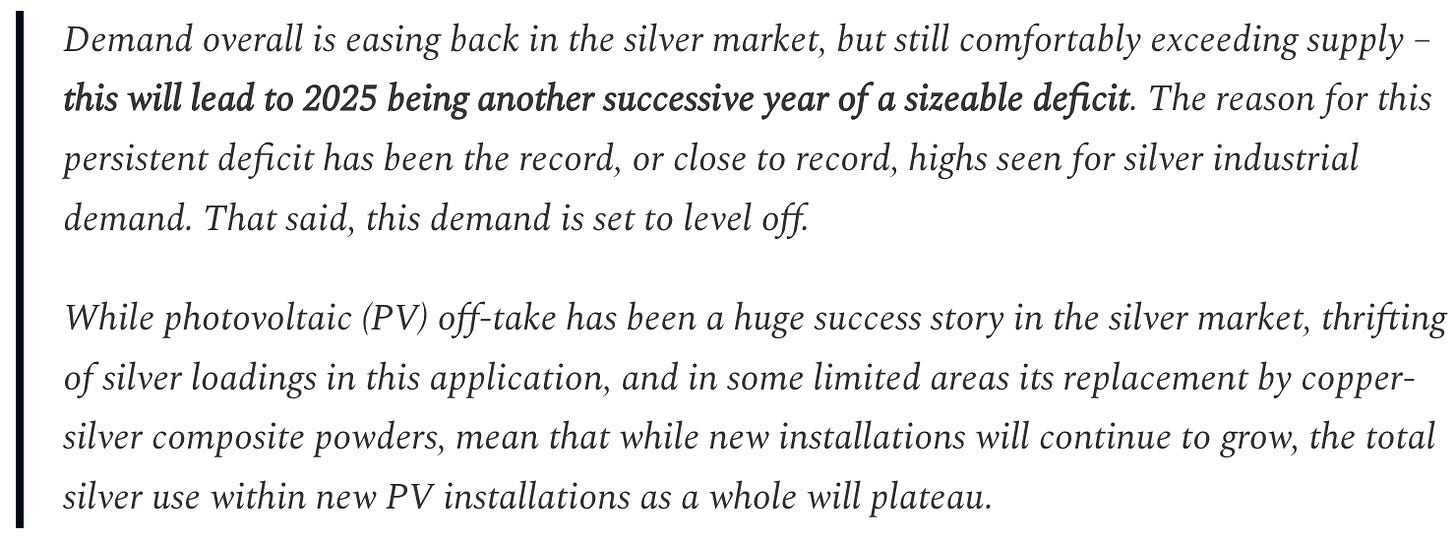

Gold & Silver Bank COMEX Short Positions Remain Near All-Time Highs, While Silver 'Free Float' Is Running Low

