Gold And Silver Technicals: This Is A Healthy Correction If $1800 Holds

Image Source: Unsplash

The data over the last several months has been spot on in predicting the moves in gold and silver. November showed the market was in neutral, but then the December analysis correctly identified an impending move upwards, the January review concluded:

Nothing moves straight up. Even though the consolidation in gold and silver lasted more than two years (Aug 2020 – Dec 2022), markets always need time to rest and recover. The current move has been very strong, but gold does not yet look ready to take on $2000 and attack new all-time highs.

Both metals have taken a breather. The current data suggests the market may be back in neutral until a compelling catalyst can push the momentum one way or the other.

Resistance and Support

Gold

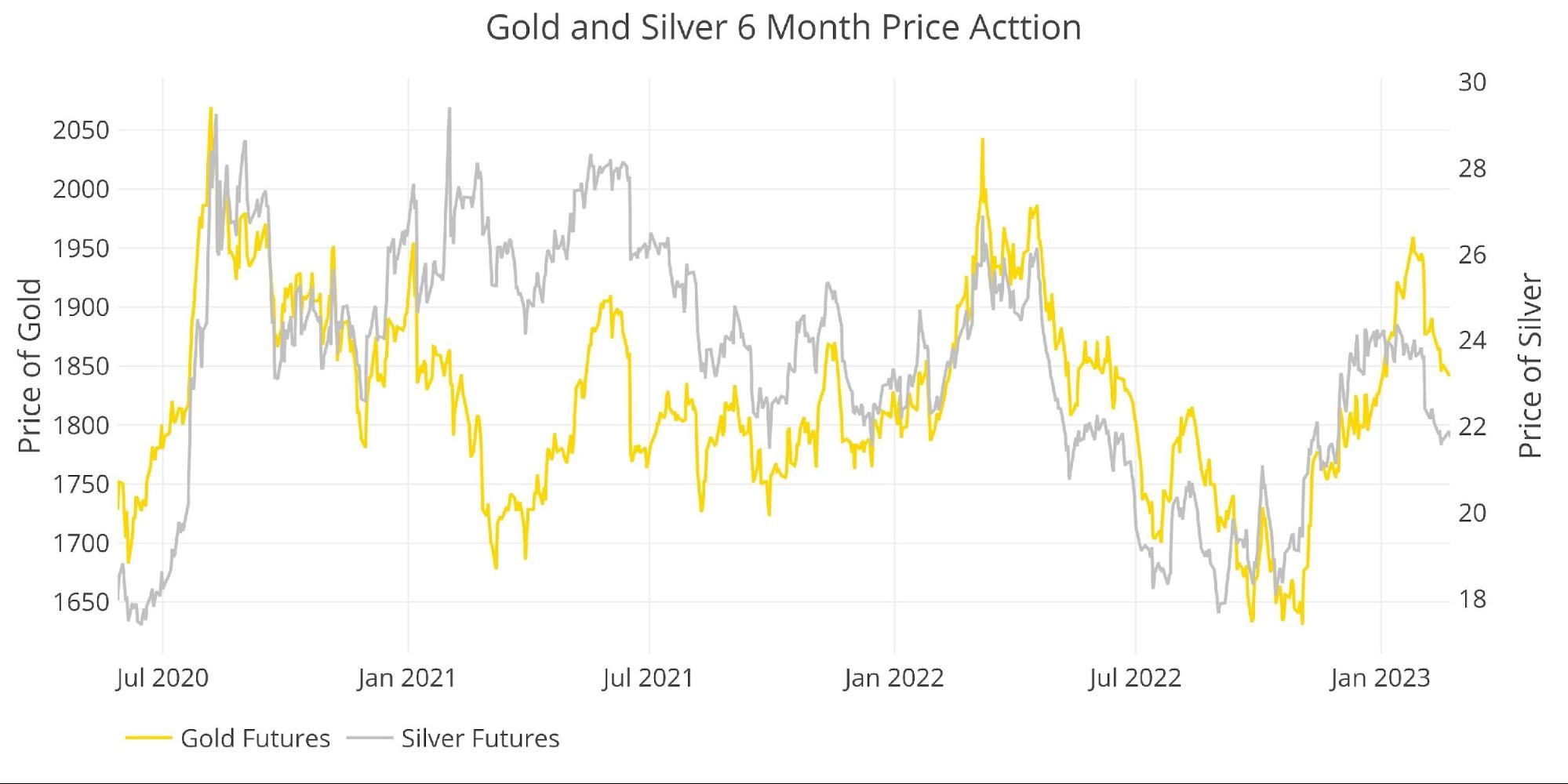

After gold broke through solid resistance at $1800, it didn’t waste much time blasting through $1900 before running out of gas at around $1950. It is now slightly below $1850 and trying to consolidate gains and hold above $1800. It would have been better to see gold consolidate north of $1850, so the bigger move down leaves the door open for another retest at $1750. This is not currently the base case, but the price action makes it a possibility.

