Gold At $3,850: What’s Next For Precious Metals?

Image Source: Pixabay

Gold has now surged to around $3,850 per ounce, breaking record after record and keeping momentum firmly on its side. The question now is: can it keep climbing, or are we due for a pause? Having tracked the precious metals sector since 2005, here’s how I see it.

The New Bull Market in Gold

This bull run really began in March 2024, when gold broke out above $2,100 on the back of heavy central bank buying and strong investor demand. From there, it’s been a steady rise with periods of consolidation before pushing higher.

At the start of 2025, we witnessed something unusual: massive shipments of gold moving from the London Bullion Market (LBMA) to the U.S. at prices around $2,800–$3,000. In nearly 20 years of following this market, I’ve never seen that happen. To me, that firmly established a $3,000 floor for gold. Barring a major black swan liquidation event, I don’t think we’ll ever see gold trade under $3,000 again.

Catalysts Driving the Rally

Recent price action has been fueled by several key factors:

-

Safe-haven demand: Gold spiked as U.S. government shutdown fears grew and investors braced for political uncertainty.

-

Fed policy shift: The U.S. rate cut cycle, which helped gold break out of the $3,300–$3,400 range this summer, remains a powerful tailwind.

-

Weaker dollar: A softening greenback has added more fuel to the fire.

-

Supply crunch in other metals: Investigations under Section 232 are tightening supplies of platinum-group metals, indirectly boosting interest across the precious metals complex.

The result? Spot gold hit $3,831.27 on September 29, while U.S. futures climbed to $3,860.60—both new all-time highs. Year-to-date, gold is up about 45%, while silver has gained an even more impressive 60%, recently moving above $47/oz.

Big Picture Targets: $4,100 … or $10,000?

Looking at gold through the M2 money supply lens gives us some perspective. In 1980, gold at $850 touched the red M2 line. In 2011, gold at $1,920 hit the blue M2 line. If history repeats, today’s breakout points to a target near $4,100.

If gold stretches further to align with the red M2 line, that suggests a potential just under $10,000. And while I’m not predicting Rickards’ extreme case of $23,000 gold just yet, it’s clear that the upside potential remains strong. My view? We probably land somewhere in between over the coming years. Either way, the bull market is alive and well. Image above from Bloomberg and shared by Katusa Research.

The Silver Factor

Here’s where things get even more interesting. At $3,850 gold, if the gold-to-silver ratio compresses to 45:1 (as it did in the last metals bull cycle), silver would be trading at about $85 per ounce—nearly a double from current levels. And markets love round numbers, so I wouldn’t be surprised to see silver test $100 if gold keeps pushing higher.

That ratio shift alone could unlock massive upside in silver, making it a key play to watch alongside gold.

Final Thoughts

The precious metals market is in uncharted territory. With gold above $3,850 and silver rallying hard, the bull cycle that began in 2024 still has room to run. My base case is gold hitting $4,000 in the coming months, but the bigger picture suggests much higher levels are possible as global uncertainty, central bank policies, and money supply dynamics continue to play out.

For long-term holders, dips are opportunities. For traders, volatility is your friend. And for those watching silver—keep your eye on that ratio. If it tightens to 45, we’re looking at $85+ silver.

Onward and upward.

More By This Author:

The Silver Bull Market Is Alive & Well... The Silver Miners Are Confirming This.

Overview Of Emerald Health Therapeutics, A Growing Cannabis Producer In Canada

Interview With Vitality Biopharma Inc.

