Gold & Silver Rebound After Weak Labor Report, And Then Trump Fires The Woman In Charge Of Compiling The Data

Image Source: Pixabay

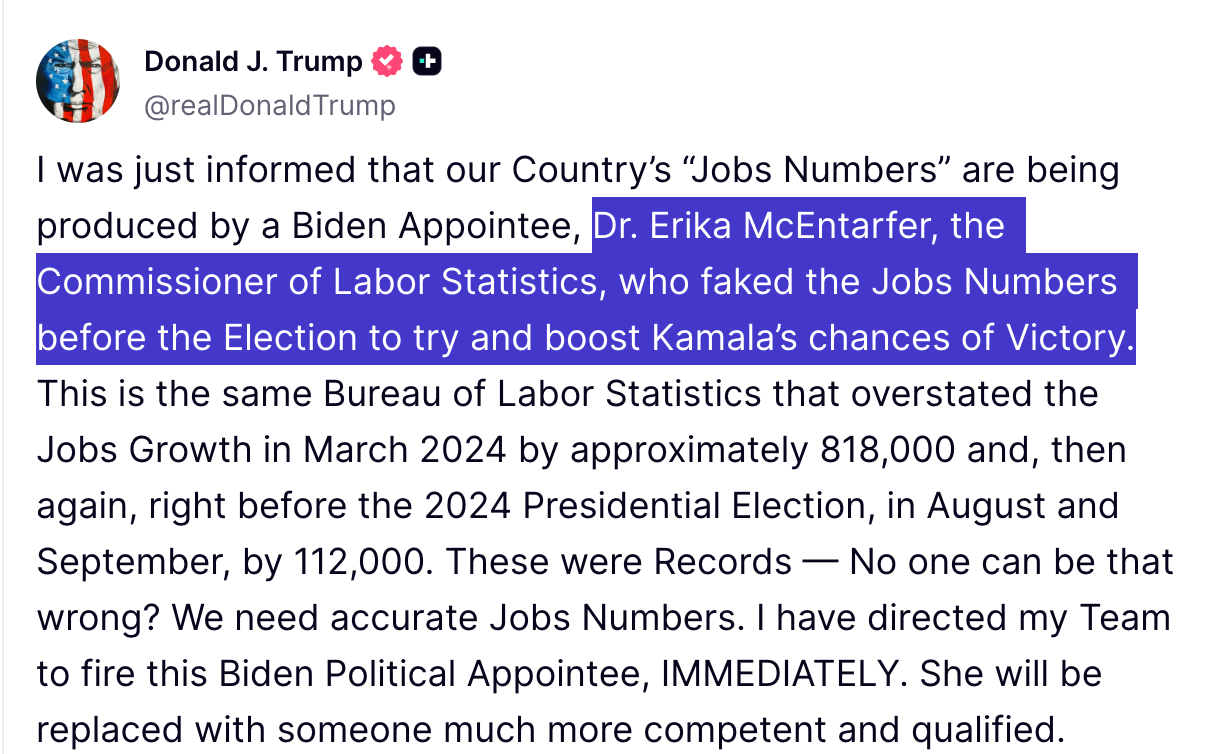

Well, just when you start to think you've seen it all, the president fires the person responsible for collecting the labor data after the number comes in lower than expected.

As all of this was going on, and certainly after this morning's weaker-than-expected labor report was released and stated that only 73,000 jobs were created in July, gold and silver have been rallying, with gold making the bigger move on the day.

The gold futures rose $67 to $3,415.

The silver futures are 39 cents higher to cross back over the $37 level to $37.10.

In the video I shared in yesterday's column with metals and mining analyst Lobo Tiggre of Independent Speculator, we talked about how the Trump administration may at this point be overwhelming the impact that the Fed still has on the precious metals.

We were talking more specifically in regards to Trump's reshoring agenda, although who would have guessed that just a few days later, Trump would be firing the head of the Bureau of Labor Statistics.

Now, if you've been following the precious metals for any period of time, you're likely already well familiar that all of the government data should be taken with multiple grains of salt. Who knows... maybe even a full salt mine is truly required.

Craig Hemke of TF Metals, in particular, as well as many other authors on Zero Hedge, do a great job each month of pointing out the discrepancies between the government numbers and reality. These include a lot of adjustments and often have the effect of presenting the data in a manner that looks a lot more appealing from a political standpoint.

So for Trump to come out and say that the numbers are basically useless isn't entirely incorrect. Although at the same time, I'm guessing if the numbers had come in above today's expectations, he would not have had the same issue with Dr. Erika McEntarfer.

But at a time when much of the financial world is already feeling anxious about the perceived lack of an independent barrier between the White House and the Federal Reserve, this latest news seems like a significant step. Because I'm guessing whoever replaces the old commissioner is probably going to be producing numbers that are more in line with what Trump thinks they should be. Which means that now the president is taking an action to alter the labor data.

But ultimately, it's just another brick in the wall that has left countries increasingly wondering whether to continue using the US Treasury as a reserve asset, or turn to gold. And while perhaps what happened today doesn't leave you or I with the greatest confidence in the way this system is constructed, at least you were probably hardly shocked by the news, and can rest easily knowing that you've prepared accordingly.

One final note is that the silver short position held by the banks actually did decrease by 693 contracts over the past reporting week to a net short position of 48,707 contracts. Which is not far off from the all-time record, and means that the short position is still on the high side right now. Although there's a good chance it comes in a bit further next week, given that the banks likely did a fair amount of short-covering on the sell-off that occurred on Wednesday and Thursday.

But now go out and have a great weekend, and I'll look forward to checking back in with you on Monday.

More By This Author:

Gold & Silver Mixed After Wednesday's Sharp Fed-Day SelloffHow Trump Reshoring Plan Impacts Gold & Silver, Regardless Of What The Fed Does

Gold & Silver Get Clobbered Before The Fed Meeting, & Then Again After It