The base case is to carve out a bottom over the next couple of weeks and grind higher into March and April. Gold has the fuel but is still not ready to launch… yet!

Outlook: Neutral

Silver

Silver led gold higher and then led it lower. It failed to hold $22 which is not a great sign, but silver is known for its volatility. If it cannot reclaim $22 in short order that would be a bad sign and could see a quick retest of the $20 level.

Outlook: Neutral to bearish

(Click on images to enlarge)

Figure: 1 Gold and Silver Price Action

Daily Moving Averages (DMA)

Gold

Last month, the chart below was the clearest sign that a pullback was due. The 50 DMA had moved pretty far out in front of the 200 DMA, coming off quite a depressed level. While the last golden cross turned out to be a false flag, this still looks like a healthy move in a new bull market. There would be more reason for concern if gold cannot hold its 200 DMA ($1784).

Outlook: Neutral to Bullish

Figure: 2 Gold 50/200 DMA

Silver

Silver is still enjoying its golden cross that was formed back in December. It looks like it may try to test the 200 DMA ($21.02), but is now consolidating. As the chart shows, the last three years have had a few false moves where the golden cross was quickly invalidated. This leaves room for more caution than gold. For now, too early to tell on this one… next month should have a clearer signal.

Outlook: Neutral

Margin Rates and Open Interest

Gold

Open interest saw two quick spikes up that were both sold hard. The CFTC raised margin requirements 3 times directly into the recent up-move to blunt the rally. Now the market sits with open interest at multi-year lows and the CFTC has already played its first round of margin hikes. Probability suggests the next move is likely higher than lower.