Disclosure: The content provided by Vin Maru and Financial Liberties is for informational and educational purposes only and does not constitute financial, investment, legal, or other ...

more

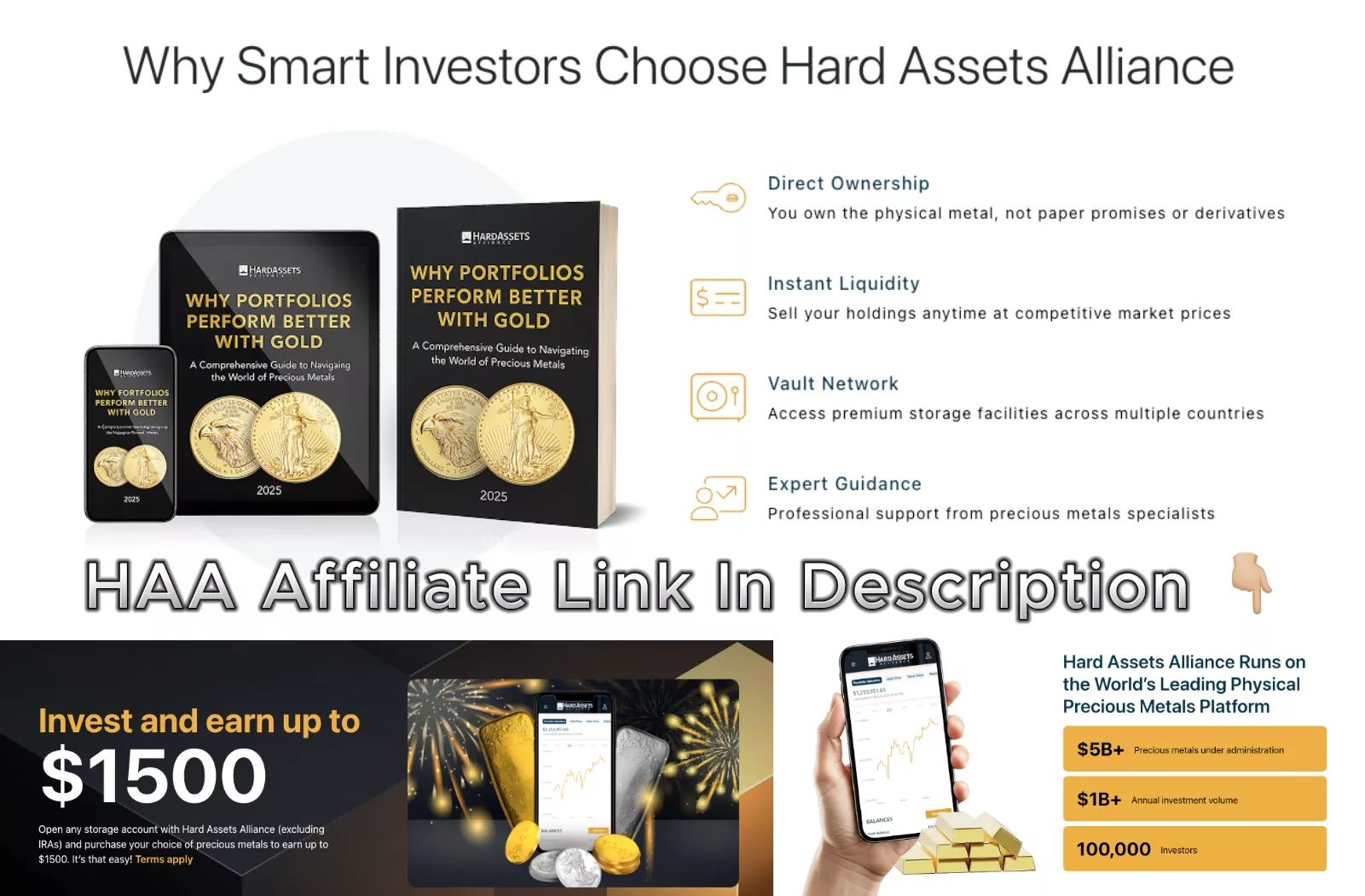

If you are interested in buying physical gold and silver, we suggest you look at Hard Asset Alliance, which manages over $5B in metals and has 100K clients. I have been an affiliate with them for over 12 years, with no complaints from clients. Here is our affiliate link to them...

https://hardassetsalliance.com/free-cash-bonus-offer/?_ef_transaction_id=&oid=5&affid=15&aff=VMCB