Gold & Silver Sell Off After This Week's Furious Rally

Image Source: Unsplash

The precious metals selloff finally arrived on Thursday after a furious rally to start the week. Although don't start your weekend early, because we still do have the latest labor report coming out tomorrow morning.

The gold futures were down $35 to the $3,600 level.

Meanwhile, the silver futures gave back 74 cents to trade down to $41.32.

As I've mentioned during previous rallies this year, any time the prices move as quickly as they have in the past week, a correction becomes a higher probability. Tomorrow's labor report will have a lot to do with whether the selloff continues or if there is a rebound on Friday.

But given that last month, Trump fired the commissioner who compiled the data after the numbers came out too low, there's probably a skewed probability towards this month's labor report looking better, regardless of whether that's any reflection of reality or not.

There was an interesting note from my dear colleague Vince Lanci of Goldfix about the latest gold commentary from Goldman Sachs.

Goldman suggested that gold could trade near $5,000 per ounce if the perceived independence between the White House and the Federal Reserve was infringed upon. Although it's somewhat confusing to me why the word ‘if’ was used here, given that the Trump administration has made it pretty clear over the past few months that they're going to find a way to get what they want.

Yet nonetheless, here's Goldman’s comment.

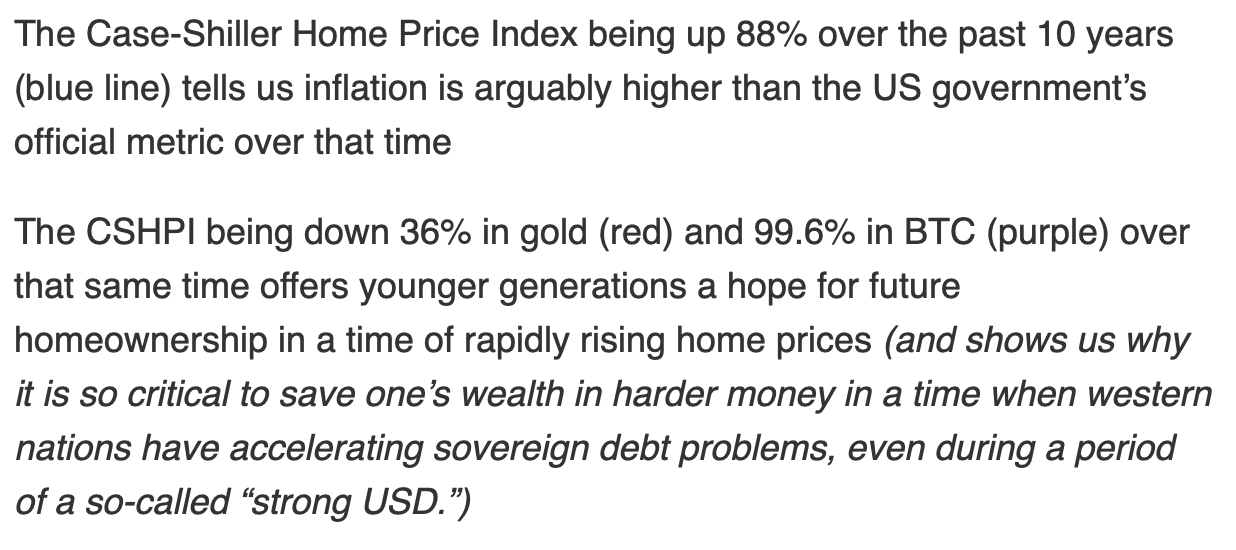

Luke Gromen passed along the following note to his email list last week, which addresses one of the more common inflation questions. In that, one of the criticisms of gold and silver investors has been that despite a decade of easing out of the Fed, consumer inflation never rose as much as many suggested it would.

Although what often gets missed is that a large portion of this inflation went into the real estate market (along with the stock markets and the government bond markets).

Today's column is perhaps a little shorter than normal, as after mentioning it several times over the past few months, the silver report I've been writing has been completed, and I’m working to get it out tomorrow afternoon in this column (if you’re reading this but are not yet a subscriber, you can sign up here for a free or paid account which will allow you to access the report when it’s released).

But one last note is that with the labor report coming up in the morning, I did post a video today where I talked with Greg Crennan of Golden Coast Consulting about the labor picture, what to expect, and how that will affect the precious metals pricing.

So all eyes will be on that report tomorrow, and that will have a big part to do with how the gold and silver prices finish out what has been a rather historic week. And I'll look forward to checking back in with you in the afternoon.

More By This Author:

One Day After Silver Futures Break $41, Then They Break $42 On More Tariff ConfusionGold Futures Rallied To Over $3,600 Even In The Face Of Dollar Rally

After Silver Futures Broke $40 For First Time In 14 Years, They Break $41 A Few Days Later