Cyber attacks are increasingly likely. These attacks could come from Russia, China, or even from the US government in a “false flag” operation.

Ironically, gold bugs are worried about the increase in price volatility in the mining stocks, when they should be ensuring they have food, medicine, water, cash, and physical metal to deal with cyber warfare attacks. The bottom line:

Gold price volatility is best handled with a yawn and a laugh. That’s not the case for war cycle volatility in our daily lives.

(Click on image to enlarge)

From the early October low, I’ve warned US stock market investors that an H&S top was likely forming, and it did.

Now the neckline is failing, and that’s just one of a myriad of ominous indicators.

(Click on image to enlarge)

The CAPE ratio for the S&P500 is in the stratosphere and still above where it was the highs of 1929!QE is finished, a boatload of rate hikes is required to reverse inflation, and cyberattacks may be imminent.

Clearly, the stock market freight train appears “scheduled” for a one-way trip… to Hades.

What about the miners? Well, if the markets remain open, it should be clear sailing for most of them.

(Click on image to enlarge)

key GDX chart

A massive bull wedge pattern is in play, but note the rallies from 2008 and 2020 highlighted in red.

The game has changed. Rallies since 2008 were themed on QE welfare programs and rate cuts. Most of the money went to stocks, bonds, and real estate. Now, gold stocks are rallying while rates rise, QE is ended, and the stock market crashes. This is a new paradigm, and it is awesome!

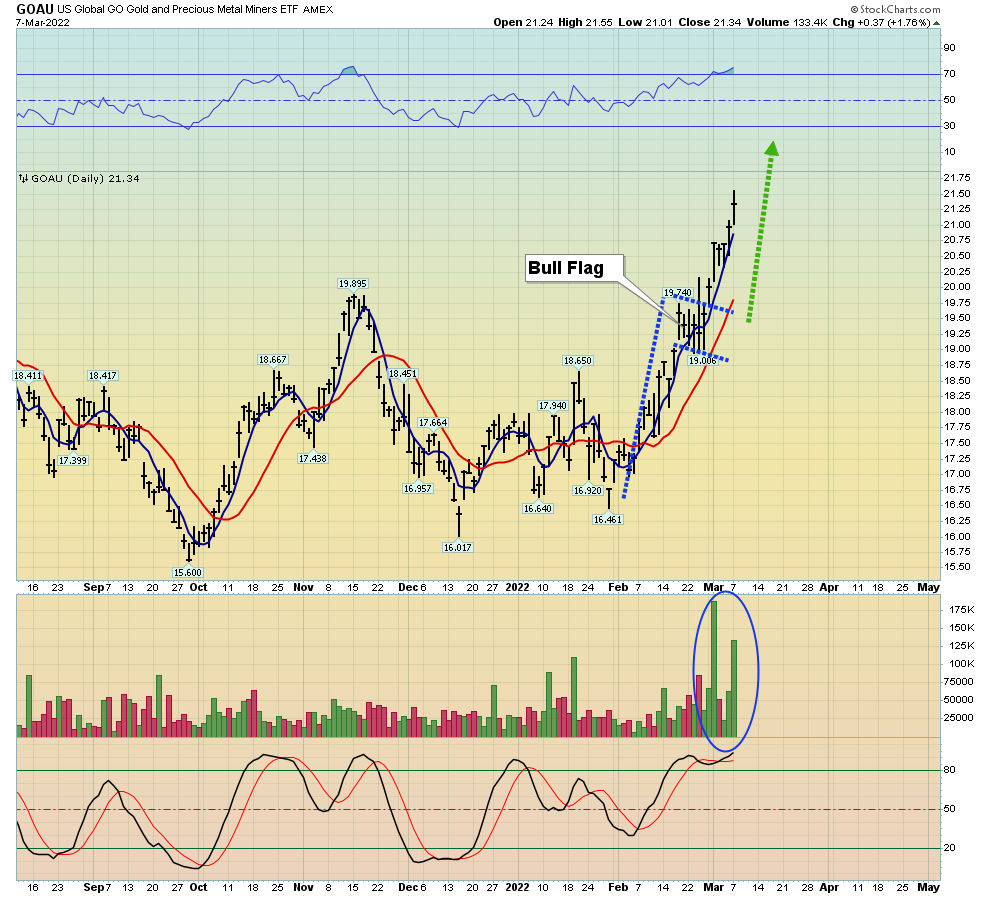

(Click on image to enlarge)

fabulous GOAU chart

Note the bull flag and the significant rise in volume. Institutional money managers are beginning to put proceeds from their stock market sales into the precious metal miners.

Gold and silver stocks will have sharp pullbacks, but these should be short-lived. This is a time when both dip buyers and momentum players can thrive. It’s a time to buy dips. It’s a time to chase price. It’s a time that is best labeled… very, very nice!

A huge number of war cycles are converging, and I cover them in detail in my daily big picture newsletter where I cover gold, silver, commodities, ...

more