Outlook: Bullish

Figure: 4 Gold Margin Dollar Rate

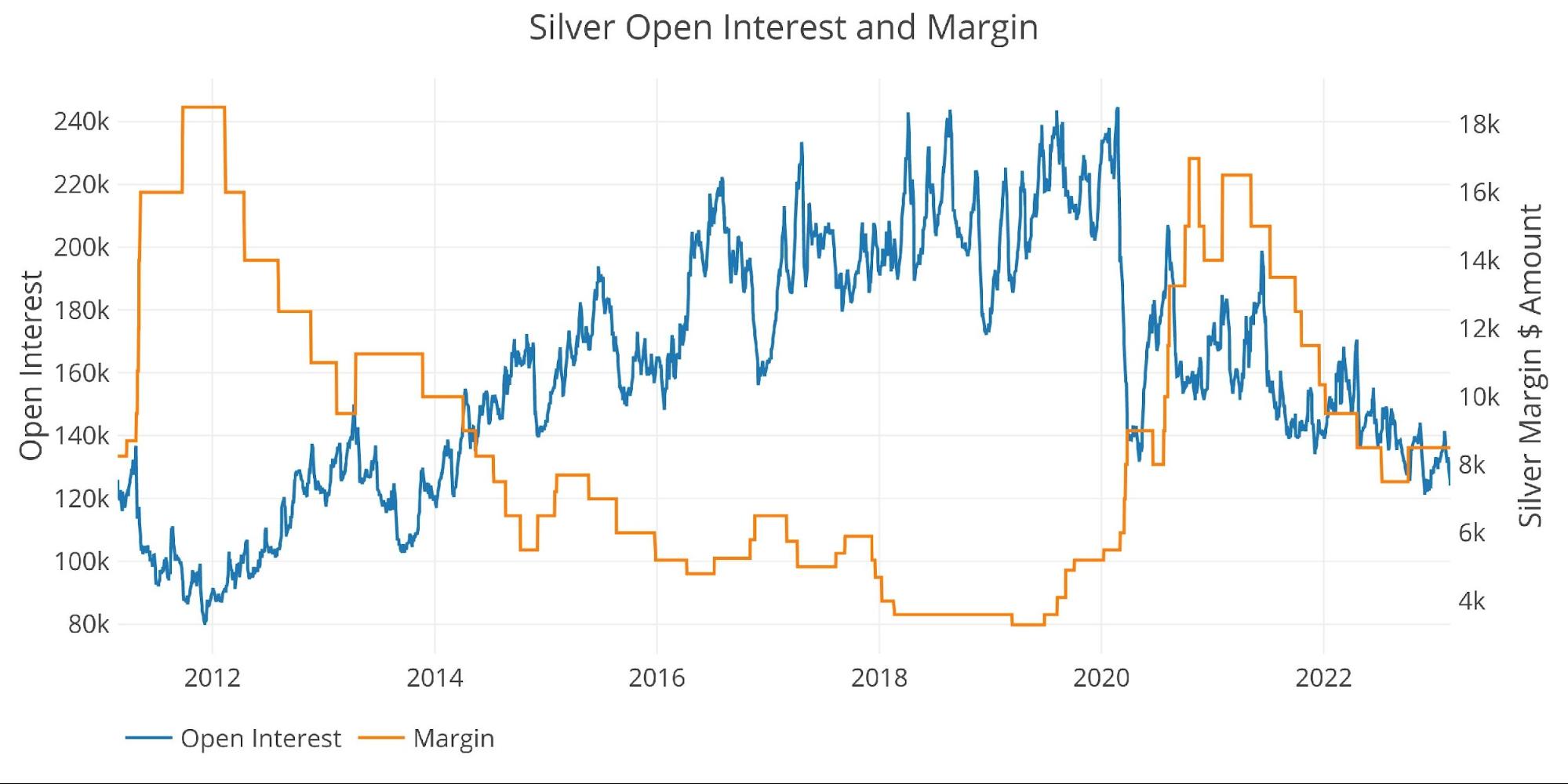

Silver

Silver open interest is near multi-year lows but the CFTC has not yet played the first round of margin hikes. This means that while open interest could increase to drive prices higher, it’s likely the CFTC would hike rates to slow the move. Silver will have to rally in the face of higher margin requirements to validate the bull run.

Outlook: Neutral

Figure: 5 Silver Margin Dollar Rate

Gold Miners (Arca Gold Miners Index)

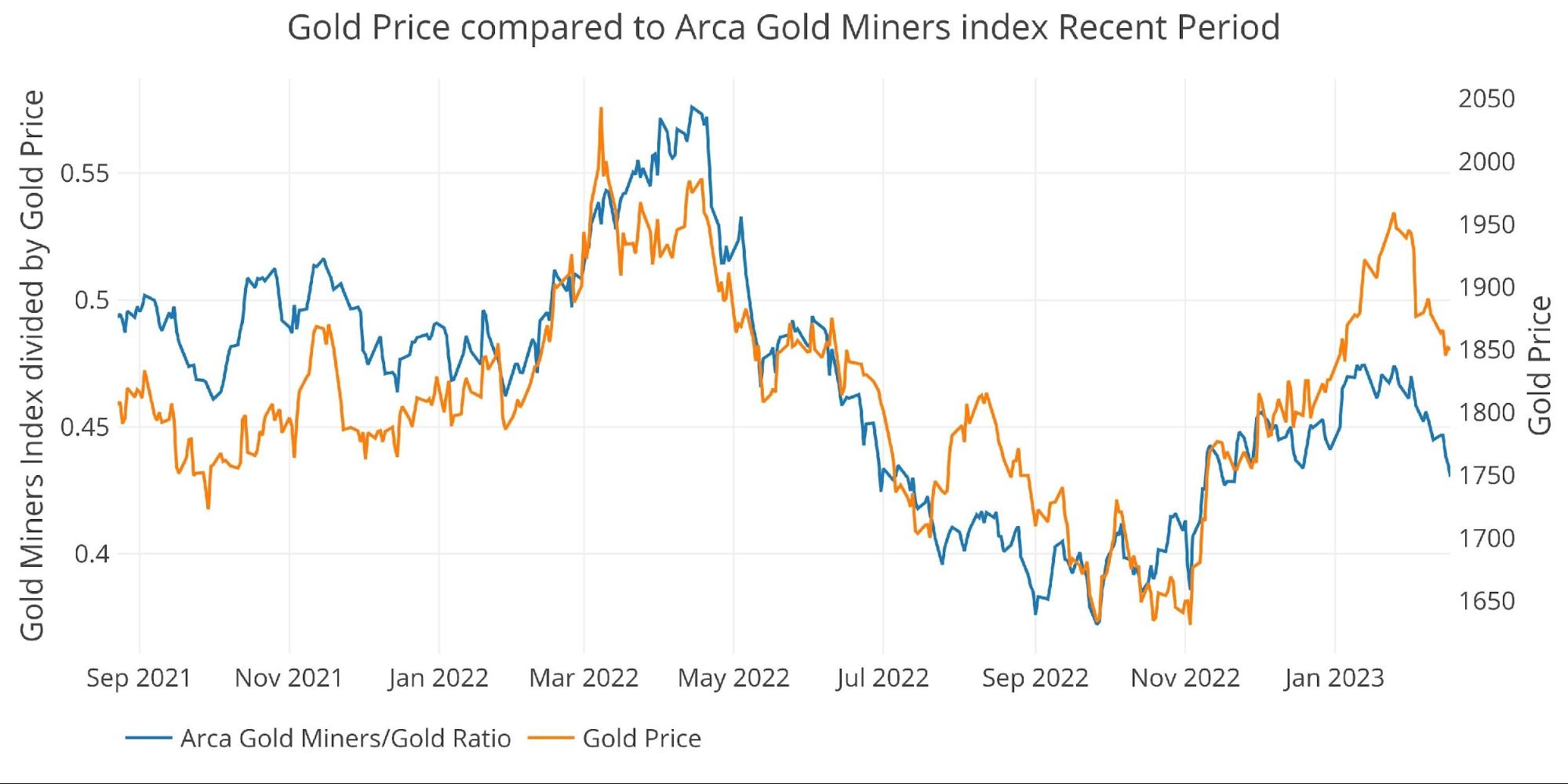

The gold miners have been consistently leading the price of gold in both directions for years. The miners have sold off pretty hard in the recent correction which suggests there is more room to the downside for both gold and miners. The last time the ratio was this low, gold was almost $100 lower. The stock investors are certainly cautious of the current move up in gold. For good reason too, gold has been struggling to get any sustained momentum for years now. While the short-term correction is expected, the longer three-year correction has been far more frustrating and unexpected. The miners are clearly showing this frustration!

