Gold & Silver Get Clobbered Before The Fed Meeting, & Then Again After It

Image Source: Pixabay

One could say that Wednesday was not the best of days for gold and silver investors.

The Fed left rates unchanged during their meeting, and the precious metals, which were already down heading into the meeting, didn't fare all that much better after it was done.

The gold futures were down $53 on the day to $3,327 (the price chart below had already reset, which is why it only shows the price being down 25 cents here).

Here you can see how silver was already selling off throughout the morning and early afternoon, before it fell off a cliff following the Fed meeting, and even briefly dipped below the $37 level.

Although as upset as some precious metals investors may be feeling today, if it helps, I think the Vegas odds would suggest that you're still not feeling as bad as Donald Trump right now.

(I also particularly found the last bullet of CNBC's article here somewhat amusing, as you would certainly hope that they had not already made their decision about the September meeting on July 30th.)

But with that aside, regardless of what Trump wanted, Jerome Powell and the Fed did not oblige this time. Of course, this makes it even more interesting to imagine what was said between Trump and Powell last week when the microphones were off. But I'm assuming that if they were to meet again in the near future, it probably wouldn't be too cuddly.

So where does that leave gold and silver at this point?

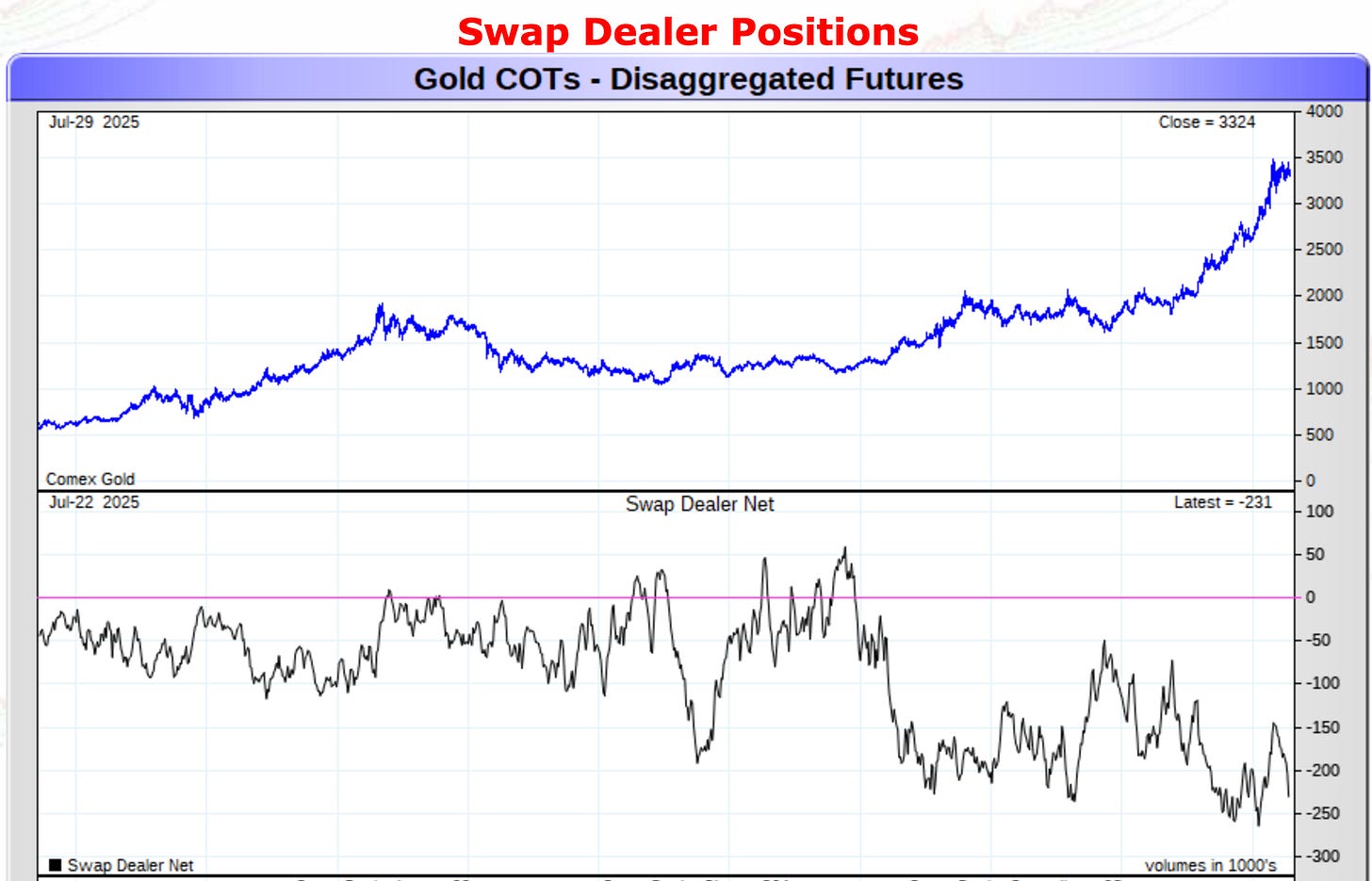

I don't know that the medium to long-term dynamics have changed all that much in the last few days. And given how the banks’ short positions in both gold and silver were still at extreme levels, a correction here was perhaps not the most unexpected event possible (the black line on the bottom section of each chart shows how short the banks currently are in each metal).

I would also point out that just back in April after the reciprocal tariffs were announced, silver went from being above $35 at the time of the announcement to eventually printing even below $28.50. Yet just a few months later, the futures were a dime away from the $40 level.

Which of course does not guarantee that we will follow that exact pattern this time as well. But the attention being placed on the gold and silver markets, whether due to central bank gold buying amidst the continued deterioration of the US Treasury, or the additional coverage that silver supply and demand dynamics have received as the institutional funds have read the reports the banks have put out about this in recent months, has still occurred.

Additionally, had we seen a sell-off like this at a time when the bank short positions were on the lower side, that would be more alarming. But while I would not by any means suggest that silver is going to rebound and break $40 tomorrow or next week, it would also be premature to be worried that silver is now going to fall back to the low 30s just simply based off of the trading action of the past few days.

In terms of some of those silver supply and demand issues, that are also facing the copper market (which was down 18% today after Trump went ahead and imposed the 50% import tariff), we actually did discuss this on today's broadcast.

I think it would be helpful as a reminder of some of the issues that today's trading action notwithstanding, remain very much intact. Leaving us in a position where, at least if these governments want to actually meet their green mandates, that likely requires more silver and copper than is in any way feasible to actually be mined in the suggested timelines.

So hopefully all of this was helpful on a day where gold, silver, and the mining stocks all got clobbered. And as always, we will see what tomorrow has in store.

Although for long-term investors, nothing that happened today materially altered any of the reasons that you have already been invested.

More By This Author:

Trump: Strong Dollar Sounds Good, But Weak Dollar Makes You 'A Hell Of A Lot More Money'Gold & Silver Dip

Why The World Is Shunning U.S. Treasuries In Favor Of Gold