Gold: Adjusting To A New Paradigm

Fundamental Perspective

With the government printing massive amounts of money, tensions between the US and China rising, Europe dealing with Brexit, the effects of the pandemic continuing to spread, and tensions with Iran rising, the fundamentals for gold still look fantastic. Massive unemployment, businesses closed or failed, and people leaving some of the big cities all point to a serious economic crisis and are bullish for gold. All the trillions of dollars that have gone into the system have clearly not been enough to restore the economic system. In March, the best thing the Fed did was to act right away with a stimulus package. That action avoided a devastating sell-off of almost every asset in the markets. The Fed helped establish the confidence that it would provide a buyer of last resort for assets, which kept the market from entering a free fall.

The low made in gold in March basically said that the damage from the pandemic had been taken into account. Then, gold raced up $600 or so, which was the premium the market added in relation to the US dollar losing its purchasing power as a consequence of all of the stimulus the Fed is adding to the system.

Now, the longer the Fed waits to do something more, the more damage is being done. We expect massive bankruptcies in the financial area to begin to appear, just as retailers and companies in other sectors, such as airlines, are going bankrupt.

It is not just the United States that is facing this currency crisis. It is a crisis of all fiat currencies around the world, where governments are printing money in staggering amounts. This means that inflation is on the horizon, and it means that fiat currencies are going to be worth far, far less and, possibly, even just worthless pieces of paper. The Fed is talking about an inflation target, since it knows that the way to avoid every asset deflating is to allow some inflation. In March, every asset already collapsed. We are dealing with a completely new set of markets in a new paradigm. The entire economy has changed and will continue to change. It is hard to see any decisive steps that the Fed can take to avoid either deflation now or inflation in the near future. Main Street has already collapsed, and Wall Street may not be that far behind.

Month-over-Month vs. Year-to-Date Changes in Prices of Various Metals

Palladium: +8.5% vs. +22.8%

Copper: +6.4% vs. +10.2%

Nickel: +6.0% vs. +8.7%

Zinc: +5.5% vs. +8.5%

Tin: +3.2% vs. +5.8%

Aluminum: +2.3% vs. -1.7%

Platinum: +1.5% vs. +1.0%

Cobalt: +0.1% vs. +2.2%

Silver: -0.8% vs. +53.2%

Gold: -1.0% vs. +30.0%

Gold: Technicals

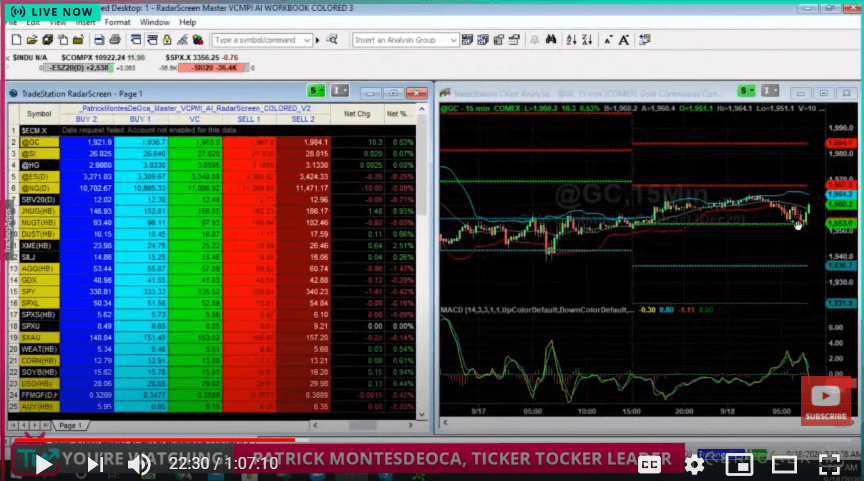

(Click on image to enlarge)

Courtesy: TickerTocker

The Variable Changing Price Momentum Indicator (VC PMI) has gold last at $1957, up about $7.50. The daily average price is $1953. The market trading above the daily average price is bullish. The target is $1967, which is the Sell 1 level. The Sell 2 level is $1984. If you are looking for a day trade, wait for the highest-probability trade, which is at the Sell 1 or 2 level. If you are a day trader, you are neutral, waiting for the market to hit Sell 1 or 2 to go short, which will give you a 90% or 95% probability of a reversion back to the mean.

The price is also trading above the weekly average of $1945 and the daily average price of $1953. The market is establishing a bullish price momentum. From a day trader's point of view, the day trading signal has not activated a trigger yet.

Swing traders had the chance to take a profit up here from the low yesterday of $1938, which was right near the Buy 1 level daily. When the price crossed the weekly mean, it brought in the bullish price momentum of the weekly signal into the daily, which brought in the target of $1960. The weekly Sell 1 level is $1978, and $2008 is the Sell 2 level.

Yesterday, the market came down into a level of support. In conventional terminology, all you know is that it is a level of support. The VC PMI then converts that information into actionable advice. Gold then activated the Sell 1 level of $1968. Then, we wait for the market to reach the highest-probability trade entry points. Sometimes you have to wait. Sometimes the market is boring, if it is trading around the mean. You want to trade the extremes above and below the mean.

Gold is moving up toward $1968 with a bullish momentum. We are in a bullish mode. Long term, we are bullish. Then, we trade the market actively short term. Occasionally, we swing trade the market. We use ETFs and stocks to hold onto our positions overnight. We do not use futures overnight given the risk of margin calls.

We do not trade the fundamentals. Even though the fundamentals have been very, very bullish, the technicals showed that the market hit a Sell level. When gold hit $2089, the fundamentals were still bullish, yet the market then corrected some from that level. Gold started the run-up from about $1450, providing a solid $600 move since March. Most thought gold would keep going up, but the VC PMI said that the price was too high above the mean and was likely to revert back to the mean, which it started to do. The monthly target was $2084, so the VC PMI was set for the $2089 high based on our August report. When gold closed below that level, it activated a bearish trigger, which is where we are now. Gold came down to the average price of $1979. Now, we are trading below the average price.

For the monthly now, the Buy 1 level is $1869 and Buy 2 is $1764. $1979 is the average monthly price. The market trading below that average price means we have a bearish monthly price momentum. Even though we are looking at a short-term rally based on the daily, the target is $1979 for the monthly.

Summary

- The monthly trend momentum of 1733 is bullish.

- The monthly VC PMI of 1979 is bearish.

- A close above 1979 stop, negates this bearishness neutral.

- If long, take profits 2084-2194.

- If short, take profits 1869-1764.

Disclosure: I am/we are long DUST.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold and silver, check us out on more