Regardless of the reason, the price of gold has not maintained a distance above the ratio as shown below. This means if the miners do not turn around imminently, the next move in gold would be down into the $1750 range. The miners are taking another hit lower at the time of publishing (down over 2%) which is another bad sign.

Outlook: Bearish

Figure: 6 Arca Gold Miners to Gold Current Trend

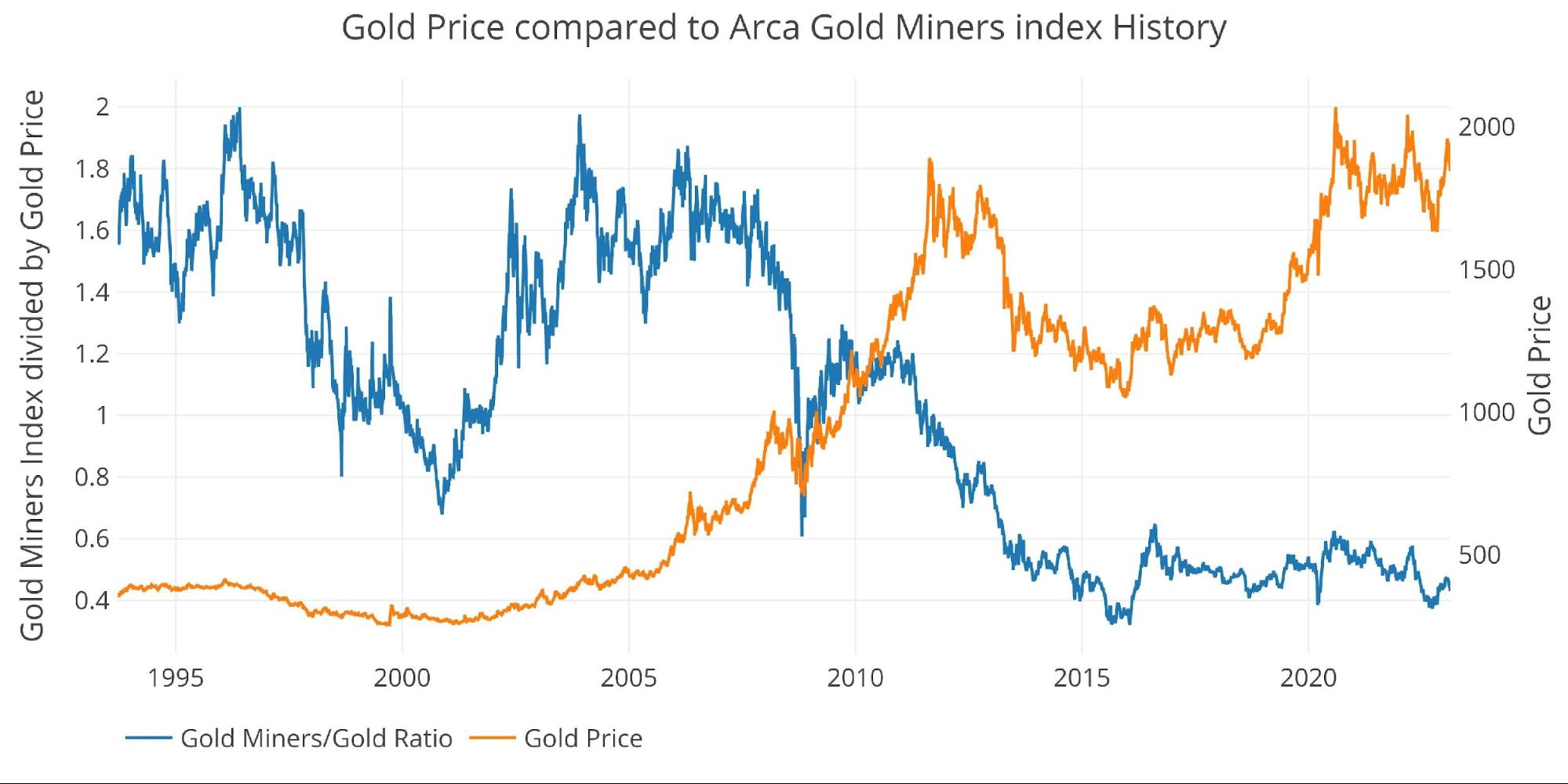

Looking over a long time horizon shows how badly the miners have underperformed gold over the last decade. This shows traders have never confidently bought into any gold momentum, anticipating price advances will be short-lived. So far, they have been correct. Eventually, that will change!

