Gold And Silver Technical Outlook: Modest Gains In The Cards?

Gold Short-term Technical Outlook - Neutral

There is a growing chance that gold may be forming a short-term floor and could rise toward the upper end of the recently established range.

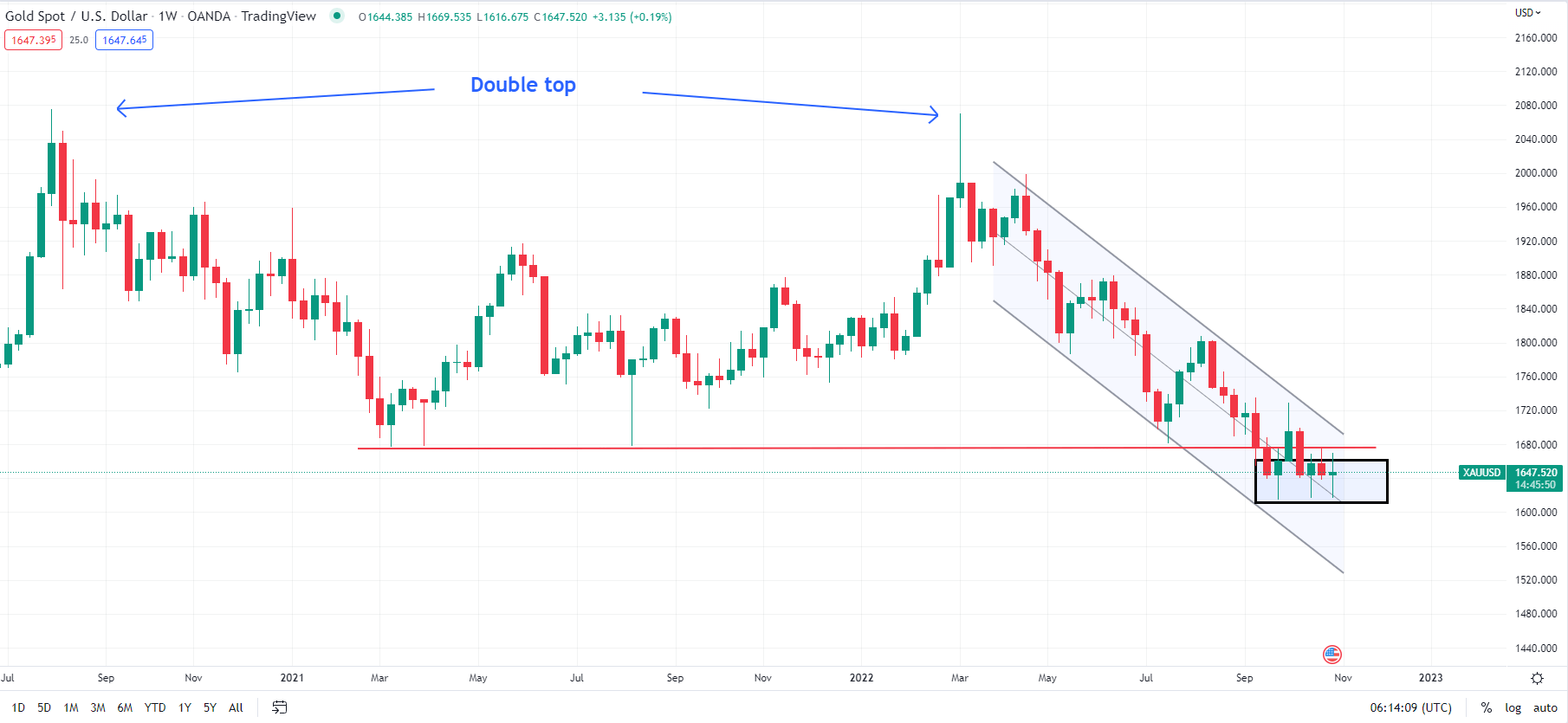

In recent weeks, XAU/USD has struggled to break below the horizontal trendline from 2021 at about 1675-1680, roughly coinciding with the 200-week moving average. If the yellow metal closes this week around the current level, it would be the third back-to-back long-legged candle on the weekly charts, implying support at lower levels not too far from 1675-1680 (see chart).

XAU/USD Weekly Chart

(Click on image to enlarge)

Chart Created Using TradingView

However, XAU/USD needs to break above immediate resistance at the end-October high of 1675 at minimum for immediate downward pressure to fade. That’s because the stalling of the downtrend recently could also be interpreted as a digestive pause before gold embarks on its next leg lower.

