Gold & Silver Bull Analogs

Precious Metals closed last week and January strong, particularly Gold. The ancient metal of kings closed January up over 7% and Friday at a weekly all-time high of $2835/oz.

Silver, though far from an all-time high, closed the month up over 10% at $32.26/oz. Surpassing resistance at $32-$33/oz would take it to $35/oz. Strong support is at $29/oz.

Gold’s potential measured upside targets are $3000 and $3100/oz, while Silver’s targets are $35/oz to $37/oz.

If Gold begins to outperform the stock market, then this bull market has the potential to accelerate.

Let’s consider history and our proprietary analogs.

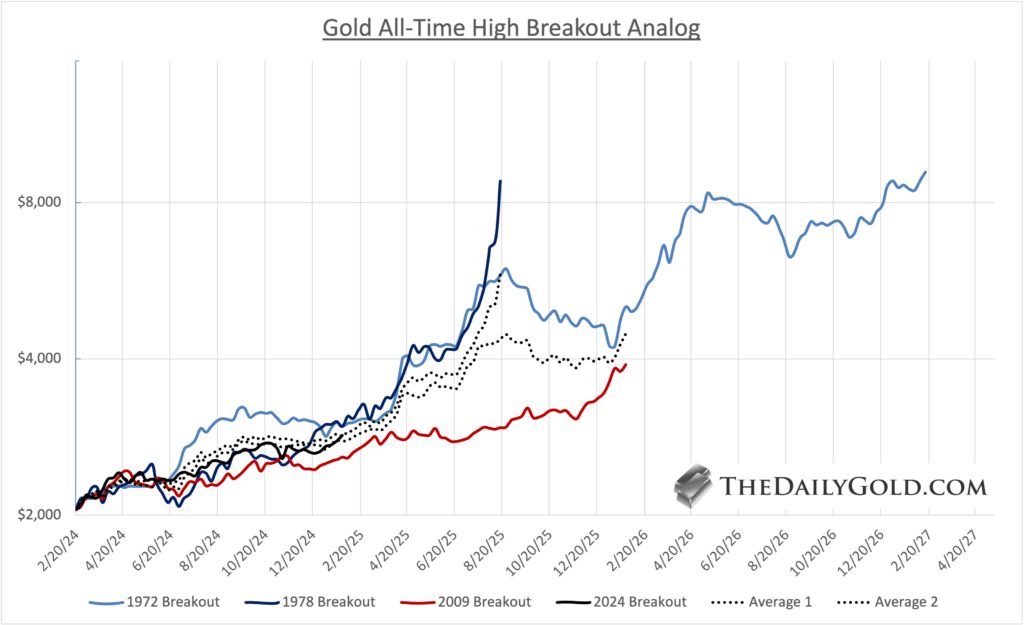

First is Gold’s performance after it breaks to a new all-time high. It has occurred sustainably four times.

Gold over the past year has traded and trended in line with the lower of the two averages.

It may not be ready to accelerate, as this chart shows. However, the weakest of these lines shows the potential to reach almost $4000/oz in 12 months.

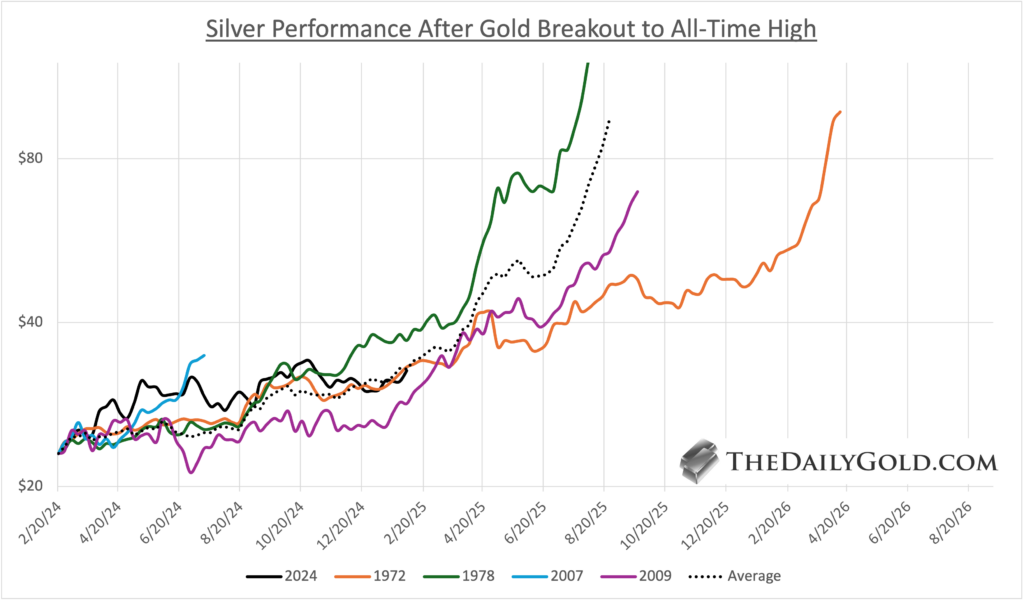

Next, we plot Silver’s performance after Gold makes a new all-time high.

Silver is currently touching the average line and the 1972 line.

I doubt it is ready to explode, as the chart indicates. First, it would need to surpass $35 to $37/oz.