Figure: 7 Arca Gold Miners to Gold Historical Trend

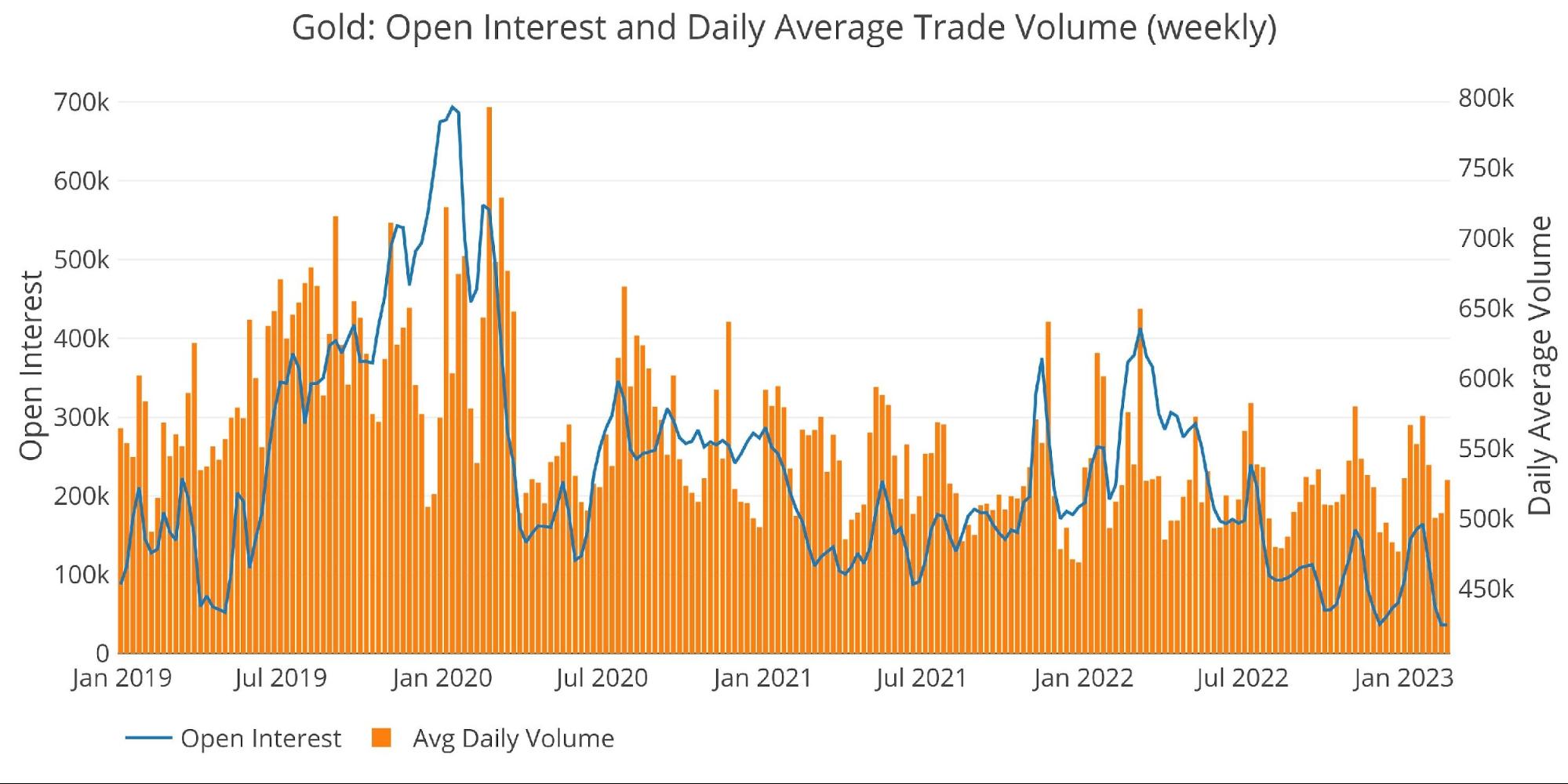

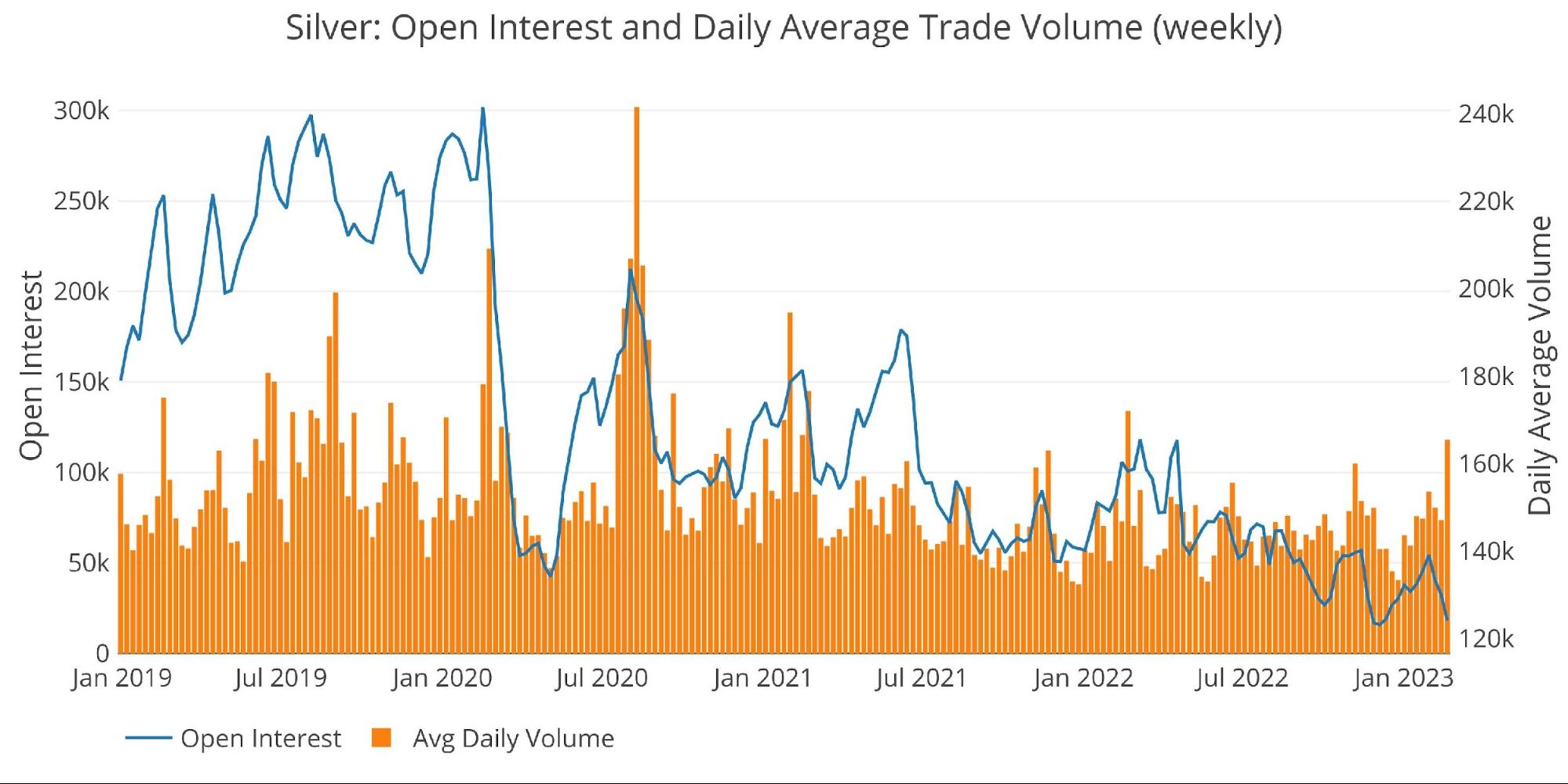

Trade Volume

Love or hate the traders/speculators in the paper futures market, but it’s impossible to ignore their impact on price. The charts below show more activity tends to drive prices higher.

Volume in both metals spiked in the face of falling prices. This is atypical and suggests that the recent price move is from heavy liquidations of longs. This is exactly what would be seen in a healthy correction. Low volume and falling prices would be a worse sign. The tide won’t flip imminently, but this is supporting the notion of carving out a bottom.

Short-term neutral and medium-term bullish

Figure: 8 Gold Volume and Open Interest

Figure: 9 Silver Volume and Open Interest

Other drivers

USD and Treasuries

Price action can be driven by activity in the Treasury market or US Dollar exchange rate. A big move up in gold will often occur simultaneously with a move down in US debt rates (a move up in Treasury prices) or a move down in the dollar.

Figure: 10 Price Compare Inverse DXY, GLD, 10-year prices

The weak dollar was a major fuel behind the recent move up in gold and the rebound in the dollar and interest rates has also led to the current pullback. The dollar was way over-bought, then became over-sold, and is now trying to decide the next move. Similar story in rates when the 10-year hit went well above 4% and then fell below 3.5%.

Both down moves in rates and the dollar were more than a correction which suggests the rebound we are seeing is the correction. This would support gold prices but is not a sure thing. The moves are not clear-cut at this point.