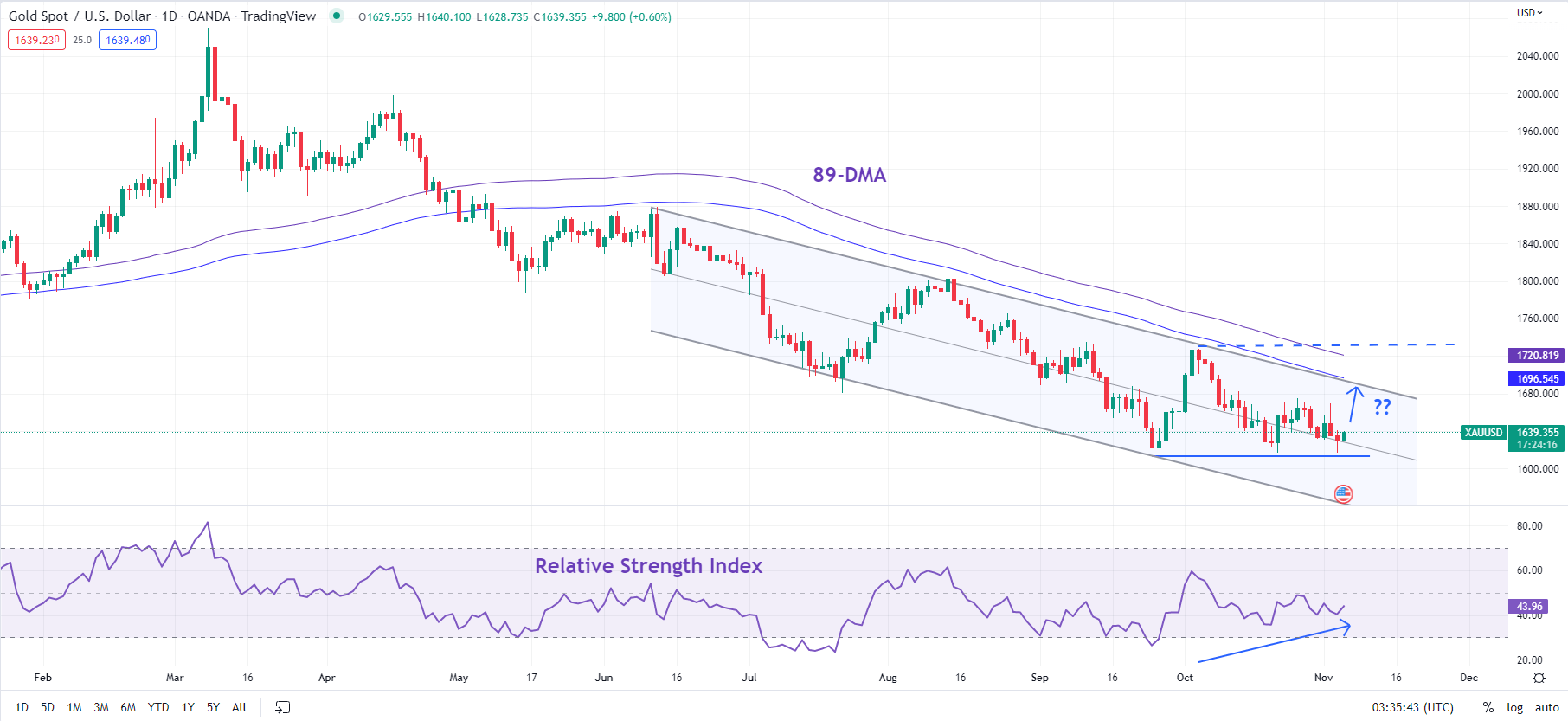

Any break above 1675 could push the metal towards a stiff barrier on the upper edge of a falling channel from June, roughly coinciding with the 89-day moving average. This combined resistance has capped rallies in recent months (see chart). There is a stronger hurdle at the early-October high of 1729, which could be tough to crack as the trend on longer-term charts remains bearish.