Nevertheless, the weakest line puts it at $40/oz in six months and $43/oz in nine months.

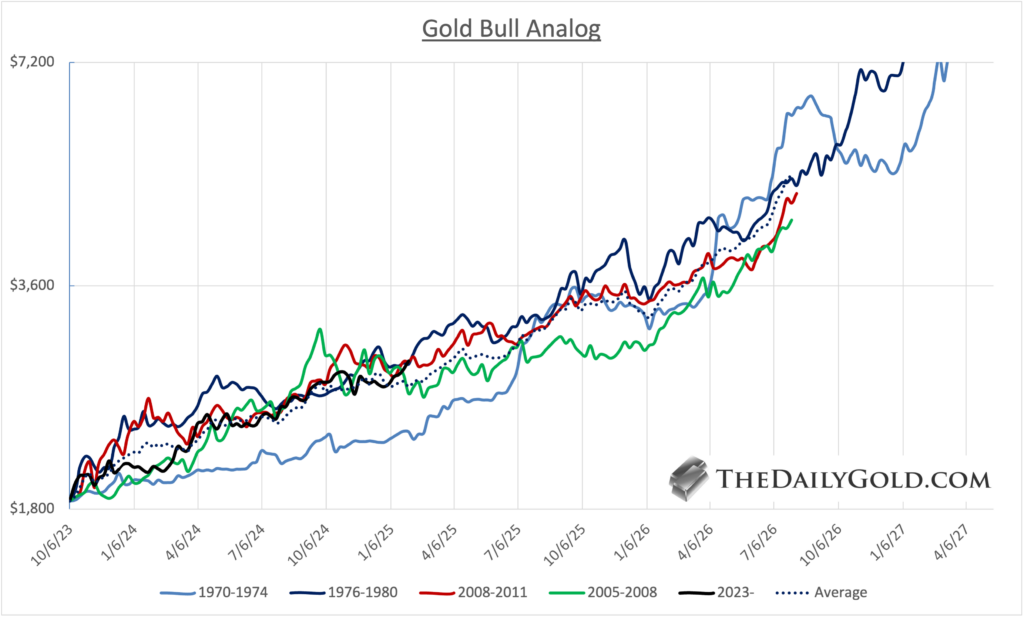

The Gold bull analog chart plots the four strongest cyclical moves in Gold at the start of the current advance, which began in October 2023.

The average of the four moves reaches $5000/oz in 18 months, while the weaker moves reach $4600/oz and $4800/oz.

If there is a recession and market downturn, this cyclical move can and should trend beyond the average.

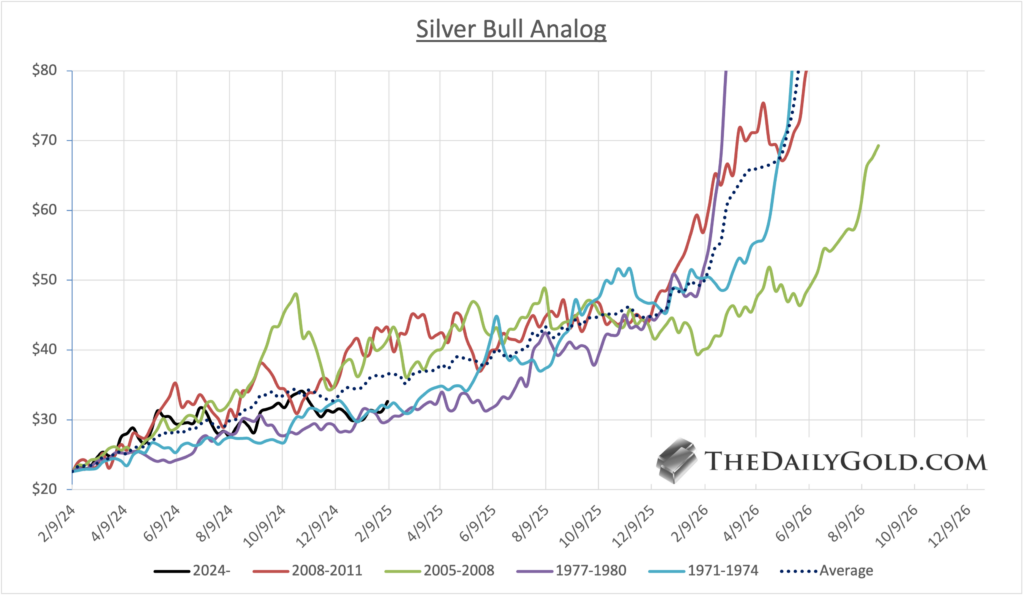

The Silver bull analog chart shows below the average, which breaks above $50/oz in 13 months.

Interestingly, all of the four cyclical advances accelerated after breaking $50/oz.

The average reaches $38/oz in four months and peaks at $45/oz in 10 months.

These aggressive Gold and Silver targets are only attainable if more capital rotates out of US equities and into Gold.

Hence, it is very important to monitor the performance of precious metals against the stock market.

In any case, the window to accumulate high-quality gold and silver stocks with huge potential may close soon.

We are positioned in the leading companies but actively uncovering more companies that could lead the next move higher.

More By This Author:

7 Must See Gold & Silver Charts Signaling Huge PotentialThese Two Things Always Lead To A Recession

Top 5 Gold & Silver Breakouts In 2025

Disclosure: None