Outlook: Neutral to slightly bullish

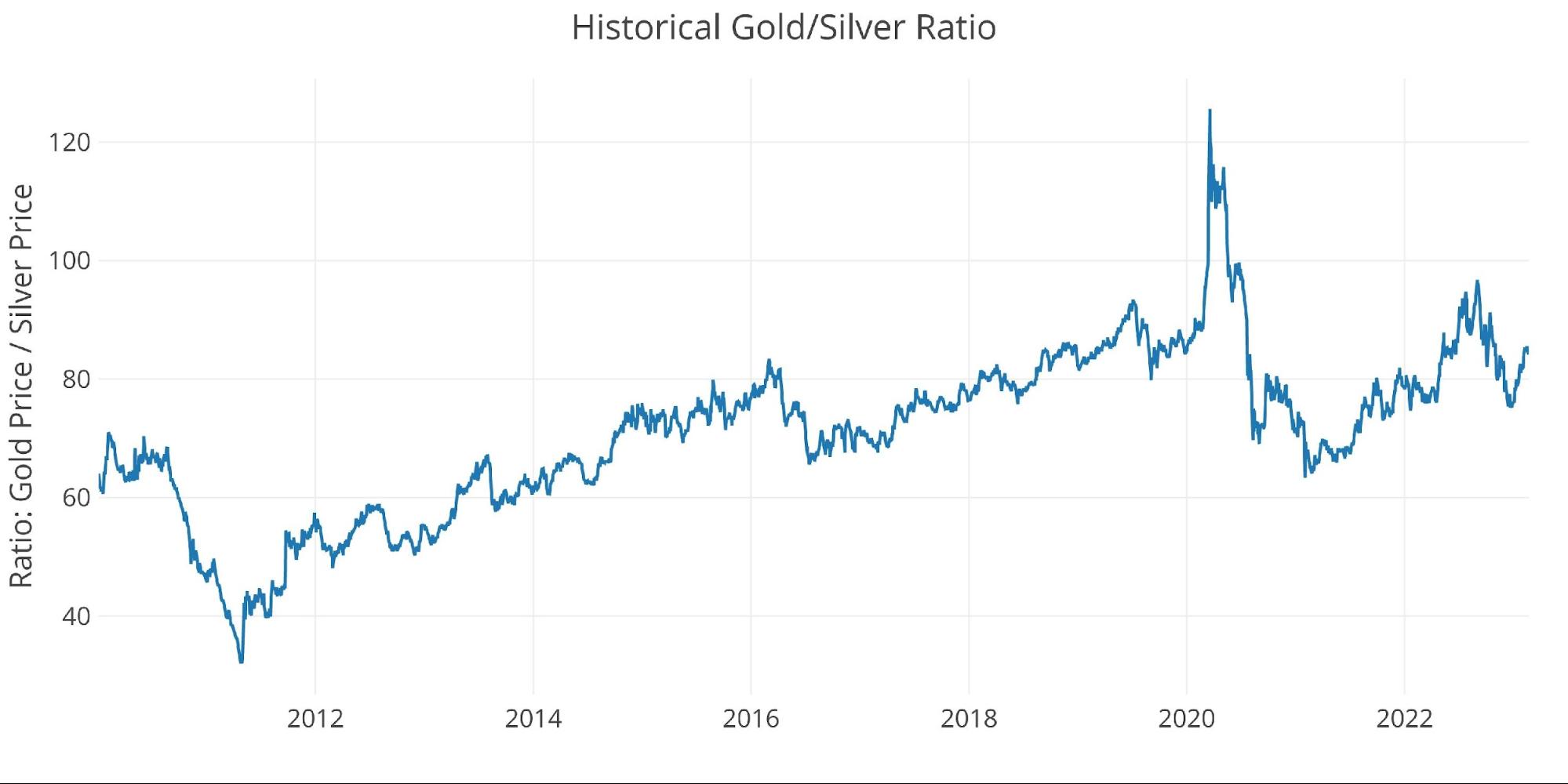

Gold Silver Ratio

The gold-silver ratio has been steadily falling and got as low as 75 in December. Since silver has stalled out, the ratio has turned back upward and is back above 85.

