Gold $3k Target Hit! Now, Look For Miners To Do This

Image Source: Unsplash

It’s been a remarkable run to the historic $3,000 level in gold...but it hasn’t been quite as carefree as the charts might show. It’s often said that “A bull market climbs a wall of worry” but this gold bull has seemingly climbed a “cliff of concern” amongst oft-beaten gold investors. Now, start your due diligence on the best of the junior mining stocks.

Given their history with the yellow metal, it’s no surprise that gold bugs are always wary of getting slammed once again by the markets. I understand the feeling completely, being a gold bug myself.

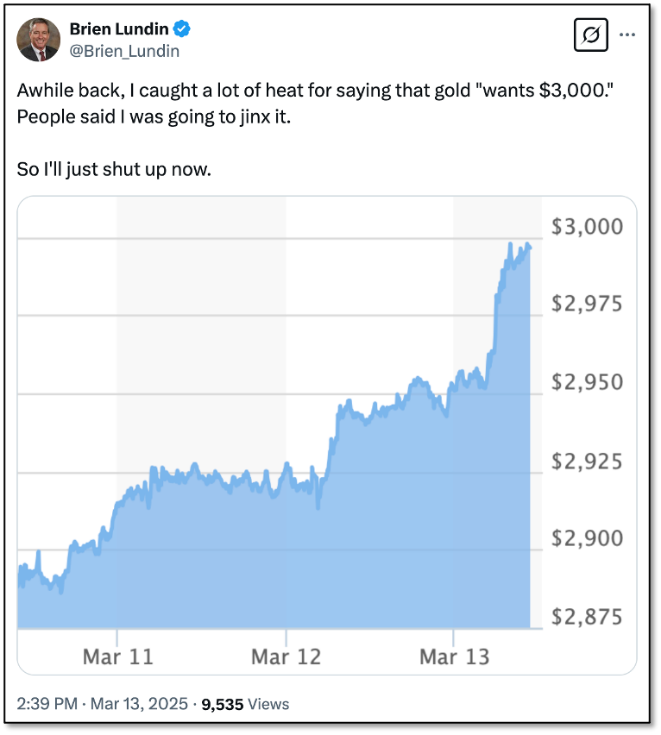

Yet I was fairly confident a while ago that gold had its sights set on $3,000. And I said so quite publicly...with a mixed reaction from investors. Here’s what I posted on X last week just as gold approached $3,000.

It wasn’t long after that post that gold hit the magical $3,000 level on a futures basis, and then even on a spot basis intra-day. That prompted some wags to post that I should start saying “Gold wants $4,000!”

In short, with gold subsequently gaining room above $3,000 on a futures basis and oscillating around the big number on a spot basis, it seems that few are concerned about a jinx.

What’s most encouraging right now is the fact that the gold equities are beginning to respond. And it’s not only the major gold producers that are moving higher. I can tell you that one after another of the junior mining stocks in our Gold Newsletter portfolio are breaking out to the upside.

It’s a remarkable opportunity. In fact, I’ve maintained that it’s a generational opportunity the likes of which we haven’t seen since 2000.

I can’t stress enough the urgency of this situation — and the scope of the opportunity. Back in 2000, and the beginning of that amazing 11-year run in metals and miners, both gold and the mining stocks were at bombed-out levels. It took remarkable courage and conviction to not only believe that gold was headed to record levels, but that the miners were as well.

Today’s situation is much easier. Gold is already at record levels...yet the miners have yet to truly respond. This is easily the most compelling market environment that I’ve seen in four decades in this sector.

More By This Author:

SPX: Why We're Lowering Our TargetsS&P 500: What Past Post-Inauguration Patterns Tell Us About 2025

What Separates Winning Traders From Losing Ones

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more