Gold And Silver: A Lot Of Pressure Is Still Visible

Image Source: Unsplash

- During the Asian trading session, the price of gold moved in the range of $1735-1745.

- The price of silver yesterday fell to its four-month low at the $18.62 level.

- A solid recovery in equity markets, along with Fed expectations, should prevent traders from aggressively betting on gold.

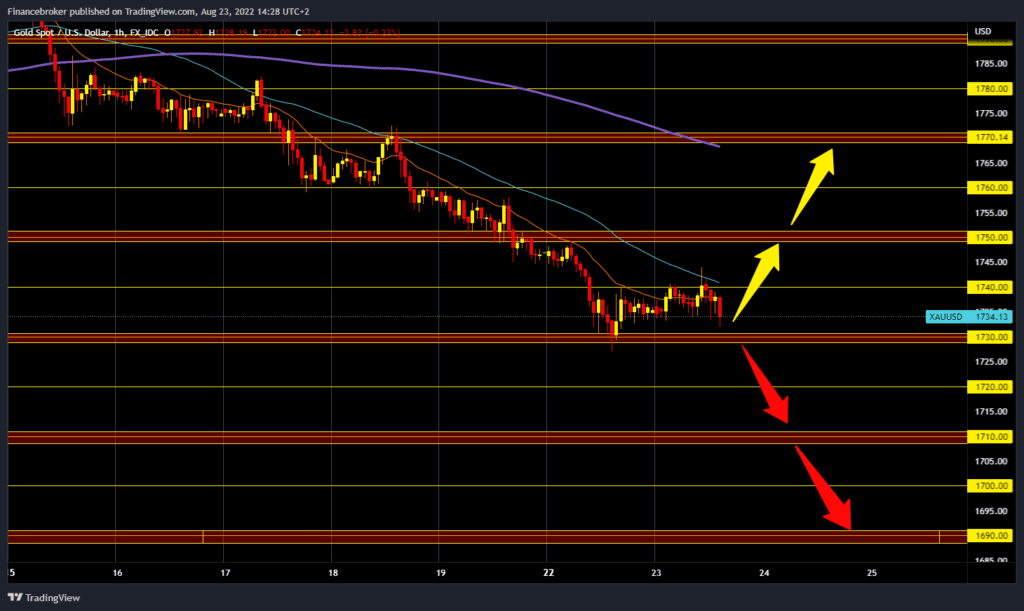

Gold chart analysis

During the Asian trading session, the price of gold moved in the range of $1735-1745. A lot of pressure on the price is still visible on the chart, and based on the current situation, we could expect a further decline in the price of gold. We need a price drop below the $1730 support level for a bearish option. After that, we could see a continuation of the negative consolidation. Our potential lower targets are $1720 and $1710 levels. We need positive consolidation and break prices above the $1740 level for a bullish option. Then we would get additional support in the MA20 and MA50 moving averages. The following important target is the $1750 level. Potential higher targets are the $1760 and $1770 levels.

(Click on image to enlarge)

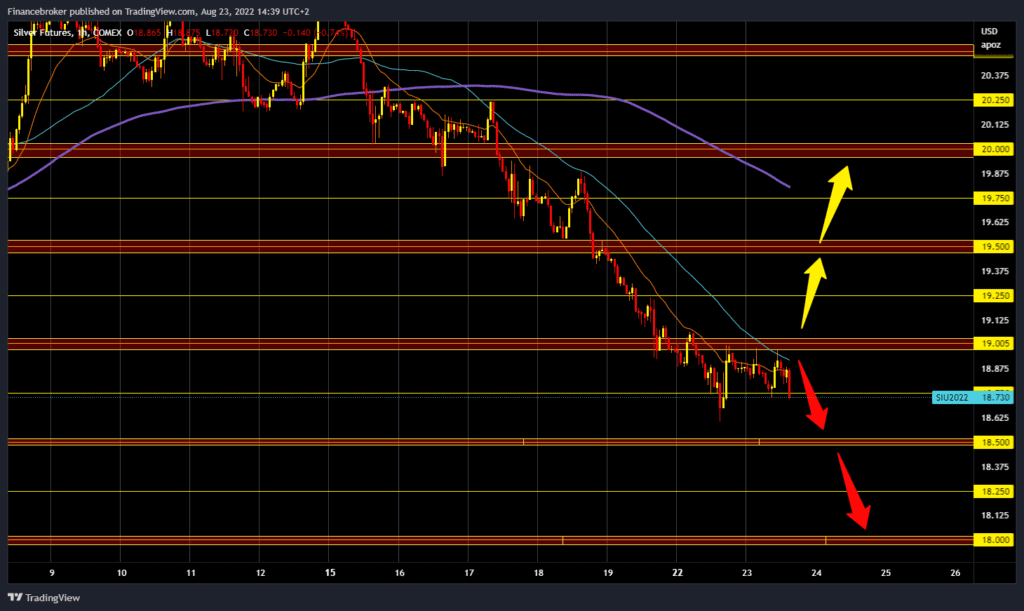

Silver chart analysis

The price of silver yesterday fell to its four-month low at the $18.62 level, then we saw a jump to the $19.00 level. Today we are moving in the $18.75-$19.00 range, but we can say that the pressure on the price is slowly increasing and that a break below today’s support and a price drop to the $18.50 level could happen. Potential lower targets are the $18.25 and $18.00 levels. For a bullish option, we need a new positive consolidation and a return of the silver price above the $19.00 level. If we succeed, we will get support in the MA20 and MA50 moving averages. After that, the price should continue to recover. Potential higher targets are the $19.25 and $19.50 levels.

(Click on image to enlarge)

Market Overview

A solid recovery in equity markets, along with Fed expectations, should prevent traders from aggressively betting on gold. Despite last week’s signs of easing US inflation, investors still believe the Fed will stick to its policy-tightening path. Such beliefs have been confirmed by recent hawkish comments from several Fed officials, which should act as a tailwind for the dollar index and US bond yields.

More By This Author:

The Dollar Reaches A Five-Week HighOil Prices Climb As A Result of Data On U.S. Oil Stockpiles

EURUSD And GBPUSD: Bearish Pressure Is More Noticeable