Gold & Silver Rally Again, But The Real Story Is The Bond Market Collapse

Image Source: Unsplash

If it was actually possible, the reversal in the gold market this week may have made up for last week’s decline and more. As the gold futures surged again today, with the price up $67 to $3,244.

(Click on image to enlarge)

Silver had another big day as well, up $1.15 to $31.91.

(Click on image to enlarge)

Yet perhaps even more significant is what we’re seeing happening in the bond market.

Because previously, the bond market was rallying as money was fleeing out of stocks. Yet yesterday, and again today, the bond market sold off sharply, even as the stock market was declining (at least until the end of the day rally - that actually reminded me a lot of my option trading floor days back in 2007).

So if investors are selling stocks, and they’re not reallocating that money into bonds, where exactly is it going?

Well….there's a reason why the precious metals are rallying right now. And perhaps what’s even more intriguing is that now some of the mainstream banks are talking about how ‘we are entering unchartered territory in the global financial system.’

I know there’s a tendency for gold and silver investors to think that the system is headed towards a complete breakdown. And over the longer-term, it does seem like something like that is in our future. Although I’m often reluctant to say that it’s happening tomorrow. Yet when you start hearing even big name banks like Deutsche Bank make comments like that, it does make you start to wonder just how close we might be to something similar to 2008 or 2020.

