Gold & Silver Rally Again In Volatile Pre-Holiday Session

.webp)

Photo by Zlaťáky.cz on Unsplash

The gold and silver prices are rallying again on Tuesday morning, although a sell-off over the past hour has brought them off their peaks.

The gold futures are up $5 to $4,475 after earlier reaching another new all-time record high of $4,530.

The silver futures are currently up 98 cents to $69.54, and the high of the day, and of all time, is now $70.79.

I mentioned yesterday that I would comment further on the impact of silver being confirmed as a strategic critical mineral in the US, despite there not being a big move in the price on the day that was announced.

I thought that was more likely to be the type of event where developments play out and have their price impact over time, and here’s what I wrote back on November 16:

However, what will impact the pricing on a longer-term basis, at least on the silver side, is something that you’ve probably heard about already, yet I get the sense that it’s the type of thing that doesn’t get priced in fully immediately. And what I’m referring to is the confirmation of silver as a critical mineral.

Yes, that was announced last week, so it’s been out there for a couple of days now. Although, as was discussed at the Silver Institute dinner last night, the market is still awaiting clarity on the Section 232 report regarding the tariff treatment that silver could receive.

So on one hand, there are still layers to the situation that have not yet been finalized. But from a bigger picture perspective, I get the feeling that this news is something that people saw and registered, but probably won’t fully grasp until we’re a few months deeper into the actual impact of the policy.

The meeting with leaders of Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan came as Washington seeks to expand its influence in a resource-rich region long dominated by Russia and increasingly courted by China. Trump called Central Asia “an extremely wealthy region,” saying he wants to make America’s partnership with the five countries stronger.

“One of the key items on our agenda is critical minerals,” Trump said. “In recent weeks, my administration has strengthened American economic security by forging agreements with allies and friends across the world to broaden our critical mineral supply chains.”

Since then, China has also announced that they will begin restricting silver exports in 2026, and I think these developments have a lot to do with what’s happening with the silver price right now.

Luke Gromen also shared a link to the following piece about how one author believes the shortages of critical minerals will have to play out in the years ahead, and if his thesis is even close to being what actually ends up happening, that would further support the view that we’re still in the early innings of seeing the impact of silver being recognized as a strategic mineral in multiple areas around the globe.

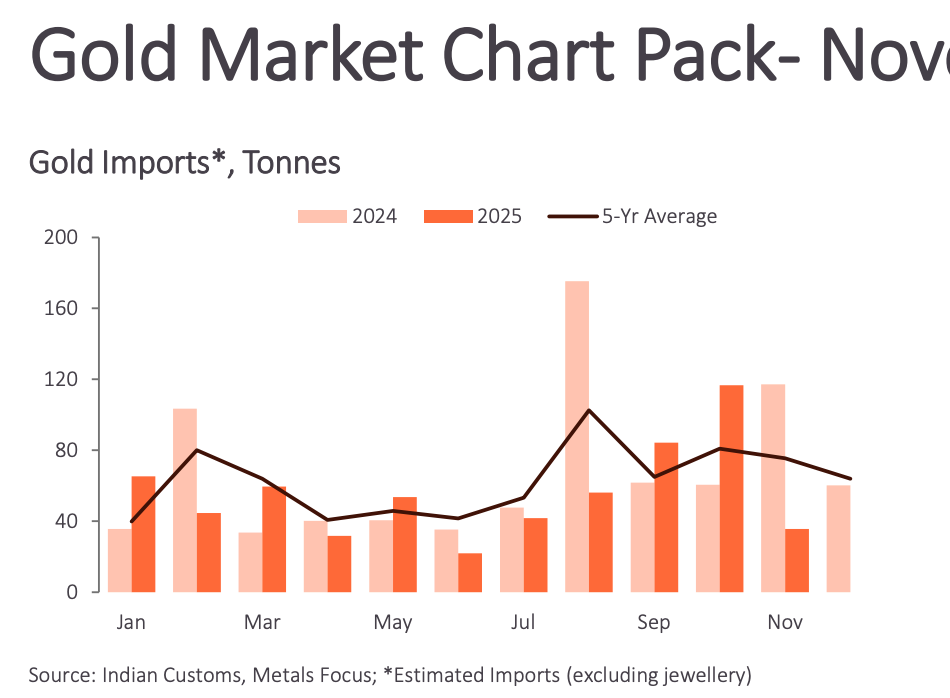

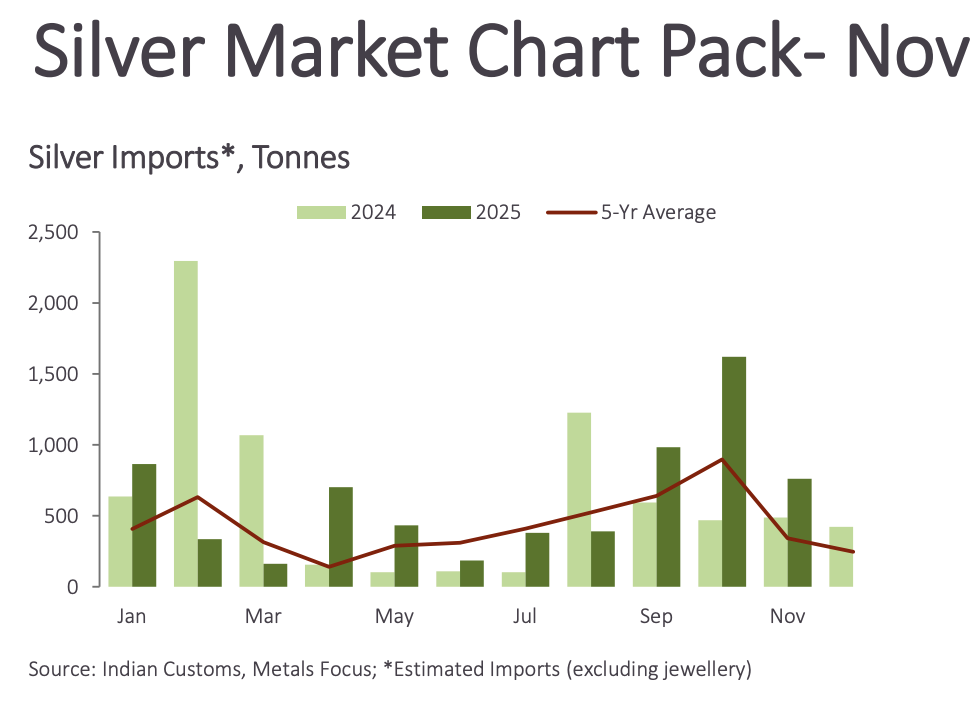

The latest Indian gold and silver import figures came out this morning, which included November’s data, and you can see that while November still had significant flows into India for both metals, they were lower than the surge of the previous two months.

Lastly, given the way the metals have rallied so rapidly over the past few weeks, it would suggest that there’s an elevated probability of a correction on the way at some point. Which doesn’t necessarily change anything that’s happening now, or with the longer-term trajectory of the metals, although it’s still something just to keep in the back of your mind.

But that hasn’t happened yet, and as the markets get set to go into holiday mode, hopefully you’re just enjoying another day of this historic time period in the gold and silver world.

More By This Author:

Silver Goes Into Backwardation As Price Breaks $70Even Wall Street's Starting To Recognize Silver As 'Safe Haven Asset'

Gold And Silver Get Big Boost From New Pension Change In India