Gold Bounces Off Daily Low; Remains Close To Nearly Two-Week Top Amid Fed Rate Cut Bets

Image Source: Pixabay

Gold (XAU/USD) recovers slightly from the daily low, though it sticks to a mildly negative tone heading into the European session amid a combination of negative factors. The prospects for lower US interest rates, along with hopes for a peace deal between Russia and Ukraine, remain supportive of the upbeat market mood. This, along with a modest US Dollar (USD) rebound from an over one-week low, turns out to be a key factor undermining the safe-haven precious metal.

Meanwhile, a mixed set of US economic indicators released this week did little to alter market expectations that the US Federal Reserve (Fed) will cut interest rates again in December. This might keep a lid on any meaningful USD appreciation and continue to act as a tailwind for the non-yielding Gold. Furthermore, thin trading volumes on the back of the Thanksgiving Day holiday in the US warrant some caution for the XAU/USD bears and positioning for deeper intraday losses.

Daily Digest Market Movers: Gold bullish bias remains amid dovish Fed expectations

- The US Census Bureau reported on Wednesday that new orders for manufactured Durable Goods Orders rose 0.5% in September, down from the upwardly revised 3.0% increase in the previous month. The reading, however, exceeded market expectations of 0.3%. Additional details of the report showed that new orders excluding transportation rose 0.6% during the reported month, while excluding defense, they increased 0.1% following a 1.9% rise the prior month.

- Separately, the latest figures published by the US Department of Labor showed that the number of Americans filing new applications for unemployment benefits fell to 216K, or a seven-month low, in the week ending November 22. This helps to offset the disappointing release of the Chicago PMI, which unexpectedly fell deeper into contraction territory and came in at 36.3 for November. The US Dollar, however, struggles to lure buyers amid dovish Federal Reserve expectations.

- Recent comments from top Fed officials shifted market expectations strongly in favor of another quarter-point reduction at the December 9-10 FOMC meeting. In fact, New York Fed President John Williams said last Friday that interest rates could fall in the near term without putting the central bank's inflation goal at risk. Moreover, Fed Governor Christopher Waller said at the start of this week that the job market is weak enough to warrant another quarter-point rate cut in December.

- Meanwhile, Fed Governor Stephen Miran echoed the dovish view and noted in a television interview on Tuesday that a deteriorating job market and the economy call for large interest rate cuts to get monetary policy to neutral. The outlook, in turn, drags the USD Index (DXY), which tracks the Greenback against a basket of currencies, to an over one-week low during the Asian session on Thursday. This might continue to act as a tailwind for the non-yielding Gold.

- Russia said that the US-brokered talks to end the war with Ukraine are serious, though Kremlin spokesman Dmitry Peskov cautioned that an agreement is a long way off and Moscow would offer no major concessions. US President Donald Trump said that a Ukraine–Russia agreement is very close, fueling optimism. This, along with prospects for lower US interest rates, remains supportive of a generally positive tone around the equity markets and weighs on the safe-haven bullion.

Gold technical setup backs case for move towards reclaiming $4,200

Any subsequent slide is likely to find decent support near the $4,132-4,130 region, below which the Gold price could accelerate the fall toward the $4,100 mark. Some follow-through selling would expose a confluence support, comprising the 200-period Exponential Moving Average (EMA) on the 4-hour chart and an ascending trend-line extending from late October, currently pegged around the $4,040 area. A convincing break below the latter might shift the near-term bias in favor of bearish traders and drag the XAU/USD pair to the $4,000 psychological mark.

On the flip side, the $4,171-4,173 zone, or a nearly two-week high touched on Wednesday, now seems to act as an immediate hurdle, above which the Gold price could aim to reclaim the $4,200 round figure. A sustained strength beyond the latter will set the stage for an extension of the momentum toward testing the monthly swing high, around the $4,245 zone.

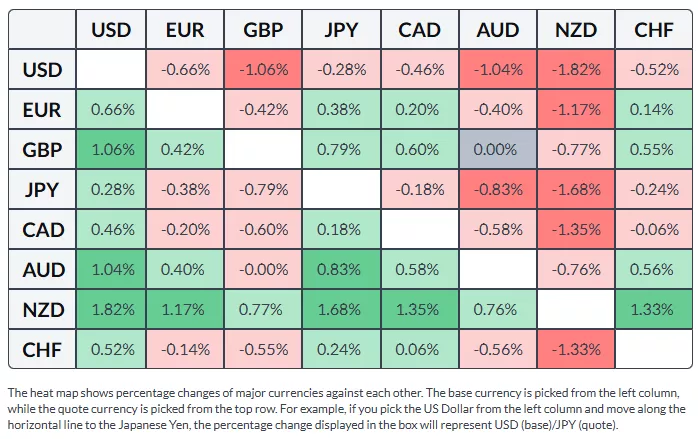

US Dollar Price This week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Japanese Yen.

More By This Author:

USD/JPY Slides To 156.00; Remains Close To One-Week Low Amid Contrasting BoJ-Fed OutlooksGold Holds Firm Amid Dovish Fed Expectations

GBP/USD Strengthens On UK Autumn Budget And OBR Projections

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more