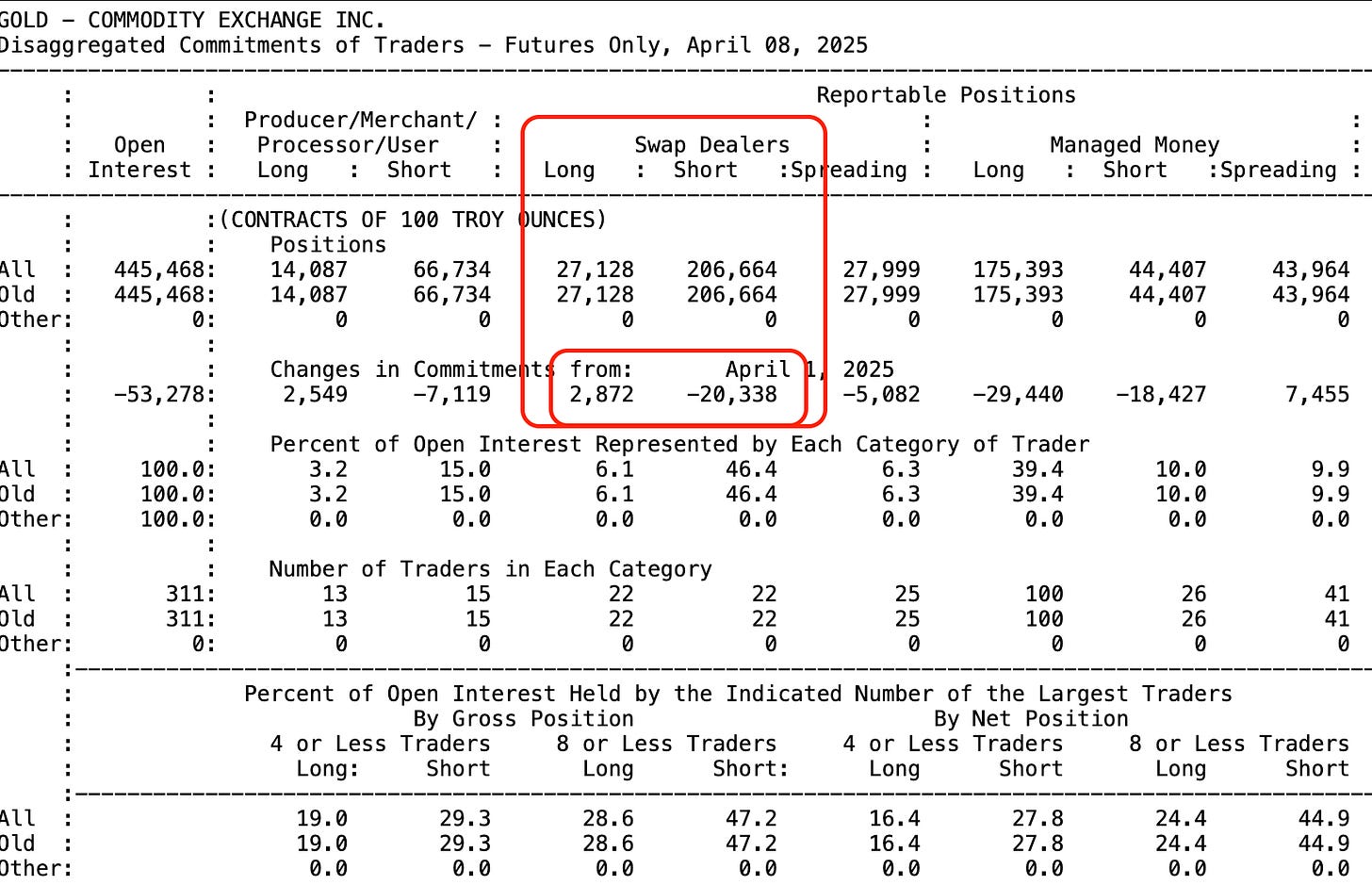

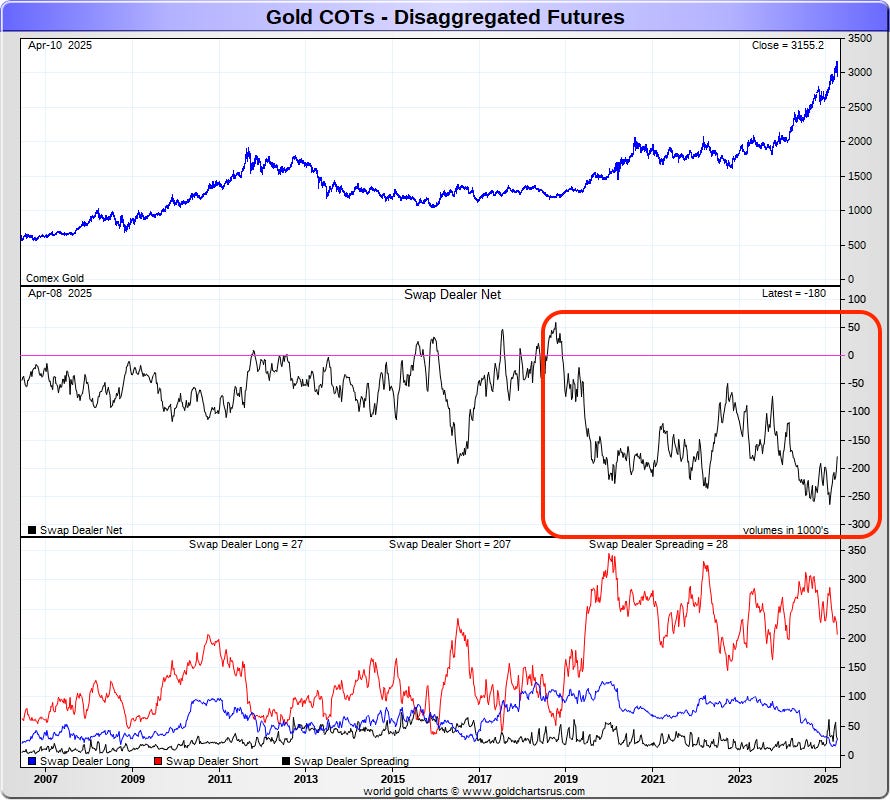

Also, I’ve mentioned all week that I was looking forward to seeing how many gold and silver shorts the banks covered during last week’s selloff, and finally the data is in.

On the gold side, the banks reduced their short position by 23,210 contracts to a net short of 179,536.

(Click on image to enlarge)

Here you can see in the middle row the reduction in the bank gold short position.

(Click on image to enlarge)