Image Source: Unsplash

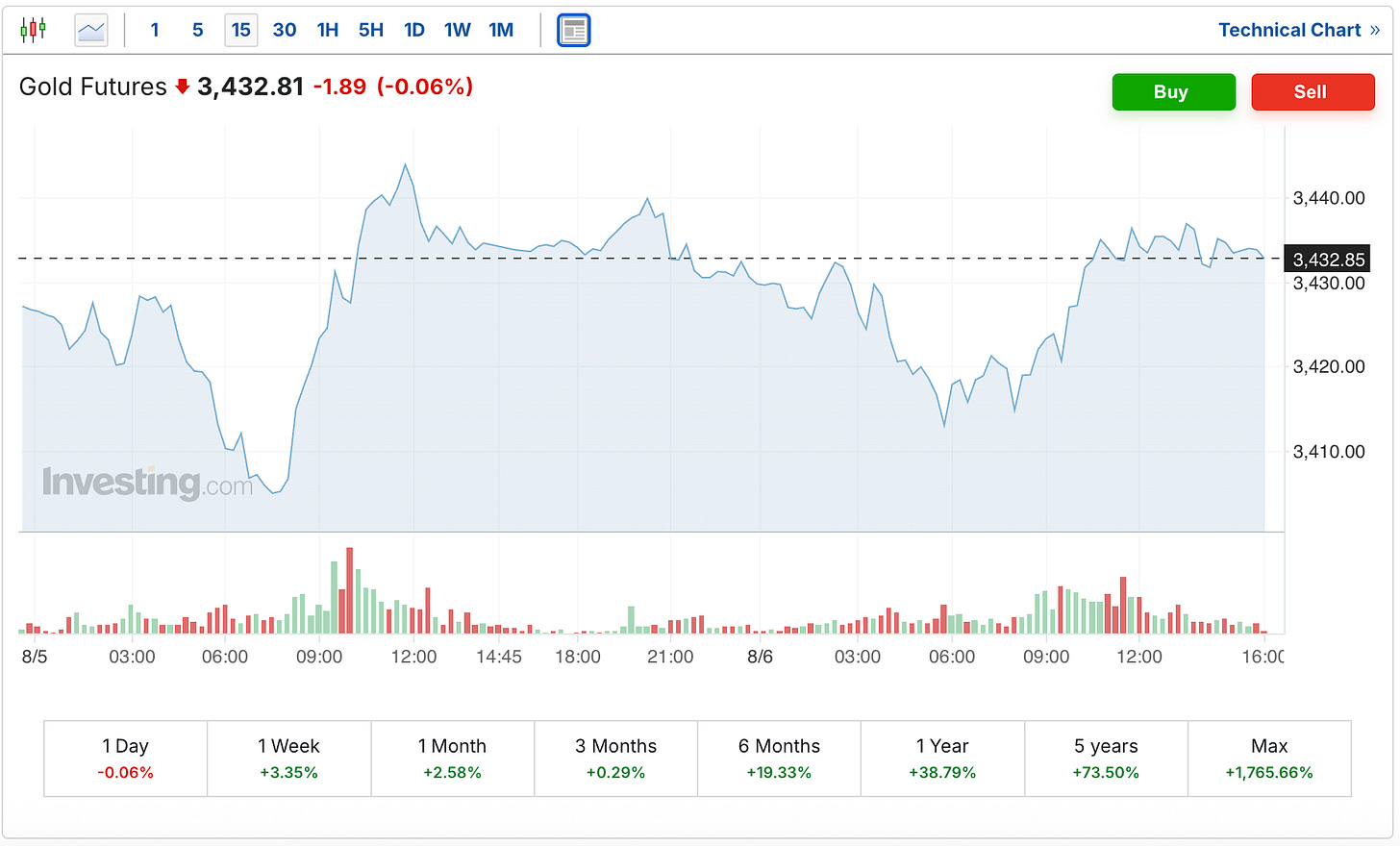

After two days of rallying to start the week, both precious metals were pretty quiet on Wednesday.

The gold futures are currently down just under two dollars to $3,432.

(Click on image to enlarge)

The silver futures are up a dime on Wednesday to $37.93.

(Click on image to enlarge)

