Gold And Silver – Buy The Dip?

Image Source: Unsplash

Bank forecasts are rising for gold’s year-end price now after the latest SVB banking crisis. Citi raises their Q2 ’23 gold price forecast to USD 1,875/oz (prev. USD 1,800/oz); Q3 to 1,900/oz (prev. 1,850/oz) and Q4 to 1,950/oz. ANZ have raised their gold price forecast to $2000 for year-end and sees very little downside risk. On Monday this week, Gold moved 2.5% higher and Silver went over 6% higher. So, what’s the appeal of gold and silver?

There are three drivers for gold and silver prices.

The first is the fall in yields.

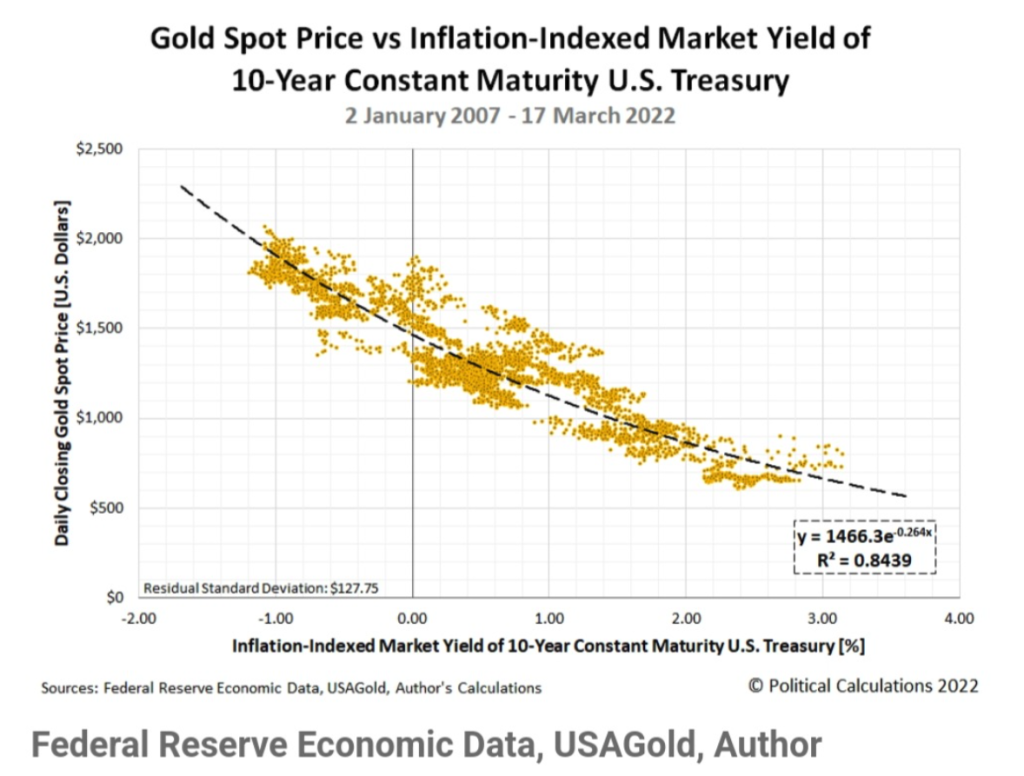

With inflation still at high levels, but the markets now expecting a Fed ‘pivot’ this would mean that real yields fall rapidly. The relationship between gold prices rising when real yields falling is strong

The second is the falling USD

A weak USD tends to be supportive of gold and silver and the rapid expectations of a Fed pivot have sent the USD sharply lower from Friday last week to start this one.

(Click on image to enlarge)

The third is the gold/silver ratio

The outsized gains for silver vs gold were flagged with the gold-silver ratio pushing back above 90.

(Click on image to enlarge)

When the ratio is high it shows that silver is trading cheaper relative to gold. A big move higher in the gold/silver ratio can often flag a large move coming. Silver could well outperform gold if the falling yields and falling USD environment remain.

The Fed meeting next week on Wednesday and traders will be keen to see whether they will start signaling a pivot in rates or not. These are uncertain times, so expect some volatility in asset classes, but the mood has turned very positive for buying gold and silver on the dips. However, the risk of more twists in the fallout from this SVB crisis remains very high.

(Click on image to enlarge)

More By This Author:

All Eyes On The NFPRBA: Why Inflation Data Will Be Key Going Forward

Is US Oil Set To Test $95?

Disclosure: High Risk Investment Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs ...

more