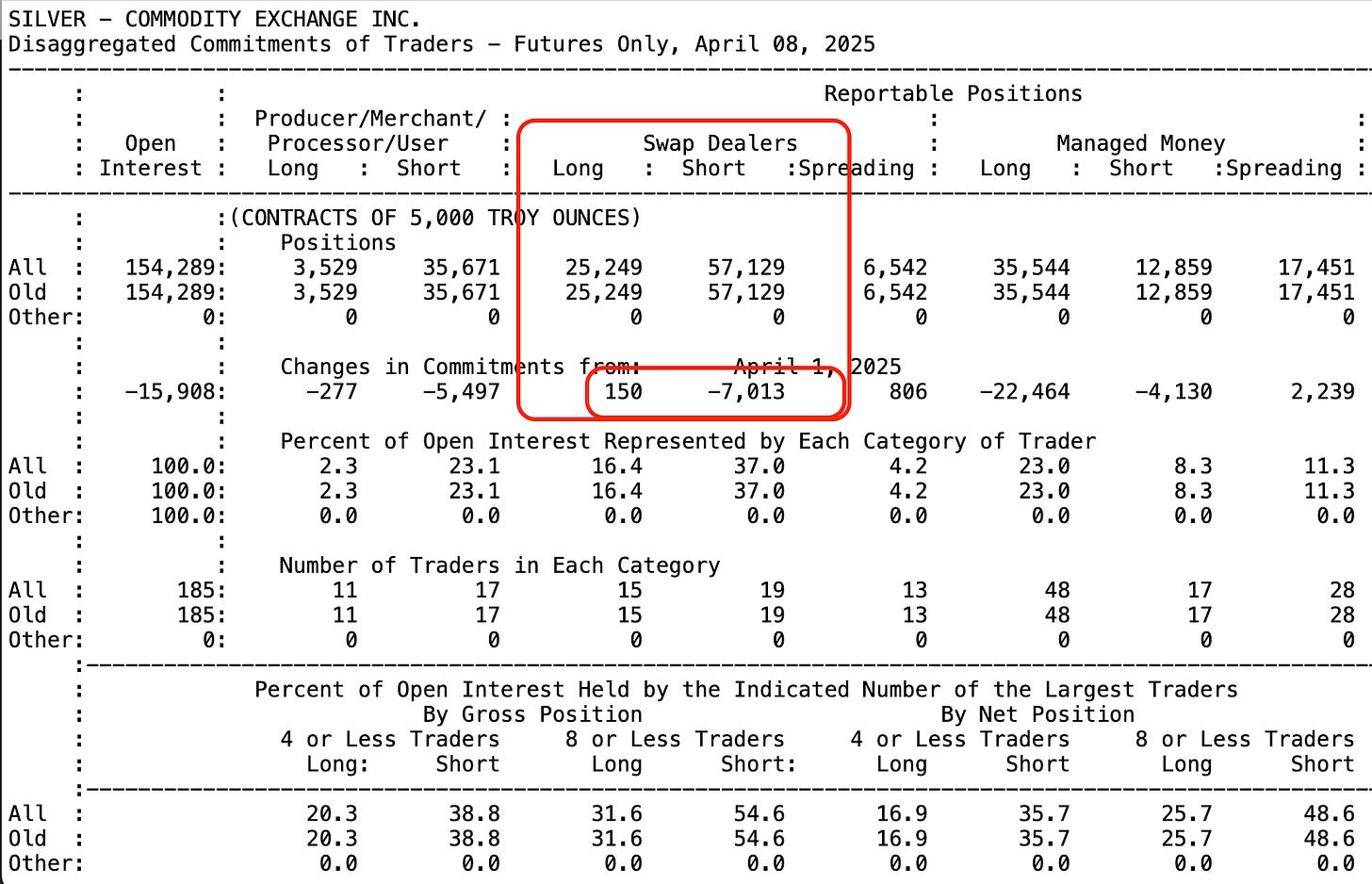

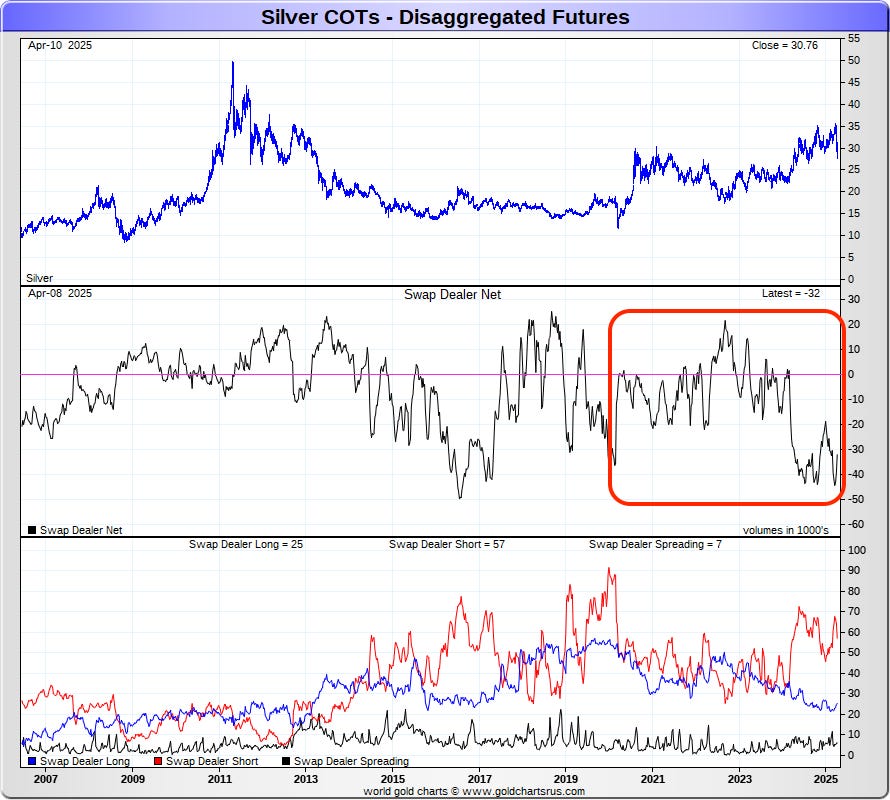

In silver, the banks reduced their net short position by 7,163 contracts to a total of 31,880.

(Click on image to enlarge)

And here you can see how the short position has come in substantially over the past week in particular.

(Click on image to enlarge)

More By This Author:

Banks Likely Covered Gold & Silver Shorts On Precious Metal SelloffGold, Silver & Stock Liquidation Continues

COMEX Sees Massive Amount Of Gold Stand For Delivery With 'Reciprocal Tariffs' On Deck

Disclosure: None.