Gold & Silver Selloff Continues After CPI Predictably Comes In Hotter Than Last Month

Image Source: Unsplash

Both gold and silver prices fell lower on Tuesday.

The prices of each metal were already sinking coming into the New York session, and continued to fall after the CPI showed that the government's best attempt to measure the rate of price increases over the past month came back with a higher rate than the previous month.

The gold futures declined $28 to $3,330.

And the silver futures fell another 76 cents down to $37.98, after reaching a new cycle high of $39.57 in early Monday morning trading.

Not entirely surprisingly, the dollar index was up again on the day, rising to 98.30, and continuing its rebound from its 96 low earlier this month.

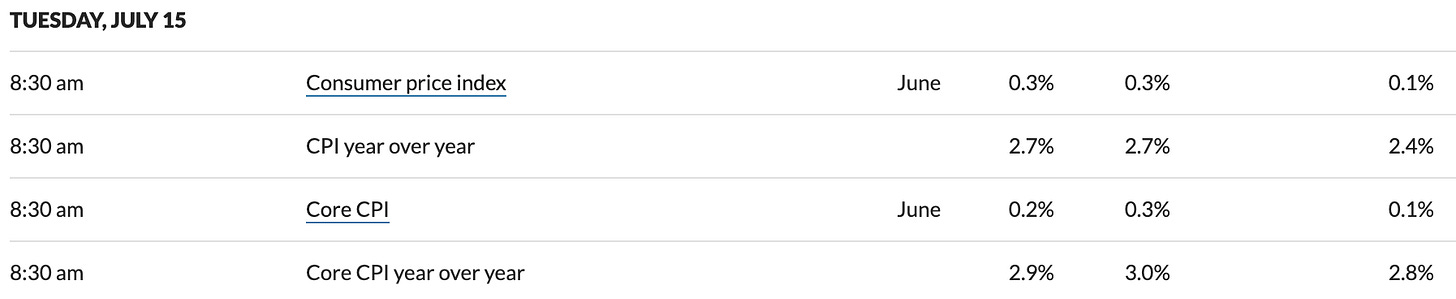

Also not a surprise was that as mentioned earlier, the CPI rose relative to May.

Year over year CPI came in at 2.7%, vs. just 2.4% last month, while core CPI came in at 2.9% vs. 2.8% the previous month.

The reason this was rather predictable, was that over the past month while President Trump has been berating the Fed’s Jerome Powell and saying that he should lower interest rates because there's ‘no inflation,’ I've mentioned how all of the government inflation metrics are still running well in excess of the Fed’s alleged 2% mandate.

More By This Author:

Silver Makes A Run At $40 Before Selling Off, As New Tariffs Are AnnouncedSilver Futures Break $38 For the First Time In 13 Years, And Then Break $39 A Few Hours Later

Silver Reaches Highest Level Since September Of 2011