Gold: And You Thought You Missed The Move? Think Again

Day Trading Action

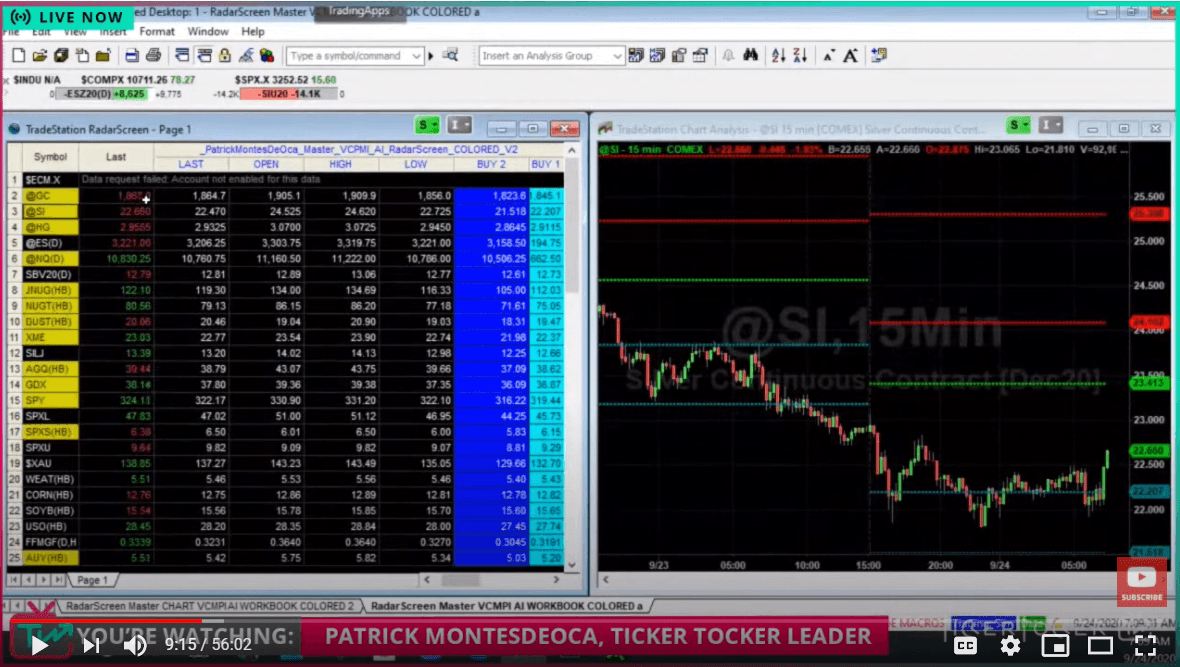

Precious metals are in a fast market to the upside. We recommended our subscribers go long in silver at $22.3250. The market is breaking out to the upside. Silver last is at $22.60 and we are locking in profits if you entered with multiple positions. We have been expecting a major reversal over the past few weeks. We seem to be establishing the lows that we were expecting. We base our recommendations on the Variable Changing Price Momentum Indicator (VC PMI) proprietary algorithm.

Courtesy: Ticker Tocker

We recommended yesterday to cover your silver and other metals shorts. The silver market has completed the monthly target of $18.69. We are getting confirmation in silver that we are in a reversal pattern. We have met the downside target and have activated a buy signal from $22.20.

VCPMI Monthly Gold Signals

Gold is at $1867.70. Closing above $1869 activates the monthly trigger. Prepare to buy long gold at $1869. Gold is trading below the mean. The level in gold is $1878 for the daily average price. The market trading below that daily average price has activated the Buy 1 signal of $1845. Buy 2 is at $1824. If gold comes down to that Buy 1 level, there is a 90% probability of a reversion to the mean. If it reaches Buy 2, then there is a 95% chance of a reversion to the mean. The closer gold gets to the buy levels, the higher the chance that buyers will come into the market.

Gold made a low of $1851. It almost came down to the Buy 1 level, but it found buyers at a slightly higher level. It then reverted, since the buyers were stronger than the selling pressure. Gold is moving up to the monthly Buy 1 level of $1869. The VC PMI is based on the principle of reversion to the mean, which is structured around the two buy levels below and two sell levels above the mean for daily, weekly and monthly data. The mean is the equilibrium price between supply and demand.