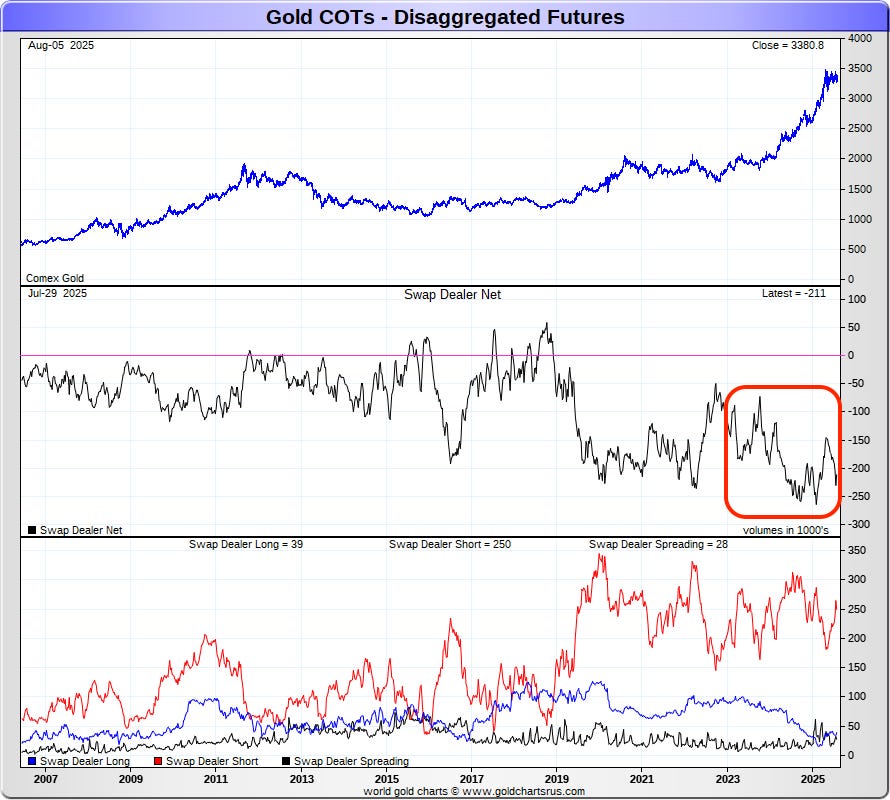

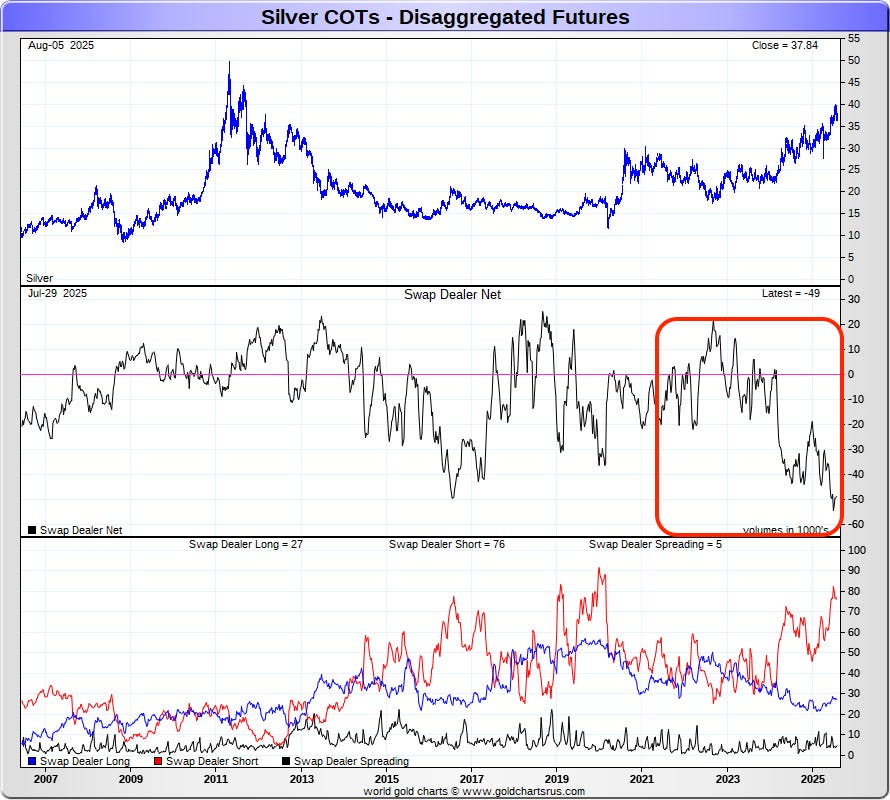

As you might imagine, given the current price levels, the short position held by the banks in both the gold and silver markets remains near the extreme end.

The current level for both metals is slightly off of the all-time highs, and I would imagine that would remain the case again this Friday when the latest COT report is released.

However, they are also still not all that far off from the all-time highs, which means that ultimately the greater takeaway is that the banks’ short positions on the COMEX are just about as large as they have ever been.

Here you can see the picture in the gold market, where the banks are currently short 211,000 contracts.

(Click on image to enlarge)

In silver, the banks are short 49,000 contracts.

(Click on image to enlarge)

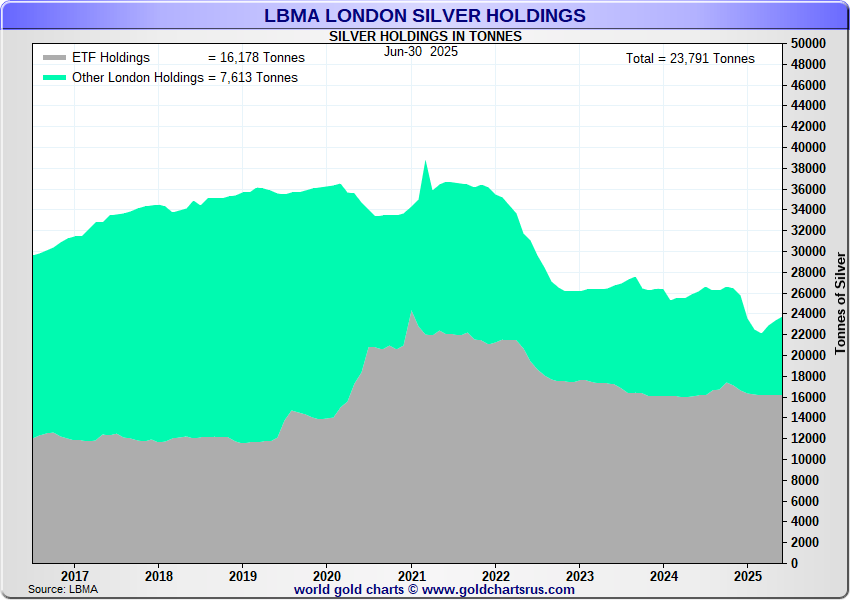

I've also mentioned before how the banks will often say that their position on the COMEX is a hedge for their physical holdings in London.