Outlook: Silver bullish relative to gold

Figure: 11 Gold Silver Ratio

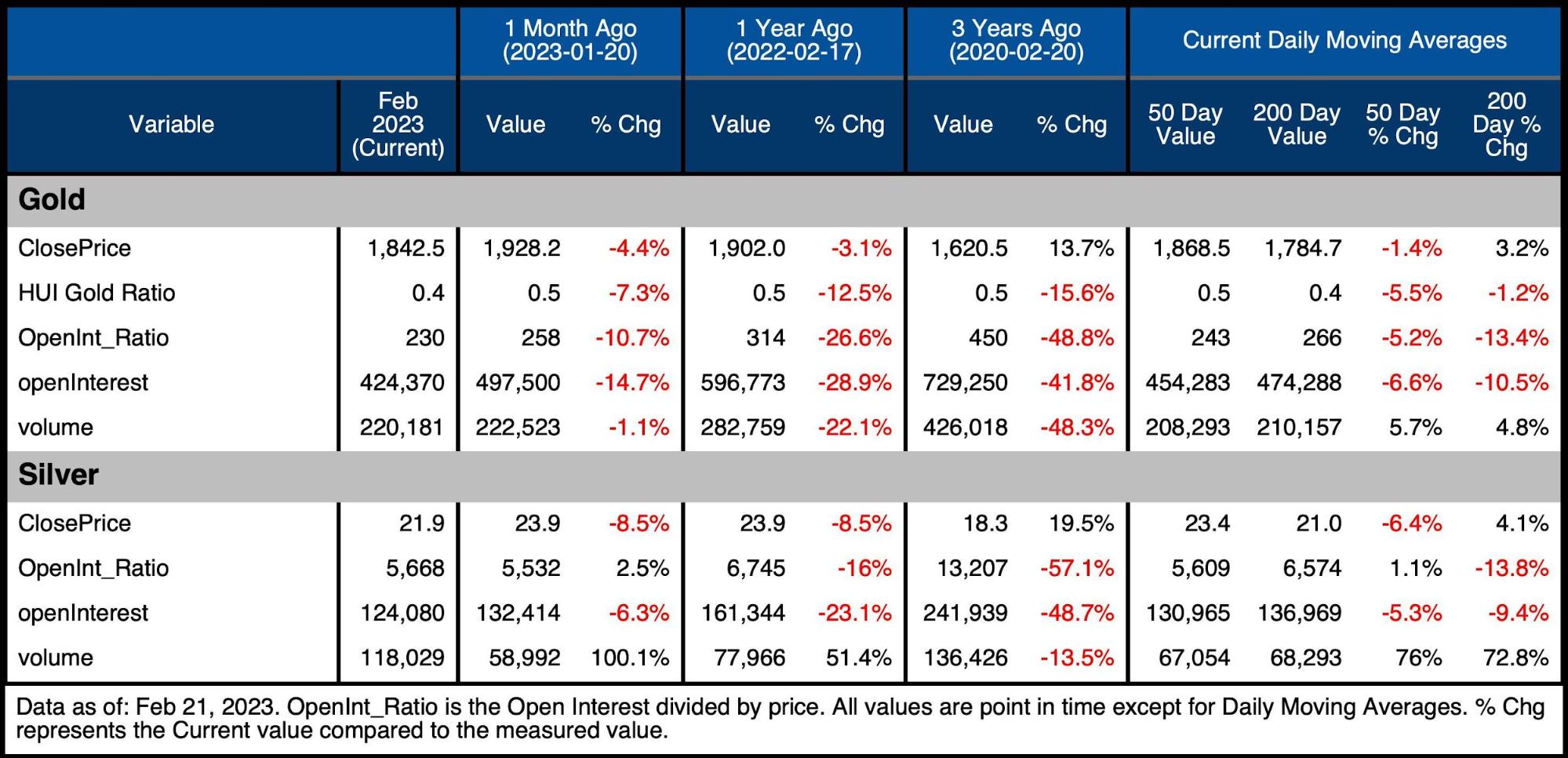

Bringing it all together

The table below shows a snapshot of the trends that exist in the plots above. It compares current values to one month, one year, and three years ago. It also looks at the 50 and 200-daily moving averages. While DMAs are typically only calculated for prices, the DMA on the other variables can show where the current values stand compared to recent history.

-

- Open interest is down almost 15% in gold since last month

-

- It is also below the 50 and 200 daily averages

-

- The HUI ratio fell over 7% since last month

- Silver is also seeing relatively low open interest despite a spike in volume

- Open interest is down almost 15% in gold since last month

Figure: 12 Summary Table

Wrapping up

Any short-term traders in the precious metals have gotten beaten up badly over the last few years. The markets have been moving up and down with no clear sustained momentum in either direction. As soon as the longs see $2000 and think they are set for clear selling, they get smacked down. Similarly, the shorts have been unable to push the prices lower despite all the hawkishness by the Fed.

Theoretically, the current environment should be very bearish for gold and silver. But the markets clearly do not fully believe the Fed.

As noted above, the data has been pretty clear about moves recently. Currently, the data is very mixed with bullish, bearish, and neutral indicators. This can be frustrating. If I had to make a prediction that was not “it could go either way”, I am thinking the market is stuck in neutral for a few weeks and then finds a catalyst to move higher. Holding $1800 is key. If it drops below $1800 then that becomes firm resistance which will use up a lot of the longs firepower on the next up-move.

Thus, I am reading this as a healthy correction unless $1800 falls but I also do not see an imminent move higher through $1900.

Data Source: https://www.cmegroup.com/ and fmpcloud.io for DXY index data

Data Updated: Nightly around 11 PM Eastern

Last Updated: Feb 21, 2023

Gold and Silver interactive charts and graphs can be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/goldsilver/

More By This Author:

How Government Spending Messes Up The Economy

Total Household Debt Charts Biggest Rise In 20 Years

Upward CPI Revisions Further Undercut Disinflation Narrative