We do not have any signals in gold yet, but if we close above the monthly of $1869, it will activate the monthly signal. A close above $1878 will bring in the daily average price and confirm a daily bullish price momentum. The target in the daily is $1899, the level above. The monthly target from the Buy 1 level is $1979. The daily, weekly and monthly trends are in alignment, which provides us with the highest probability trades.

Fundamentals

Fundamentals tend to lag the market. Sometimes when everyone is buying up top, as when gold was at $2084, all the fundamentals were bullish. But now we are down about $223 from that high, yet the fundamentals, for the most part, have not changed. The pandemic is still crippling the global economy, US-China tensions are high, we have a highly volatile US election looming, and Black Lives Matters is pushing for social change.

Today we have so much data and information available. You need to cut through all the chatter first. That is why we focus on the action of the market itself and try to learn what it is trying to tell us about which direction it is likely to go.

In March, we made a low in gold of $1450 after the major collapse triggered by the pandemic, which dropped it from $1704 on March 9 in just a matter of days. This was a massive correction, but which discounted the damage that the pandemic was going to cause because the market reversed right back up. The Fed announced record stimulus and gold raced back up. The Fed, in anticipation of an even worse economic implosion, leveraged about 10% of GDP to cover the potential losses in the markets - that is about $20 trillion.

The Fed was willing to allocate that much to the markets, if necessary. The first round of stimulus was about $3.5 trillion. The market took that as bullish news for the equities markets. In fact, gold and the equities markets both started back up from that March low; gold and the equity charts almost match each other. That is because from that point, gold became a currency.

The amount of stimulus that the markets are going to need is far more than the Fed has allocated. The Fed thought consumer spending would decline about 10%, but it has only declined 4% or 5%. In the futures markets, they anticipate such changes. The futures markets put in a risk premium due to the economic collapse and a safe-haven premium for gold against the US dollar. By printing money, it devalues the underlying currency.

The buying power of the US dollar is declining and inflation starts to kick in. The Fed wants to put a 2% cap on inflation. If inflation hits that level, they will then decide what to do in relation to interest rates, which are already at almost zero. They can’t let inflation rise because it puts pressure on interest rates. Given the level of massive debt we have, any increase in interest rates will be catastrophic.

We recently published an article about gold becoming a currency: Gold Adjusting to a New Paradigm. The government is printing massive amounts of money and gold is now an alternative currency to the fiat US dollar currency and every other fiat currencies around the world. Inflation is coming and fiat currencies are going to be worth far, far less and even possibly will be worthless. The PPI (producer price index) came out at 0.03%, which is reflecting the rise in commodity prices and the beginnings of inflation in the economic system.

Silver's year-to-year change went from -0.8% to +53.2% and gold went from -1.0% to +30.0%. This is the real inflation in natural resources and precious metals. When the Fed talks about inflation at a maximum of 2%, they do not include energies and food in their calculations, even though food and energy are two fundamentals of the economy. The last ace Fed holds is that when inflation rises to 2% using their numbers, they will put a cap on the 30-year bond interest rate.

They will begin to attempt to manipulate the long-term yield curve. They will seek to cap long-term rates because they know they can’t raise interest rates in the face of such debt levels. Even at 2% governments, businesses and individuals are going to be facing a major debt payment crisis. If this happens, the price of gold is going to explode because the Fed will then print as much money as they need to control interest rates and the cost of government debt.

By printing more currency, the Fed is allowing hyperinflation to take its course. With the changes in the metals prices, we are looking at 10% inflation already. Your US dollars are worth less and less every day, while gold rises. We recommend building a long-term position in gold because we have yet to see the volatility that is coming. What happened in March is just the beginning. Gold could move $200 or $300 in a day.

We are moving into record volatility in an economic crisis with an unresolved pandemic during a US election with millions unemployed. There will be more layoffs this fall as government stimulus runs out and we face another potential spike in COVID-19 as winter comes with another lockdown. The economic system was tested by the pandemic and failed. When the dollar was taken off the gold standard, the dollar was fatally weakened and the pandemic showed that weakness. With these fundamentals, this is the greatest opportunity of your lifetime. You can change your life. Buy gold!

Disclosure: I am/we are long GDX.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold and silver, check us out on more