XAU/USD Daily Chart

(Click on image to enlarge)

Chart Created Using TradingView

Silver Short-term Technical Outlook - Neutral

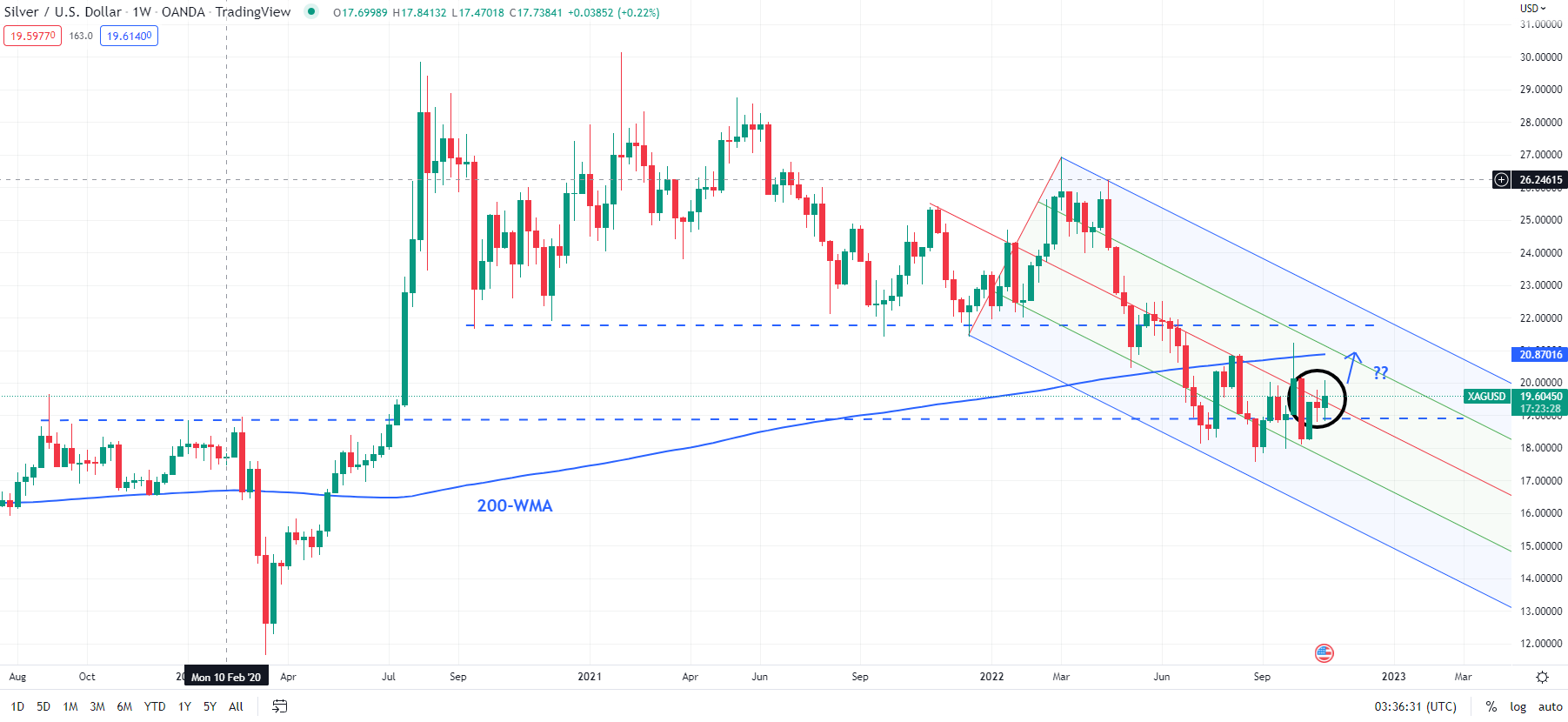

The setup on the weekly charts for silver appears to be like gold, albeit of longer duration than the yellow metal. Since July, XAG/USD has been hovering in a 17.50-21.25 range, holding above horizontal trendline support from 2019-2020 highs, and with the 200-week moving average capping the upside.

XAG/USD Weekly Chart

(Click on image to enlarge)

Chart Created Using TradingView

Like gold, XAG/USD could be gearing up for a modest rise toward the top edge of the range in the near term. In recent days, it has repeatedly tested and failed to break above the immediate barrier at last week’s high of 19.80. A decisive breach above that resistance could push XAG/USD toward 21.25, close to the 200-day moving average (now at about 21.50).

Beyond the short term, however, the balance of risks is tilted toward the downside. There is tough resistance at 21.25-21.50 (including the 200-day moving average), and silver would need to break above this resistance for the medium-term downward pressure to fade.

More By This Author:

Gold Prints a Triple Bottom, NFPs Could Cap Further GainsCrude Oil Forecast: Brent Surges On Weaker USD As NFP Takes Centre Stage

Bitcoin Price Outlook: BTC/USD Bounces Back Despite a Strong US Dollar