So one calculation that I like to keep an eye on is the free float of available silver in London. Then I also adjust that to see how much silver would be available if the banks are holding an equal amount of physical silver in their LBMA accounts, relative to the amount of silver they’re short on the COMEX.

Here you can see that the LBMA holds a total of 23,791 tonnes of silver, although 16,178 of those tonnes are already accounted for by the ETFs.

(Click on image to enlarge)

That leaves 7,613 tonnes remaining in the ‘free float,’ which is equal to 268.5 million ounces.

Yet if the banks’ COMEX short position represented a true one-to-one hedge for physical holdings in London, that would take away another 243.5 million ounces, leaving just 25 million ounces ‘truly’ available.

Now, I don't personally think that it's as simple as it all being hedged 1:1, so the truth probably lies somewhere between those two scenarios.

But in either case, that's not a lot of silver underpinning a global silver market that's running a 150-200 million ounce deficit on a yearly basis, and that Metals Focus recently reported is set to run another deficit in 2025.

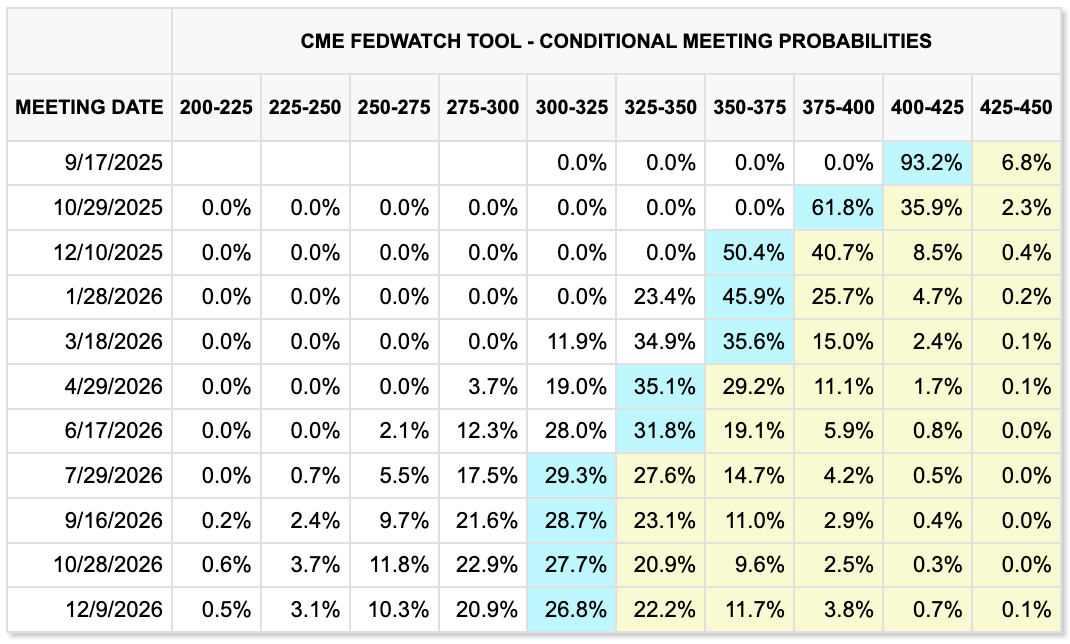

So just keep that in the back of your mind as the tariff uncertainty continues, and also as we do likely finally get some interest rate cuts from the Fed later this year.

To be clear, I have not yet heard of any industrial user reporting an inability to actually source physical silver. But if that ever were to change, which at the current rate continues to seem more like an inevitability rather than a question of "whether" it will happen, it would occur with a relatively low available free float of silver, and while the banks hold a near record short position on the COMEX.

More By This Author:

Gold & Silver Miners Set Up For A Once In 50 Year OpportunityIndustrial Silver Thrifting Continues To Occur

Gold & Silver Rebound After Last Week's Selloff, & Notes On Retail Precious Metals Demand