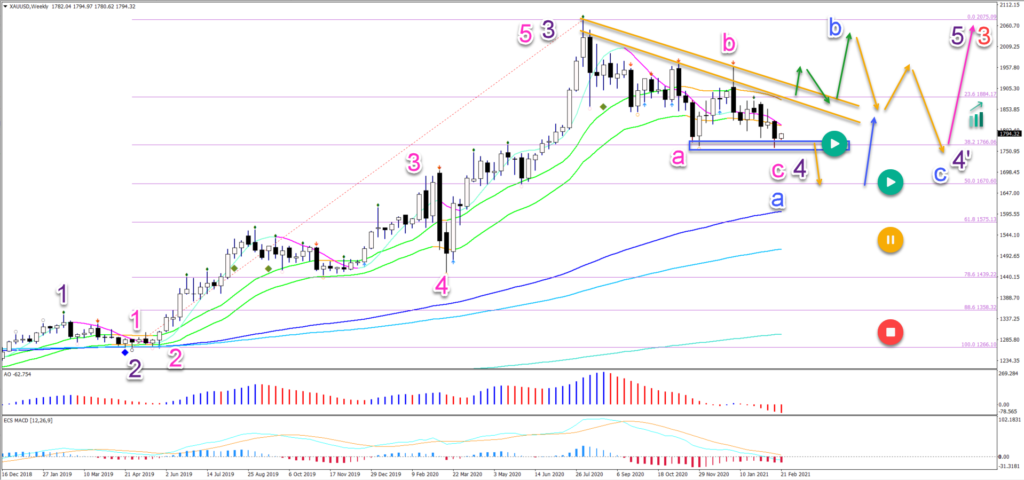

Gold Bullish Bounce At 38.2% Fib But Uptrend Pauses

Gold (XAU/USD) is building a bullish bounce around $1760-$1800. The double bottom chart pattern (blue box) could fuel the reversal.

This article reviews the potential for Gold to move up. We also analyze the targets in the short-term and long-term.

Price Charts and Technical Analysis

(Click on image to enlarge)

The XAU/USD uptrend saw price breaking above the round $2,000 level in the 1st half of 2020. But the 2nd half of 2020 has been a lot quieter. Let’s review why.

- The current pause within the uptrend is turning into a significant pullback, which is typical for a wave 4 (purple) pattern.

- Waves 4 are usually shallow retracements but also lengthy phases.

- The 38.2% Fibonacci support zone (blue box) is the usual bouncing spot for the uptrend.

- The double bottom is confirming the potential for a reversal back up.

- But waves 4 are also usually very lengthy. That is why an expanded ABC (blue) correction is likely within wave 4’ (purple). The current ABC (pink) has only completed the first wave A (blue).

- Such a wave 4 extension could indicate a retracement for another 6-12 months.

- The bullish outlook remains valid as long as price action stays above the 50% Fibonacci level. A deeper retracement could either indicate a different bullish wave pattern or even the end of the trend (red circle).

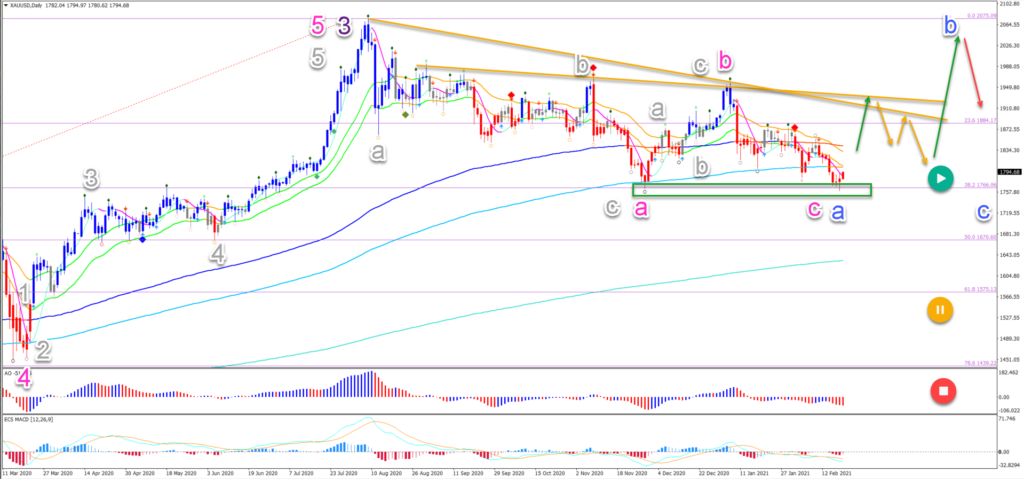

On the daily chart, the correction phase becomes better visible. As we can see, the bearish price action is slow, choppy, and corrective. This is typical for wave 4 (purple).

A bullish bounce and breakout is expected. But the main target in the short-term is the previous high at first. A bearish bounce at the previous high could confirm wave B (blue).

Eventually, a break of the high should send this commodity higher though. The main targets are $2,250 and $2,500.

(Click on image to enlarge)

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit ...

more