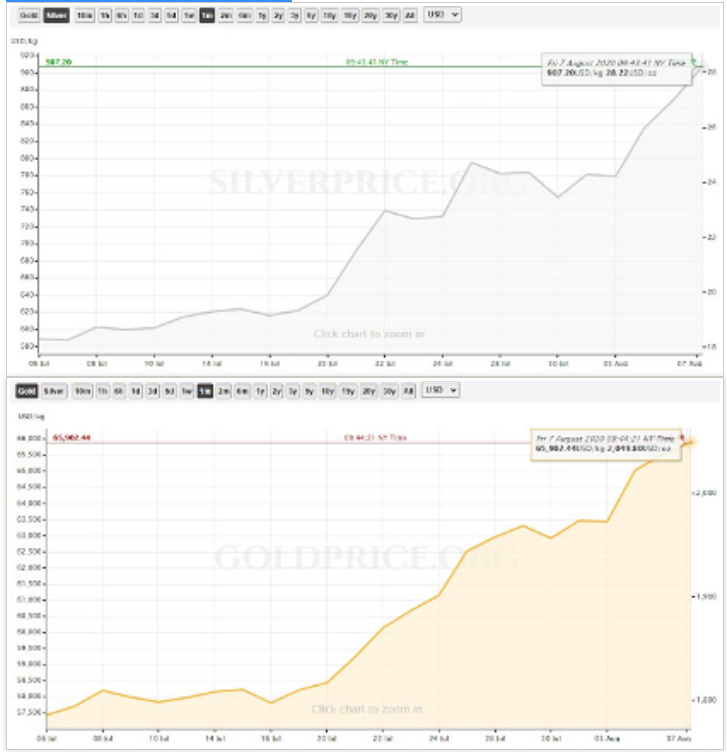

Gold And Silver Experience Stunning Gains, More Catalyst Coming

Gold and silver just experienced a stunning week, in which they surged higher based purely on real, solid fundamentals—and truly spectacular gains are yet to come.

This stands in stark contrast to the truly mind-boggling actions seen over the last few years in the broader markets, whose gains were largely based on illusions, huge injections of fiat money, debt creation, and all-around tomfoolery.

It is going to take time for people to adjust to this reality, to understand that the rally in both gold and silver bullion is based on overwhelmingly strong fundamentals, as it has been so long since the financial world has operated in such a manner. However, once this change in mindset occurs, we will experience one of the greatest bull markets this world has ever seen, with precious metals taking off to what some would believe unobtainable levels based on today's pricing.

(Click on image to enlarge)

(Chart Sources, goldprice.org)

This week’s trading action in the metals was a just a sample of what is to come. Both metals leaped to new levels, as I predicted they would after breaking through key resistance levels just a few short weeks ago, carried higher first by true fundamentals, then propelled even further by the Wall Street algorithms, with both feeding upon the other in a revolving cycle.

However, as stated last week and as we are seeing in today's trading action, pullbacks will occur, and this is a good thing. We do not want a runaway breakout, a straight up parabolic rise such as we saw during the Bitcoin mania, as that leads to weak hands and an inevitable crash lower.

A steady, healthy increase higher with new "floors" being set is what we want to see, as that will ultimately result in longer-term, more sustainable gains, with more stronger hands staying with precious metals as they inevitably climb higher.

This pullback in precious metal prices comes on the heels of a strong payroll numbers report, as 1.76 million jobs were added according to official reporting by the Bureau of Labor Statistics.

However, this data is lagging and may be short-lived, as already more and more states are imposing renewed lockdowns due to the resurgence of COVID-19 in many locations.

Even so, a return to a strong workforce, which is coming, will not change the fundamentals for precious metals in a meaningful way in the long term, as the historic amount of debt creation and fiat money printing that we have experienced since the pandemic began is not simply going to erase itself.

(Click on image to enlarge)

(Chart Source, Federal Reserve)

This newly created "money" is out there and is not going away. Gold and silver bullion are accounting for this, and they are ultimately going much higher as a result.

This will not change. It will only accelerate as we move forward and more and more institutional investors join the ranks of Central Banks, buying gold hand over fist, hopping aboard the train, hoping to ride the strong fundamentals of precious metals higher until a true blow-off top occurs.

The Next Catalyst For Precious Metals Moving Higher

Another upcoming event that I keep pointing out—and which many are simply discounting—is the extreme unrest within the United States that is coming in November of this year, following the results of the presidential election.

The DNC seems hell-bent on sending Joe Biden out to a massacre, which is baffling a large amount of people on the left, right, and those staunchly in the center, which I consider myself a part of.

This is even odder given the fact that the Democratic party’s campaign strategy seems purely "orange man bad", choosing to hide Biden from the public eye almost entirely, likely due to the fact that when allowed to speak, he appears disoriented and confused, showing, as many have pointed out, clear signs of cognitive decline.

This is made even more concerning given the fact that Biden himself has stated that "he is being constantly tested"—which is an odd thing to say—but yet will not release the results of those tests, as previous presidential candidates have done.

Even the mainstream media, which predominantly hates Trump, has started to take notice and point these issues out.

I personally don't agree with everything President Trump has done or stated while in office. However, I cannot see how Joe Biden is expected to go toe to toe with President Trump on the debate stage without it resulting in a complete disaster for the Democrats.

Perhaps this is why the DNC is attempting to get the number of Presidential debates reduced, while the RNC is looking to get more debates scheduled.

Even though the official polls have Biden leading slightly over Trump if the election were to take place today, as we saw in 2016 elections, these polls are far from accurate and typically are skewed towards the candidate who is deemed "socially acceptable” in the mainstream narrative’s eyes. Given the fact that many believe they cannot openly voice their support for President Trump or risk being ridiculed, persecuted, or worse, his support is likely undercounted.

Unless the DNC throws Biden under the bus by nominating a different candidate of their choosing (forgoing the primary results is something they can actually do, although unlikely), then I believe it very likely that Donald Trump will win re-election by a slight margin, leading to one of the most contested elections ever, given the current circumstances within the United States and given the fact that many states are choosing to go the mail-in ballot route.

This will lead to massive unrest and social upheaval regardless of who wins, as I believe neither the far left nor the far right will simply accept the results at face value.

Chaos will be the name of the game, with precious metals moving higher to adjust and account for this increased risk to the system, adding even further to an already rapidly-accelerating bull market.

Don't believe me? Just wait and see. Time will reveal all.

Until then, stay safe and as always, keep stacking.

Disclaimer: The views and opinions expressed in this material are those of the author as of the publication date, are subject to change and may not necessarily reflect the opinions of Sprott ...

more

Thanks for the article. Of course gold and silver are taking off. They are proven to be what is stable in uncertain and unstable situations, and both would be considered "crash proof" in that their value is more resistant to management errors and market emotional disturbances.

As for our presidential candidates, once again I assert that one more choice should be available, being :"NONE of the above". That would be a vote rejecting all of the presented choices, not merely an abstention from making a selection.

This time I doubt that Mr Biden would be capable of adequate governance for the full four years, and my concern about Mr Trump is that he is no longer able to control his mouth or his tweets. The random proclamations are dangerous and often inflametory.

I think that starting a war of any kind with either China or Russia would be far more damaging to the USA than the terrible explosion disaster in Lebanon. It would not matter who won or could be considered the most undamaged survivor. Thus a better choice than either of the present ones is needed.

Well said and many thanks